It’s that time of year again

Yes, the deadline to make your 2018 RRSP contribution is almost upon us. And as usual, many of you will be scrambling to get your contributions made on time. But better late than never, as RRSP’s are one of the very few ways to reduce your tax bill, and along with TFSA’s allow you to invest on a long term tax free basis. Deadline is March 1, 2019.

And this year with the collapse in housing prices I don’t have to listen to the “I should have bought real estate” argument being made over and over. Regardless of how your investment portfolio performed last year (and it should at most have been down a couple of percent, not the 10% that the market indices declined), it would have held up significantly better than your Vancouver Real estate. Go check this year’s housing assessment and compare it to last year.

As to whether RRSP’s are even a good investment vehicle, I’m not going to waste my breath trying to change your opinion if you think they are not. Suffice to say, for the vast majority of people they are (yes there are some exceptions), you get an initial tax deduction against your income, plus you get tax deferred growth until the funds are eventually withdrawn in retirement when when your income tax bracket is usually lower. Win win.

An RRSP IS NOT an investment however. It is a vehicle in which money is deposited and then investments are purchased. If you think an RRSP is an investment itself, please talk to a financial professional. The other caveat is that in order to contribute to an RRSP you must have earned income. This includes CPP disability payments and net rental income.

Maximum contribution limit is 18% of your earned income, up to a maximum of $26,230 (for 2018 tax year). This equates to around $145,000 of earned income needed to reach the maximum contribution allowed.

If your income is expected to increase in the coming years, you can chose to contribute to your RRSP now, and take the tax deduction against your income in future years, leading to greater savings. See your accountant for a more detailed explanation.

Make sure that you and your spouse have approximately the same dollar amount in registered savings. As you are fully taxed on withdrawals made, it is much more advantageous tax wise, to have you both drawing $50,000 of annual income, than to have one of you with taxable income of $90,000 and one of you with income of $10,000. Again, ask you accountant for a more detailed explanation. If you don’t have an accountant let me know.

If you can’t afford to make your maximum contribution this year, remember that you do not lose these contributions. They may be

carried forward to future years.

Unfortunately all those tax savings and tax free growth have to be paid for eventually. On the passing of the second spouse (assuming you are married, if not this occurs upon your own passing), 100% of the dollar amount of your RRSP / RRIF is included as INCOME on your final tax return (and is taxed as such). So if you pass away with $1 million in registered funds, your final tax return will report income of $1 million, plus any additional income you may have earned. Nice $500,000ish tax bill for your estate to pay. See me if you want to know what you can do to alleviate (not eliminate!) this burden on your beneficiaries.

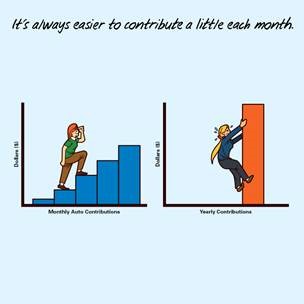

And remember, it is much easier to contribute little and often, than come up with a lump sum amount on March 1st!

For more RRSP quick tips please see additional info on my website.

Current GIC rates*

*Feb 8, 2019

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.