Where do we go from here?

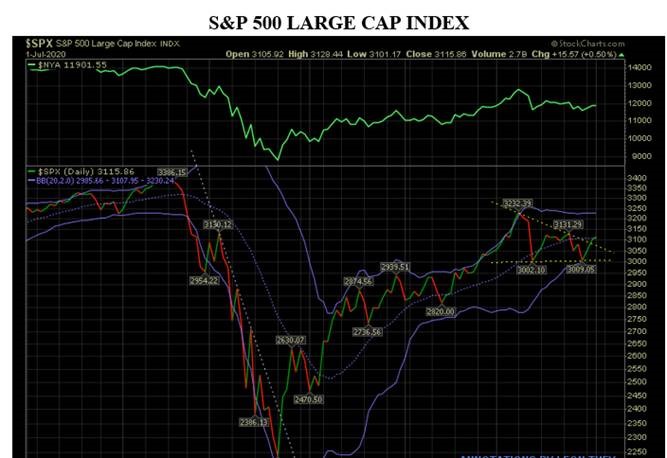

After recovering nicely from the March lows, the market has spent the past month or so consolidating, punctuated with some good, and some not so good days.

The question now becomes (as always) what comes next? As the following charts seem to indicate, we could be in for a decent run, with the market potentially reaching new highs. And just as happened in mid-March, this will likely catch most investors by surprise.

And for those doubters out there, take note of the following:

- The Federal reserve and other central banks have injected a record amount of liquidity into the system. Jerome Powell has stated “We will do whatever it takes..”

- Powell again, “We would like to smooth out the wild swings of past economic cycles by fine-tuning monetary policy”

- The more severe the downturn, generally the more powerful the recovery, due primarily to more aggressive and longer lasting, accommodative monetary policy

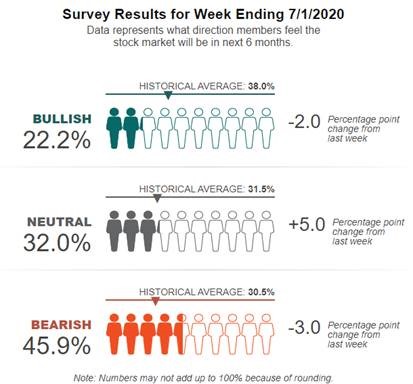

- Sentiment among investors is negative – one of the best contrarian indicators there is. Bearish sentiment above 40% shows excessive pessimism, not something seen at market peaks

- “Waiting for clarity” is a fools game, the market looks out 6-9 months, it is not a reflection of today, but a leading indicator of the future

- Momentum remains positive – see below

All in all some pretty compelling reasons to stay invested, and to stick with your long term investment and retirement plan.

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.