We recently read an interesting quote: “It is considered doubtful if there ever has been an industry in the history of this country which has had such phenomenal growth.” Surprisingly, this is not a quote about AI – it is from a New York Times article, published in 1925, referring to the radio industry.

Stock Markets & AI

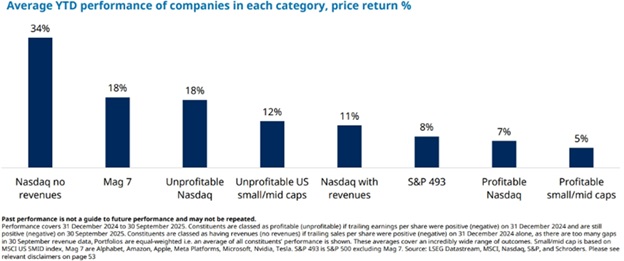

This year, most of the returns in both the Canadian and US stock markets have been driven by a few sectors and companies. In Canada, the stock market has been driven by gold companies, banks and Shopify. In the US, currently only four stocks out of 500 in the S&P 500 index (Nvidia, Microsoft, Apple and Amazon), account for 25% of the total index. Clearly, the valuation of stocks connected to AI reflect enormous enthusiasm. AI will undoubtedly lead to significant improvements in our society, from productivity improvements, to medical advancements, to educational systems. An example of change in the educational system is illustrated by the Alpha School program in the US. Alpha School uses generative AI, rather than teachers, to teach students for two hours per day and has led to standardized test scores that are in the top 1%-2% in the country. The ultimate question for financial markets is whether the eventual profits will justify the largest-ever investment in a technology. We expect to find out the answer to this question in the next twelve to eighteen months. The below illustration highlights year-to-date returns in the US technology sector. Notably, stocks of companies on the Nasdaq exchange with no revenues are up, on average, 34% this year!

Trump, Trade and Real Estate

We are often asked why stock markets are doing so well despite Trump. One reason is that markets have become increasingly desensitized to Trump’s outlandish comments. This spring, markets reacted wildly to almost every tweet. More recently, his comments have had less of an impact on markets. Another key reason for stock market strength is that Trump is pushing very hard to lower interest rates. Next year, the Federal Reserve will have a new chairperson. The new chair will be aligned with Trump’s objective to lower rates.

With the USMCA agreement up for review in July 2026, Mark Carney and his team have their work cut out for them. Carney and Trump seem to have a better relationship of late. A reasonable trade agreement would remove uncertainty for the Canadian economy.

Real estate is another topic that often comes up when we speak with clients. Oversupply of condos and a significant change in Canadian immigration policy are two of the main reasons why the real estate sector is struggling. The last significant housing slump in Toronto lasted from approximately 1990 to 1995. While things seem to move faster these days, it will probably take a few years for the condo market to stabilize. However, for first-time buyers and those looking to move into a larger home, the current environment has created an opportunity.

Geopolitics

As many people are, we are extremely relieved that after more than two agonizing years, the living Israeli hostages have returned home and the war in Gaza is over. Trump deserves credit for getting the deal done. We all pray for continued peace and stability in the Middle East.

Pearlstein Wealth Team

We are very excited that Alicia will be returning to our team, from maternity leave, in mid-December! Alicia, Spencer and their two boys are doing very well.

Wishing everyone a great fall!

Pearlstein Wealth