Market Expectations

With the volatility that is continually around us in the Market, fueled determinedly by the media, we often forget to take a step back and look at the bigger picture that is surrounding us. What happens in the markets on a daily, weekly, even monthly basis is irrelevant to us as long term investors, and we should remember so when evaluating our portfolios.

The unfortunate outcome of this is that the volatility of the market is impossible to predict on a daily basis, but provides fodder for the media. Looking at longer term fundamentals does not make an advertising selling news story.

So if we take a look at the current market, the media would have us believe that we have seen the biggest rally of all time and that the current levels are unsustainable and that we must be due for a correction.

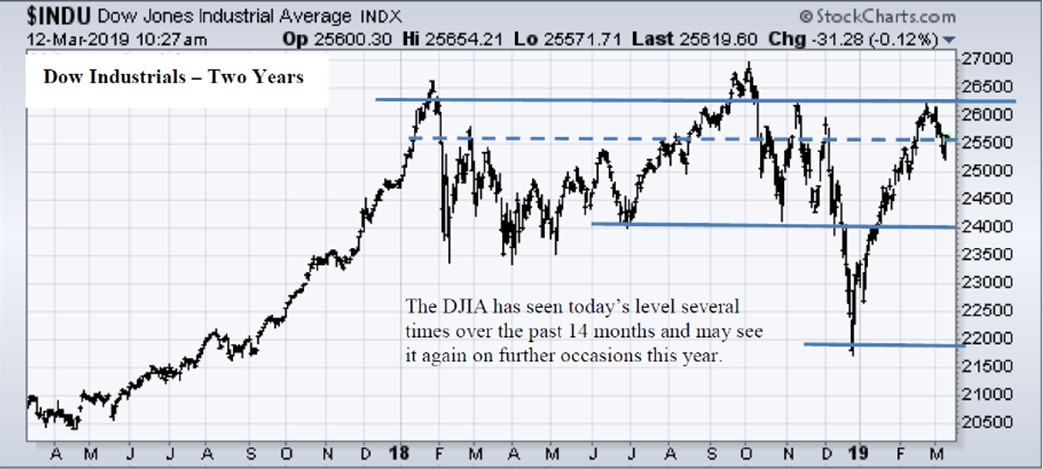

However, if we look at the longer term market trend, which always takes more time to develop than people expect, we can see that a pattern has been in pace for well over a year now. Indeed it looks very much like we are in a consolidating range that may still take some time to break out of.

Source: stock charts

However, rather than considering the above, investors and the media focus on the bullish or bearish side of things without realizing that markets can actually spend much time in between these two extremes. The markets, are in fact at the same levels that they were at 14 months ago, despite what the media would lead us to believe.

It appears more likely that we are in a consolidation period, despite shorter term price swings, the populist news, and investor sentiment, all making it seem like the markets have moved much more than they really have.

The bigger challenge as investors is being patient while this period takes its time to play out. However it should be remembered that the market rarely declines significantly after a long period of consolidation, rather the next move is to the upside, and often significantly so.

It follows then that any pullbacks within the trading range developed, could be good times to build or add to positions.

Remember the old adage, it is time in the market, not timing the market that determines long term investment returns.

Source: Randy Glasbergen

Current GIC rates*

*March 22nd 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.