Where do we go from here?

After a dramatic vaccine reversal uptake in Canada, we are now ahead of the U.S. in the vaccine stakes and with that comes the continued hope that the worst for us all may be behind us.

What does this mean in the investment world for us?

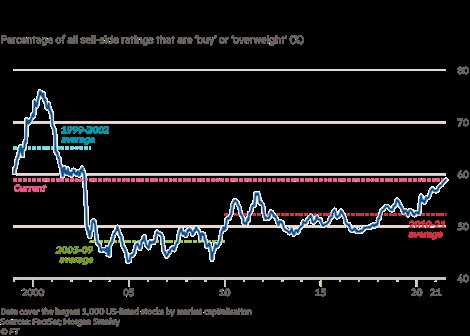

Well on the positive side equity research analysts are more positive overall than they have been in the past 18 years. Corporate confidence has also been rising, cash levels are high, and debt levels are very easily serviced due to the record low interest rate environment. This gives corporations significant pricing power, operating leverage, and cost savings, and hopefully higher stock prices in the months and years ahead.

Earnings growth also looks to have peaked in Q2 2021, which although historically has resulted in a volatile 6 month period, it has also given us a market that is higher 12, 24 and 36 months later.

There are however a couple of negatives both in the short and long term. The near term surge in Covid cases in the U.S. may give us bumps in the recovery, which in the short term may cause market volatility. Additionally there is always the fear of inflation and rising interest rates.

However after rising sharply from October through May, inflation fears have now begun to ease. According to the Wall Street Journal, their expectations for inflation five to 10 years from now is 2.9% (in early July), close to the historical average of 2.8% in surveys from 2000 to 2019. Which according to Kathy Bostjancic, chief U.S. financial economist at Oxford Economics point to “markets are saying, we think there’s inflation in the near term, but eventually it’s going to ease and go back to the Fed’s 2% target, maybe be a little above, but it will certainly not remain elevated”.

The above, coupled with a pent-up demand and continued fiscal stimulus, lead us to believe that the equity markets still offer significant out performance potential in comparison to other more conservative investment alternatives.

Sincerely,

Vice President and Portfolio Manager

Privacy & Security | Legal | Accessibility | Member-Canadian Investor Protection Fund

RBC Dominion Securities Inc. and Royal Bank of Canada are separate legal entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2021.

All rights reserved.