Canadian Banks, safe or not?

Canadian banks have perennially been the darlings of the Canadian investment landscape, despite their performance not always living up to expectations. Case in point, Royal Bank, first crossed the $100 stock price threshold back in February of 2017, a level it has barely surpassed today. You have of course received the generous 4% ish dividend over the last two years, but it’s hardly the performance of Amazon, which has seen its stock price increase from $850 to $1,900 over the same time period.

But much of the draw of the Canadian banks has been their perceived safety, and the fact that they exist in an oligopoly here in Canada. But are they really as safe as we may be led to believe?

We must consider current elevated levels of household debt, a continued slowing of the real estate market, and potential credit losses if interest rates were to rise.

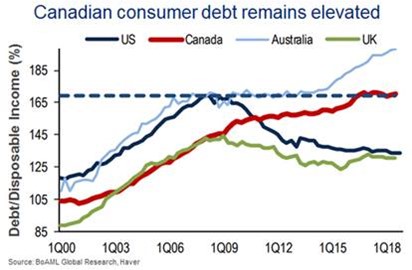

The biggest concern must be around whether or not we have reached a turning point in the credit markets, in particular the health of the individual Canadian consumer. If we look at the ratio of debt to disposable income, it does not paint a rosy picture. Levels have risen from 105% in 2000 to over 177% at the end of last year. Coupled with this, we have the worry statistic that the purchase of residential mortgage insurance is declining. Worryingly, Canada does not compare well with other developed markets as shown below.

The flip side, and the more positive side to this is that it most recently appears that the Bank of Canada, like the U.S. Federal reserve, seems to be on hold with rate hikes for now. This may allow the average Canadian to play “catch-up” before rates do again move higher.

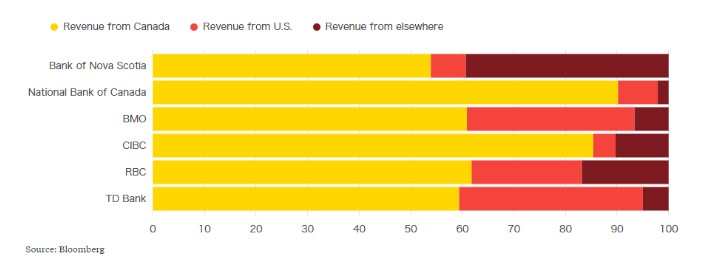

So what does this mean for the Canadian Banks and their position in our investment portfolios? Concerns about the over-extended health of the Canadian consumer are nothing new to the banks, who have been addressing and dealing with the issue for the last ten years. Primarily by diversifying internationally. Bank of Nova Scotia in Latin America, Bank of Montreal and TD bank in the U.S. for example.

So does this make Canadian Banks a good investment? While there is no perfect one stop investment that fits all, in my opinion having good Canadian bank exposure in a long term investment portfolio is a must.

GIC Rates

April 12 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.