Coronavirus and the markets

When the Vancouver housing market crashed / corrected a year or so ago, what was the first thought that came to mind? Quick, find me a realtor so that I can sell, now that my house has declined in value by $500,000 to $1.5 million?

Of course not. The more likely course of action was to either sit back and look at your house value as exactly what it is, a long term investment, or to start looking for something to buy. At a discounted price.

Same goes for a pair of jeans. You find a pair on sale for $50 down from $100, and you go out and buy two pairs. You don’t wait until the sale ends, and the jeans go back up to $100 before buying.

So why is the stock market so different?

Because human emotions are a funny thing. And that’s why it is so difficult to be an investor or an investment professional. You need to be able to step back and look at the logic of what decisions you may or may not need to make.

But I’m retired and need the income from my portfolio to live off? So stay invested. The income from your portfolio will only decline if you sell your investments. Only the total current value of your investments will decline (temporarily) as the markets sells off.

Remember December of 2018 when the market declined 8% in a couple of weeks. We should have been buying, but the world was coming to an end, the stock market was going to collapse, and we were entering a recession. The following year the markets rose north of 25%.

Of course there are a few caveats to this. We don’t know what the extent of the coronavirus will be. We don’t know how long it will last. We don’t know how and when it will be contained or when a vaccine will be produced. And individual portfolios are positioned differently.

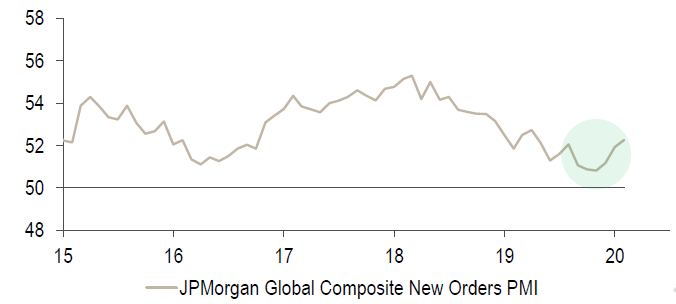

What we do know however is that the general economic-earnings trend before the virus was positive, and so is likely to remain so coming out of this crisis.

We also have some historical context as to how similar crisis have been digested. As long as economic and earnings trends can reasonably be expected to resume their previous trend, then the disruption to market growth tends to be short lived.

And finally, we should know how our portfolios are positioned. And contrary to the belief held by some that you should never sell stocks that are going up, over the last year we have actively been taking profits in out-performing stocks, reducing overall equity exposure and reducing overall levels of portfolio risk.

Even individual portfolio holdings can be analyzed. For example, Netflix, Telus, AT&T, Facebook, and many others, should not really be affected much at all (yet their stock prices have been). They are not dependent on foreign trade, or travel, but are “stay at home” stocks. Individuals are not cancelling their phone, TV or Netflix subscriptions. Additionally healthcare companies should also see little effect, as prescription drug revenue should be minimally affected, yet similarly their stock prices have temporarily fallen.

Of course there are some companies that you may wish to stay away from as their recovery will likely take much longer. Airline stocks and cruise lines are the obvious contenders. Even companies like Starbucks and McDonalds, while will likely see a short term hit to their earnings, due to individuals staying home, will more than likely continue to have significant sales and earnings growth as the eventual recovery begins.

The thesis remains. If you are not excessively exposed to stocks for your personal financial situation, and the stocks that you own are good companies, with good management, that have a dominant position in their industry sector, and are not trading at excessive multiples, then stay the course. You will come out of this latest crisis just fine. If you own a portfolio of cannabis, bitcoin and oil companies, then good luck to you!

Current GIC rates*

Feb 28 2020

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.