Trump and the Markets

Despite what the media would like us to believe Trump is not as universally hated as we may think. That is not to say that his overall approval rating is good, it is not (only 40% approve of the job he is doing overall as President), but his handling of the economy has generally been met with positive sentiment (53% approve of how he is handling the economy, with 74% of these respondents rating the economy as good or very good).

What it does mean however is that if we do enter an economic slowdown, it could spell bad news for Trump and his prospects in 2020. The caveat to this being that Presidents rarely lose their re-election bids.

So where does the economy really sit currently?

The U.S. has good jobs growth, the lowest unemployment in living memory, and solid 3% annual GDP growth. Pretty much the perfect picture. However the economy is certainly getting long in the tooth and investors are more skittish than they were a year or two ago. Hence the uptick in market volatility we have seen over the past few months. Rather than shrugging off news (Brexit, Trade Tariffs, the arrest of prominent Chinese business personal) the market is now reacting to news.

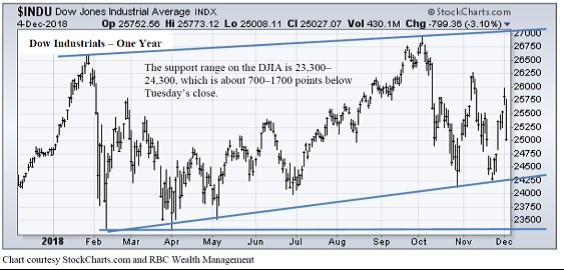

But are the markets as bad as the last month may lead us to believe?

No doubt they have been in a short term downward trend, but if we step back and take a look at the trend over the last year we can see that the U.S. market remains within a clearly defined, slightly positive, trading range. It is just that one day news is seen to be bullish and the next bearish, causing short term swings that are difficult to predict.

Who knows if the market will reach the bottom of the range again, but if it does sentiment will likely become extremely negative, which coupled with the current news and opinions (which appear to be very pessimistic) we should begin to see appositive news, as this is what generally occurs at market bottoms, not tops.

So if the market looks normal, what chance is there of an economic downturn wiping out Trump’s re-election chances? H.W. Bush was the last president to lose re-election in 1992, and even Obama won a second term after being completely wiped out in the mid-term elections in 2010. So for Trump to win a second term, history may be on his side but he does need a strong economy to help him along. My guess is that Trump will do pretty much anything to ensure that this is the case. So if he manages to stay out of jail, the U.S. economy has a lot going for it over the next couple of years, and for us as investors that means having faith, owning good quality companies, with growing earnings, and staying invested.

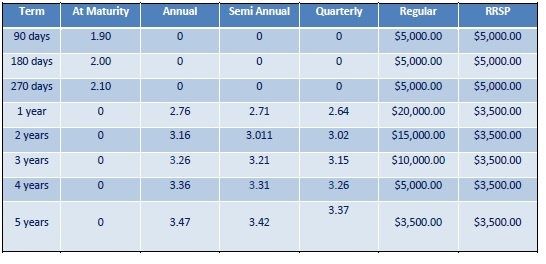

Current GIC rates*

*December 7th 2018

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. © RBC Dominion Securities Inc. 2016. All rights reserved.