Running out of Savings

The reason we all start saving and investing, is so that one day we can retire, and have sufficient resources to live the rest of our lives without having to move back in with our kids. However, according to recent numbers the average (U.S.) retiree at age 65, has only enough savings for slightly less than 10 years. This is a pattern mirrored worldwide.

The below shows years of savings in grey, of 65-year-olds in the USA, the Netherlands, the UK, Australia, Canada and Japan, plus additional life expectancy, in blue.

The Japanese however, have the greatest shortfall, with a longer life expectancy and just 4.5 years of average savings, leaving an average income shortfall of 15 years for men and nearly 20 years for women.

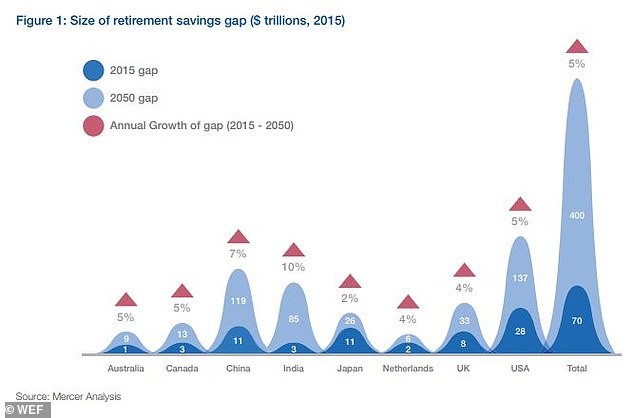

Believe it or not, the world's collective retirement savings gap likely will exceed $400 trillion by 2050, with the U.S.'s savings gap the largest at $137 trillion, followed by China at $119 trillion and India at $85 trillion.

This is shown below. The red arrow shows the growth from 2015-2050. In the US there is a 28 trillion dollar gap in 2015 but that will grow to 137 trillion by 2050. In the UK an 8 trillion gap will grow to 33 trillion.

The solution? Spend less, save more, work longer, invest better, or die earlier. Your choice.

Current GIC rates*

July 4th 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.