And you thought your credit card bills were bad

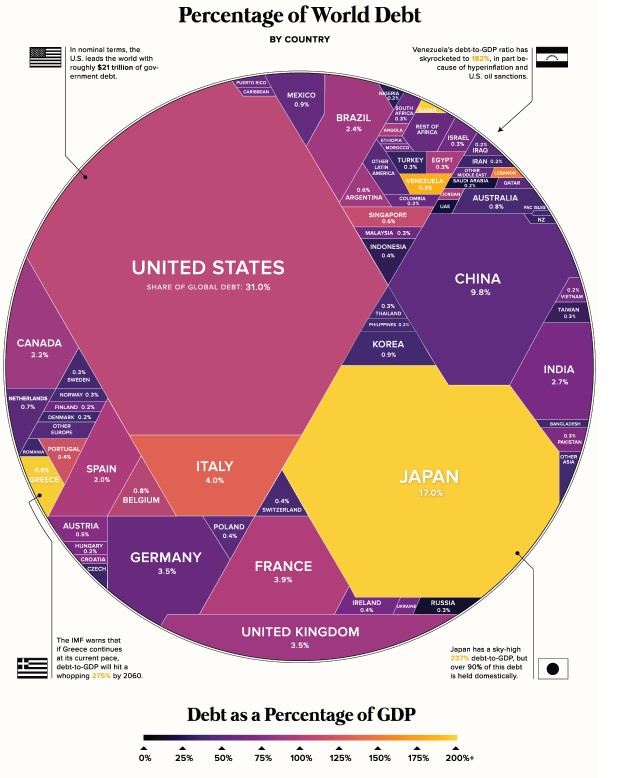

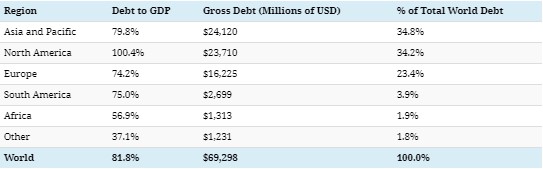

Governments around the world have accumulated $69 trillion in total debt over the years, with the US making up almost one third of this amount. This staggering figure is up from “only” $20 trillion just two decades ago. However not all countries should be treated as equal, as can be seen by the below chart.

Visual Capitalist

If one is to break things down into geographic regions, combining Asia, Europe, and North America gives us over 90% of this debt, with Africa (perhaps unsurprisingly) having the lowest.

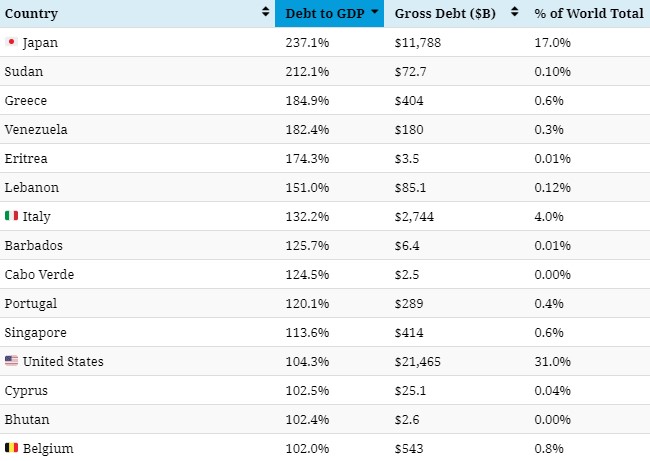

On a debt to GDP basis, (an approximation of ability to service this debt), however things look a little different, with Japan looking a lot worse than most. Anything approaching, or above 100% is not a great number to have. Canada sits at 89.9% by the way, with just over 2% of the world’s total debt.

What does this tell us? That supposedly “rich” countries may not be as well off as they first appear, but also that high debt levels do not necessarily lead to impending financial disaster (see Japan).As always take everything you read with a pinch of salt and gather your information from as many diverse sources as you can. Buy good companies that are profitable, and continue to grow their earnings, and stay invested for the long term.

Current GIC rates*

Dec 6 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.