What is Responsible Investing

Every portfolio has environmental and social risk. Investors who are increasingly concerned with what risks may be present in their investment portfolios could consider responsible investing. RBC Dominion Securities supports the merits of responsible investing. RBC is committed to community involvement, diversity and inclusion, and environmental responsibility to help the world become a better place—for both current and future generations. To help make good on our commitment to have a positive social and environment impact, we have pathways for you to invest capital in a more responsible manner.

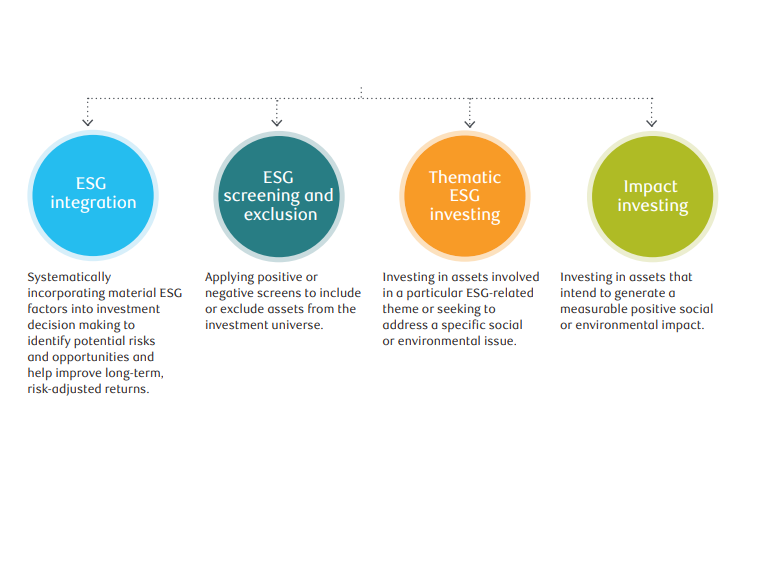

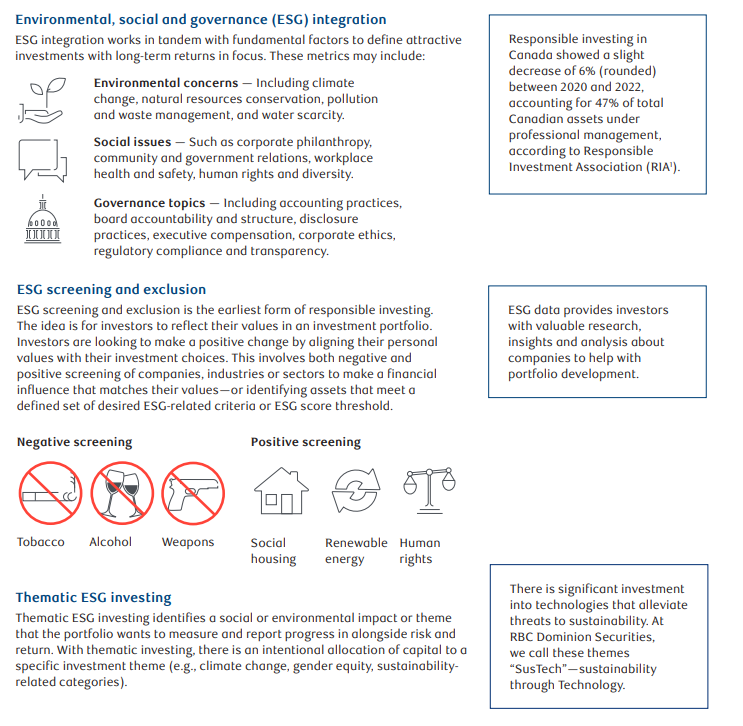

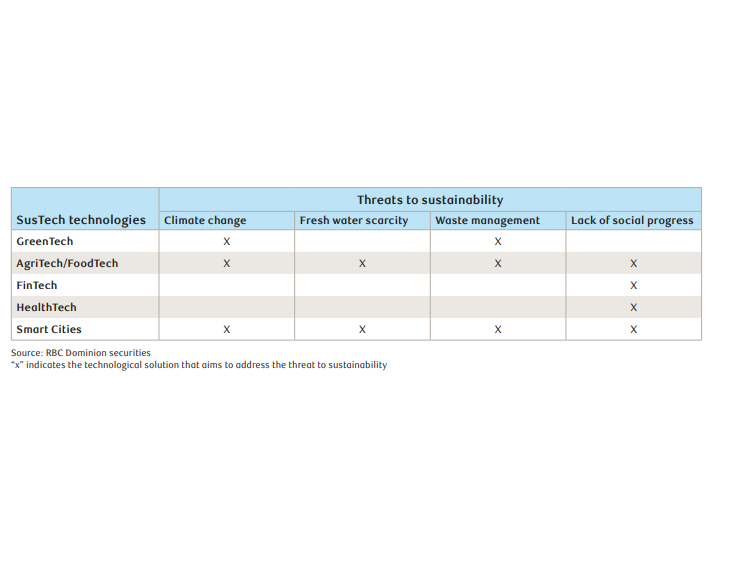

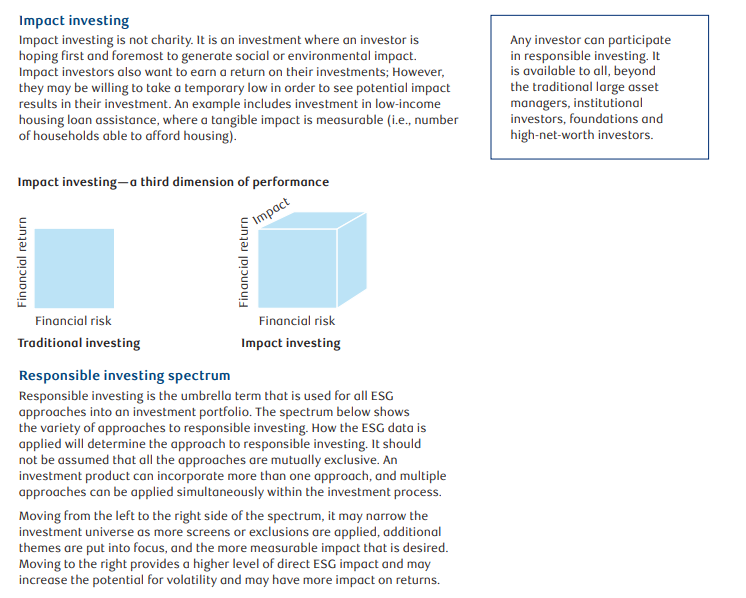

Responsible investing is an umbrella term encompassing the approaches used to deliberately incorporate environmental, social and governance (ESG) considerations into an investment portfolio. We believe there are four main applications of this data, and each applies this data very differently. The four applications are: