Time in the Market or Market Timing?

What is the difference, and should we be spending any time worrying about it? We should know by now that investing is a long term game. If you need the majority of your investment funds in the next couple of years or so, then they should not be invested in the stock market. You should have them in secure, guaranteed investments, most likely GIC’s.

However, if you are saving for, or are already in retirement and are looking for a return that is likely going to outpace at least inflation over the coming years, then the equity market is the place to be. With current dividend yields giving us north of 5-6% in many cases, the income generated from a $1 million portfolio would be somewhere in the $25,000 range from a GIC versus $50 - $60,000 from a portfolio of dividend stocks. A big difference.

The dilemma then often becomes, “Do I invest now, or do I invest later?” Unfortunately it is an impossible question in the short term.

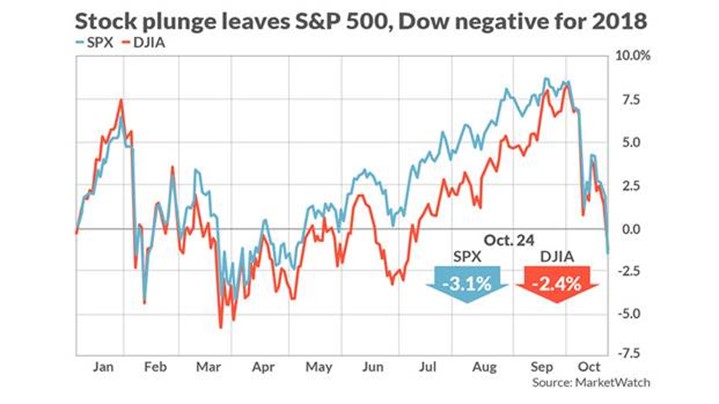

If we look at the below chart of the U.S. market this year we can see that if we had invested in late January we would have seen our investments drop almost 8% by the end of October. A similar negative return would have resulted from investing in late September.

However if we had been smart enough (lucky) to have invested in late March, April or June, we would have seen a positive return on our investments.

From an earnings perspective, nothing has really changed throughout the year, so predicting these swings in market averages would have been next to impossible.

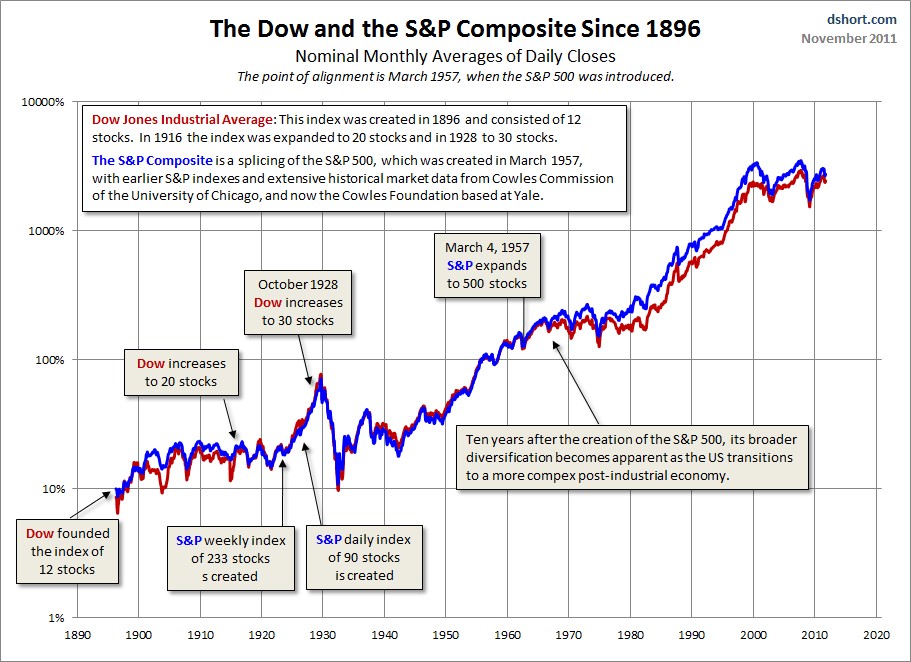

However, when we start to look at a slightly longer time frame, even that of the last 10 years, it becomes a much different proposition.

The below shows that pretty much any time other than right before the depression of the 1930’s,and the oil crisis of the 1970’s was a pretty good time to be invested. Even the 1987 stock market crash becomes nothing more than a tiny blip when looked at in a longer term context.

Source: Zero Hedge 2015

So what of today, should you be invested in the market or should you still be sitting on the sidelines waiting for that opportune moment?

If we look at a simple example of investing $100 per month over a 30, 40 and 50 year time horizon, with a 5% rate of return, we get the following (approximated) figures:

- After 30 years – $83,000

- After 40 years - $152,000

- After 50 years - $266,000

The differences are astounding. Get yourself invested and let the power of simple compounding work for you.

Current GIC rates*

*November 30th 2018

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2019 RBC Dominion Securities Inc. All rights reserved.