Surging consumer inflation has spooked the equity market, and has fueled a debate among economists and market participants: Is this higher inflation transitory? And if it is, how long will “transitory” inflation last?

The Consumer Price Index (CPI) jumped 4.2 percent in April compared to the level one year ago. This is the highest consumer inflation rate since 2008, and is well beyond the 3.6 percent consensus forecast of economists. When viewed against consumer prices just one month prior, the CPI jumped 0.8 percent, the biggest monthly gain since 2009.

The core rate, which strips out volatile food and energy prices, also rose dramatically compared to March of this year. At 0.9 percent, the increase was three times higher than economists had expected and the sharpest monthly increase since 1982.

We think much of the inflation spike is a short-term phenomenon. The annual inflation rate plunged to almost zero percent at this time last year when the economy was shut down, and has rebounded sharply this year as businesses have reopened. Once we are past the April, May, and June period when prices last year were falling, the year-over-year comparisons should be less extreme.

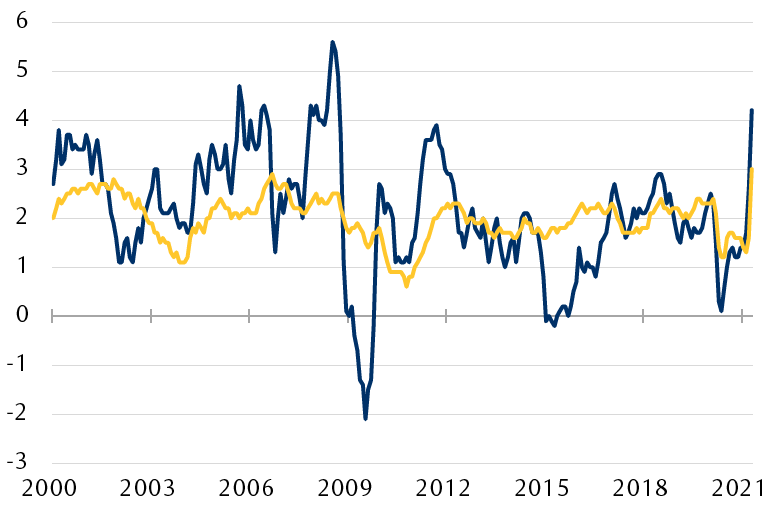

Highest inflation reading since 2008

U.S. Consumer Price Indexes (CPI) in year-over-year percentage change

Source - RBC Wealth Management, Bloomberg; data through April 2021

The question of how long “transitory” inflation will last is more difficult to gauge. The longer it lingers, the greater the risk that the Federal Reserve will shift away from its uber-accommodative monetary policies. We think this will take some quarters to convincingly sort out. This could keep equity market volatility and pullback risks elevated for the time being.

RBC Global Asset Management Inc. Chief Economist Eric Lascelles does not see runaway 1970s-style inflation as a threat. Lascelles wrote, “Yes, inflation will be quite high over the next few months and then slightly elevated over the next few years. But, from a structural standpoint, it is far from obvious that inflation has to be high over the next several decades. If anything, the long-term forces still argue for deflationary pressures to dominate.” The long-term forces he’s referring to are demographic headwinds, deflation in key segments of the economy (including technology), declining unionization, and maturing emerging market economies.

The Fed has already signaled that the hot April inflation data will not in and of itself change the course of its highly accommodative policies, and we think the Fed has reasons to stand firm even if inflation remains elevated in the near term.

Inflation’s sway

For equity investors, there are two main issues to consider: The impact of inflation on the U.S. market as a whole, and the impact on sectors within the market, both of which influence portfolio positioning.

For the S&P 500 overall, profit margins usually rise when inflation and expectations of future inflation push up from a low level—as long as wages aren’t the major factor for the inflation boost. Most companies have pricing power, as they are typically able to pass some or all of the inflation in input costs along to their customers, maintaining or increasing profit margins. We saw this pattern in Q1 earnings reports, and expect to see it again during the Q2 reporting season. Furthermore, when commodity prices rise, this often provides a broad range of industries with added pricing power—even some non-commodity producers.

Throughout this expansion period and in others in recent decades, the public’s expectations about the direction of future inflation and the broader stock market have been positively correlated. As households’ inflation expectations have risen, the market has worked its way higher.

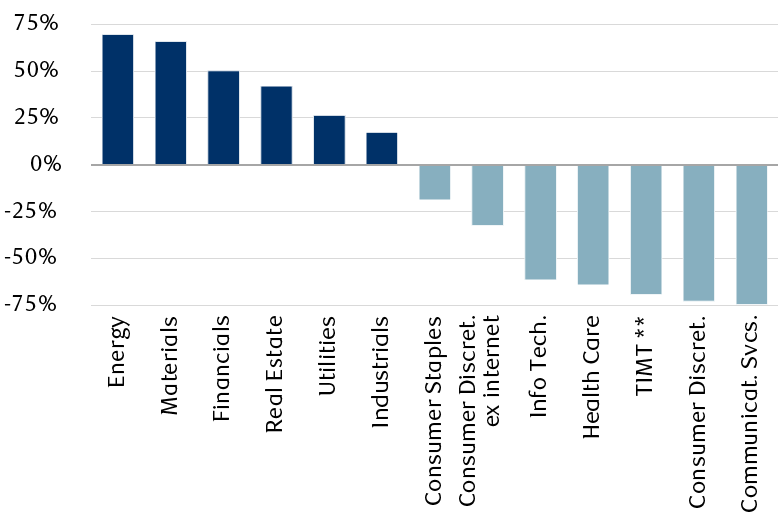

But when it comes to sectors within the market, inflation doesn’t necessarily treat them equally. According to an RBC Capital Markets study going back to 2004, some of the most economically-sensitive value sectors (those that are highly cyclical) outperformed when inflation expectations rose, such as Energy, Materials, and Financials. In contrast, the Technology, Health Care, and Communication Services sectors were underperformers. This track record supports our ongoing recommendation to tilt U.S. equity holdings toward “value” stocks instead of “growth” for 2021, at least.

Energy, Materials, and Financials tend to outperform the S&P 500 the most when inflation expectations rise

Correlations of relative S&P 500 sector performance with inflation expectations since 2004*

* The S&P 500 sector performances are measured relative to the S&P 500 Index as a whole. Inflation expectations are measured by the University of Michigan Inflation Expectations Surveys of Consumers, which presents the median expected growth of prices of goods and services over the next five years ** TIMT stands for Technology, Internet, Media, and Telecommunications

Source - RBC Capital Markets U.S. Equity Strategy, Haver, S&P Capital IQ/ClariFi; data from 2004 through March 2021

But the challenge for the overall U.S. equity market is that the inflation-vulnerable and valuation-stretched Tech sector represents a much bigger share of the market than it used to: 26 percent of the S&P 500 today versus 17 percent in 2010. As long as inflation jitters are front and center, institutional investors may be inclined to ratchet down their Tech exposure, at least temporarily. To us, this means more adjustment time for the market as a whole, which could include additional volatility and rotation between sectors.

A hurdle, not a roadblock

It’s still early in the business cycle, and the tight credit conditions necessary to produce the next recession, an accompanying decline in corporate profits, and an equity bear market appear to be a long way off. We think long-term investors should look through the latest inflation disruption and continue to moderately Overweight equities in portfolios. But we think heightened inflation risks underscore the need to tilt U.S. exposure more toward “value” stocks than “growth” stocks.