Where are we now?

As spoken about last week stock markets across the world suffered significantly towards the end of 2018, leaving many investors wondering if there was more to come. However if the year is looked as a whole, for both the Canadian and U.S. markets, things were positive right up until the beginning of December. China however was not as prosperous, falling over 25%, and 30% in U.S. dollar terms. Does this make a trade deal more likely, with China needing some good news to prop up their stock market?

The most important question to ask as always, is has anything fundamentally changed with the (U.S.) economy? Probably not. And was the extra volatility seen in December partly a function of poor liquidity due to the holiday period? Possibly.

Regardless, the market was still down for the year irrespective of the reasons we can postulate, but how does this bode for us moving forward into 2019?

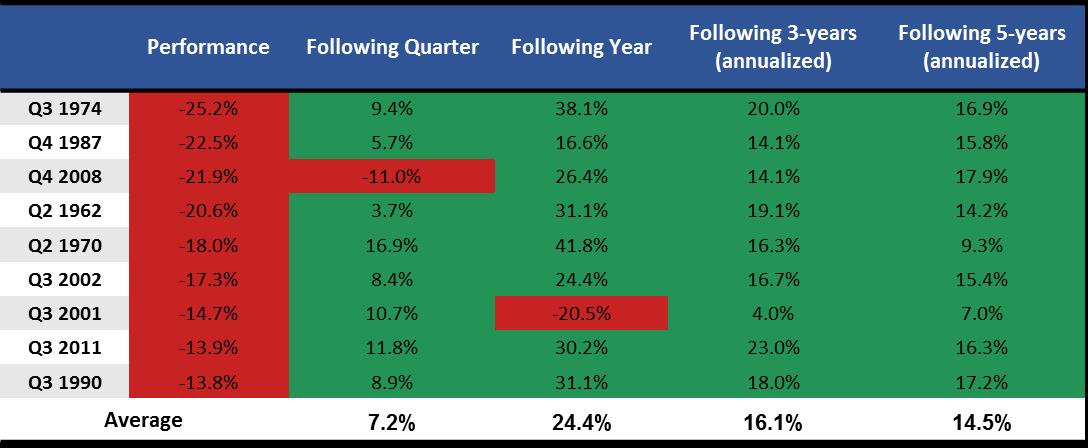

Historically, periods of similar market decline have been followed by immediate upswings. The table below shows the 9 quarters that performed worse than Q4 2018. As you can see, the following months and quarters have been rewarding for those who didn’t panic.

Source: Bloomberg, RBC GAM. Data as of January 1, 1950 to December 31, 2018. S&P 500 total return.*

From a non-fundamental basis it is also interesting to note that year three of the Presidential Cycle is generally a good one for the markets. Although global growth, while still good, is starting to slow albeit with recession risk still something too far away to worry about yet.

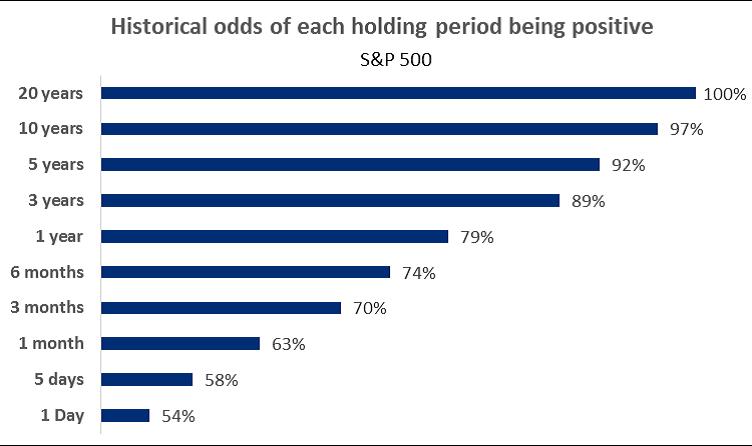

As always it is important to focus on the big picture. The chart below shows the historical odds of various holding periods being positive for the U.S. market. Simple take away, you are rewarded for staying the course with your investments. Short term it can be little more than a coin toss.

Source: Bloomberg, RBC GAM. Data as of January 1, 1950 to December 31, 2018. S&P 500 total return.

For more detailed economic commentary from RBC Wealth Management please see additional publications on my website.

Current GIC rates*

*January 18th 2018

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2018.

All rights reserved.