"What I’ve learned over the years is we spend way too much time analyzing what goes wrong rather than thinking about what goes right." – Kenneth C. Griffin, founder of Citadel LLC/Citadel Securities

Note that the contents of this memo are all my thoughts, and not the views of RBC Dominion Securities. As well, no part of this content was AI-assisted or created.

[YOU CAN LISTEN TO THE ABBREIVATED PODCAST VERSION OF THIS NOTE HERE]

Friends & Partners,

I am sending this one a couple days early so you have the weekend to peruse the note rather than the busy upcoming Monday morning.

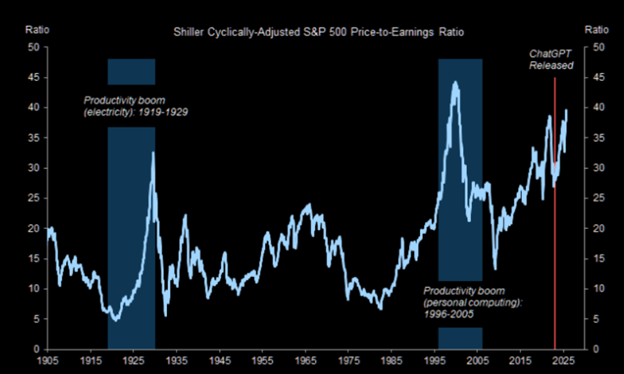

We finally got some sanity set into markets in November, though markets rallied back later in the month. Pullbacks are never fun, but you have to know that markets don’t just scream higher into oblivion forever. One of the smartest PMs over the last couple decades has been someone named Marc Weiss, who succinctly wrote that, "The AI Honeymoon is Over. Welcome to the AI Marriage". We are moving from the heady times to the daily work it takes to make a marriage work. Most of you know that story.

Some out there are finally paying the price for speculating on their investments – look no further than crypto for this type of investment activity. Benjamin Graham states that “an investment operation is one that, after thorough analysis, promises safety of principal and a satisfactory return; all other operations are speculative.” Investing involves holding an asset long term with the purpose of achieving a financial objective such as accumulating wealth during retirement or funding a child’s education. Speculation, on the other hand, is the process of placing bets on very high-risk opportunities with the purpose of achieving exceptional returns.

Sometimes it is difficult to remember that sometimes, the best investments are the ones you don’t take, as the losses can be detrimental to a portfolio and unrecoverable.

The headlines are quick to harness any weakness or pullback and amplify things – making it enticing to doom scroll. The world wants to grab your attention, but it’s harnessing confirmation bias, and the headlines often lack context. There are a number of negative things to point to, but one concerning thing to note has been the market’s ‘breadth’ - breadth measures how many members of an index are participating in its advance or in its decline. The breadth has continued to narrow because market leaders have narrowed to the megacap tech names, which has made the recent market advance very sensitive to variations in excitement around AI. I wrote about the reasons to be cautious in the prior few months HERE.

AI has been a huge positive force for both the stock market and the overall economy. The AI train has taken a bit of a pause as of late as investor sentiment toward highly capital intensive data center (i.e. GPU) capital expenditures has recently turned from red hot to ice cold, and from seemingly accretive to shareholder value to dilutive. However, I think few will argue that AI isn’t a transformational technology and yes, spending intensions and excitement about margin expansion have likely gotten ahead of themselves. But we are not at the stage yet where AI capex intensions are dramatically being dialed back and until that happens, the reality is this is a significant pro-growth economic force. If capex intentions begin to reverse (which can’t be ignored but isn’t happening at this point), then the outlook will become demonstrably more negative, but that is not happening yet...

For context on November’s pullback however, near the lows mid-month, the S&P 500 was only ~4.5% off its highs. Yet, ~350 names in the index were down over 10%, 250 were down 15%, 200 were down 20%, and 90 were down over 30%. There’s more going on under the hood than meets the eye.

Everyone is fretting over the Central Bank’s next move, and when that will happen – for asset prices and mortgage payment affordability, many want to see another rate cut ASAP. But that has been thrown into question. Reading the tea leaves of the Fed’s next move has become difficult, a relatively new phenomenon out there. This caused the bulk of the swings in November, but is actually a good thing as voting members will act more independent. I will get into this more in one of the sections that follow.

