Playing defense

After a good run in the markets over the past few years, I’m finally ready to play a little more conservatively in the months, and possibly years, ahead. After the doldrums of late December we have now reached new highs, buoyed both by the carrot of stable, even declining interest rates, and corporate earnings that have continued to be strong.

However my intention always has been to be early to the party and start to reduce overall exposure to the equity markets slightly before the 2020 elections in the U.S. Coupled with the strong markets of late, I think the time has come.

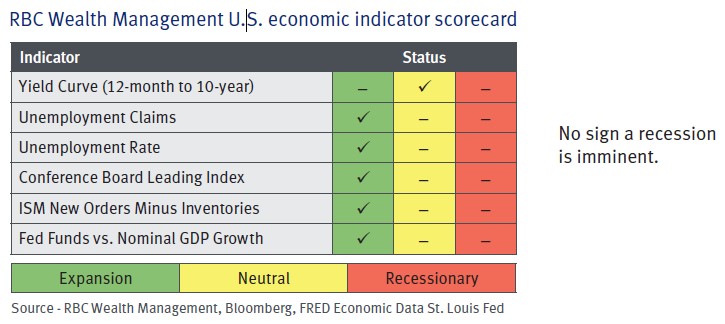

This does not for a minute suggest that I think a significant market correction or economic recession is imminent, rather that I am comfortable with the above average returns we have been able to generate over past few years, and that I would now rather be slightly more defensively positioned for a while.

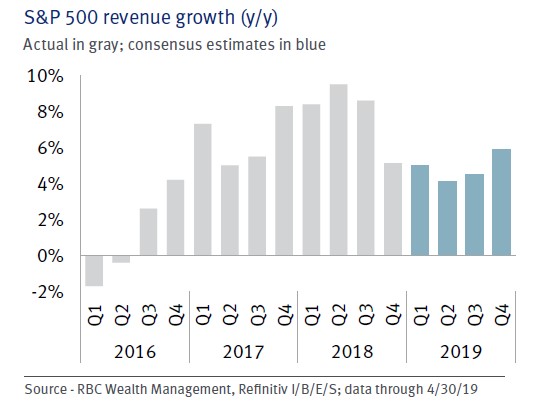

U.S. GDP growth is still expected to be strong for the next year or so, and U.S. companies are still likely to lead global growth for many years to come. Interest rates seem to be likely to remain unchanged for the foreseeable future, and companies for the large part are still reporting strong earnings, albeit at a growth rate that is slower than for the last few years.

There are still no equity holdings that I think are particularly susceptible to a market correction. Rather, if and when a correction occurs, all industry sectors will feel the effects. So trimming current position sizes, and taking profits is the order of the day, rather than making wholesale change.

Having a significant weighting towards non-Canadian names still makes the most sense to me given both the very domestic focus of the vast majority of Canadian companies, and the fact that our economy is dominated by the banks, resource and utility companies, with little else to choose from. My focus will remain on high quality companies that have a global reach, exhibit strong growth trends, and have a dominant market share. Many will also pay decent dividends.

As always, what is good today may not be good tomorrow, so an active approach to portfolio management will continue to be at the fore of the equity investment process.

Current GIC rates*

May 8 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.