U.S. versus Canadian Debt

Brexit, Trade Tariffs, Trumps tweets, and the ever present U.S. deficit. There always seems to be something to worry about in the world of investing. One such issue that we have not heard as much about of late is that of the ever growing U.S. debt level. But is it really as bad as reality T.V. would have us believe? Short answer is probably yes, but there are different ways of looking at it as we can see below.

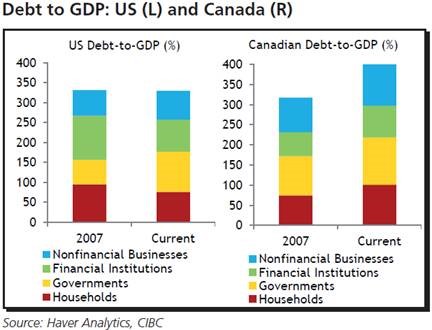

There have and likely always will be concerns over corporate and government debt levels, the overall debt-to-GDP ratio for the U.S. has remained pretty much unchanged for the last 10 years (after a high prior to the 2008 financial crisis). Frighteningly however, Canada has seen its overall debt-to-GDP ratio increase significantly to well above 2007 levels, and is still climbing. Thank you Mr. Trudeau.

And to be honest U.S. Government debt isn’t really at risk of default. For after all “in God we trust” is printed on the back of their currency! Risks in the U.S. are much more tied to a dramatic rise in inflation, or rapidly rising interest rates.

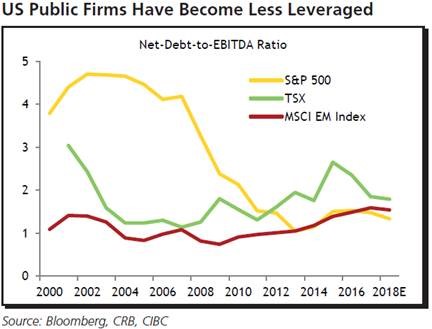

As investors however, we may be more concerned with corporate debt levels, where again we see differences between Canada and the U.S.

Corporate debt has risen more in Canada than in the U.S., with U.S. companies becoming far less leveraged when measured relative to earnings, than in Canada.

What does this tell us? Well, unlike 2008 where extreme levels of corporate debt out us into recession, in 2018 we are very unlikely to see corporate leverage (debt levels) put us into recession. Even the often quoted Canadian mortgage debt levels should not be as worrisome as they were in 2008, due to their better insurance coverage and better distribution of lenders holding the debt.

All things considered, we are most certainly not living in a debt free society, either on the personal, corporate or government level, but we may also not be in as worrying position as some would lead us to believe.Now Trump, there’s another matter altogether.

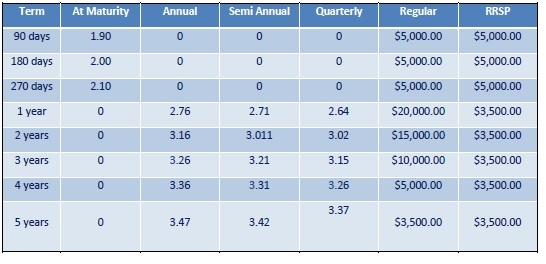

Current GIC rates*

*December 14th 2018

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. © RBC Dominion Securities Inc. 2016. All rights reserved.