Why going to cash is the worst thing investors can do

Believe it or not, nearly 1 in 5 Americans are stashing cash at home in fear of a recession, falling into one of the costliest mistakes investors can make.

This leaves one missing out on both the positive effects of compound interest, and the negative effects of inflation eroding the purchasing power of savings. Think of inflation as a tax on your money. After tax returns being slightly lower than that of inflation, is going to guarantee you that your savings slowly erode away over time.

Additionally almost 41% of Americans are checking their investments more frequently because of recent talk about the potential for a market downturn. Whether from Brexit, Trump’s impeachment, China trade talks breaking down, or some other unforeseen event, I don’t need to tell you that this is the wrong thing to be doing, as daily market fluctuations are going to cause you to either have a heart attack or make a poor emotional investment decision. i.e. trying to sell off everything in order to buy back in later at a better time.

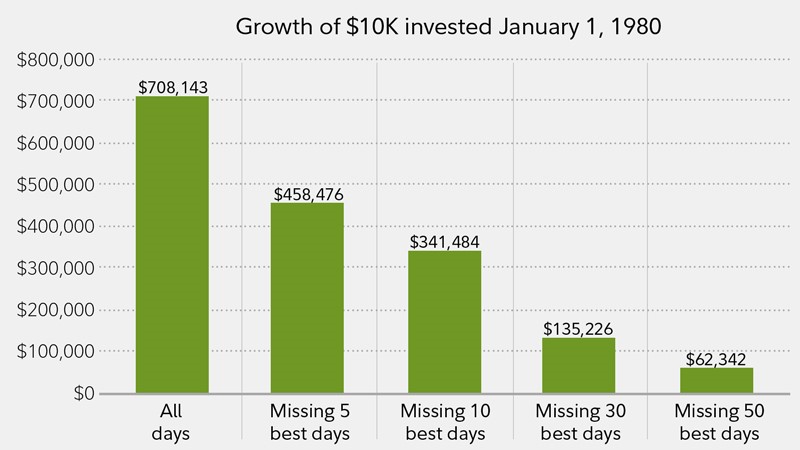

One, it’s pretty much impossible to do, and two, missing just a few of the best days almost completely wipes out almost all of your potential returns.

Rather, having a well-balanced, well diversified portfolio will serve you much better over the long term.

For those of you still arguing that going to cash is a safest way to protect against a market correction. History has shown that fixed income has proven to offer a lot more downside protection to a portfolio without having the same performance drag risk as has cash. And that is why we have a fixed income component to all of our portfolios. That said, taking profits in high performing stocks and temporarily raising cash levels while looking for better priced investments can be a strategic move, but the wholesaling of a portfolio is not.

As always take everything you read with a pinch of salt and gather your information from as many diverse sources as you can. Buy good companies and stay invested for the long term.

Current GIC rates*

*Nov 15 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.