The economy is still doing ‘OK’ – despite concerns about the economy, the reality is that growth is holding up “fine” and it’s not just the macro data that’s showing that, it’s corporate commentary, too. So, while there are risks to the economy, the reality is that actual growth metrics (both macro and micro) remain relatively stable so far. It is truly a tale of two economies however – which has led to the term ‘K-shaped economy’ – meaning that the wealthier cohort is doing well, while those not as lucky are having a hard time. And this dynamic is getting more pronounced. The wealthy are holding up the economy in short – which has been supported by the ‘wealth effect’ of strong markets, and thus AI – let’s hope something doesn’t break…

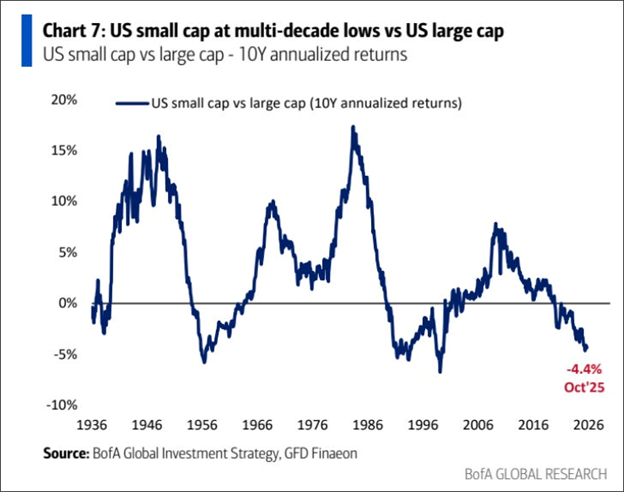

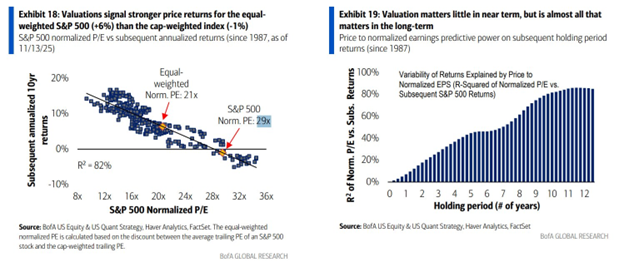

One may want to think about where the returns will lie moving forward in the markets – there will be returns to be had, that I promise. It likely won’t be where you think it is.

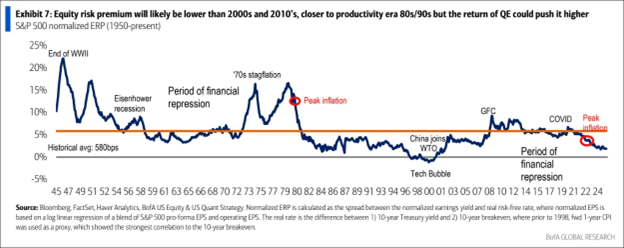

Legendary investor Howard Marks puts it bluntly in noting that “when you buy the S&P 500 at a 23x Price/Earnings, your 10-yr annualized return has always fallen between +2% and –2%, IN EVERY CASE, EVERY CASE.” Today the market sits HIGHER than that valuation, meaning that after inflation your passive US equity returns moving forward could be negative over the medium term. Value may have to be found elsewhere.

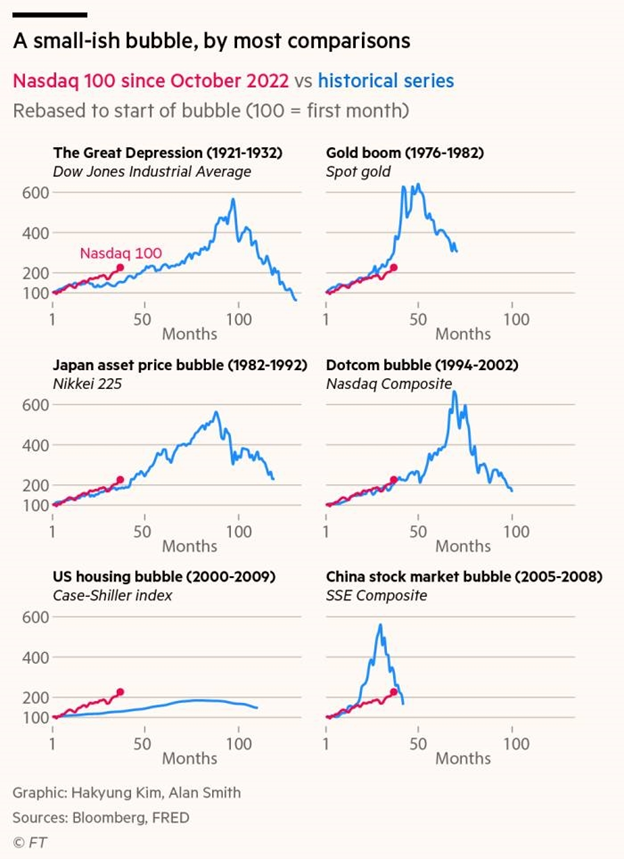

Source: Haver

The last 25 years saw three major bubbles before the current one (if we’re in a bubble!?), each of which involved different assets and required quite different responses. For example, the Internet Bubble was a frenzy where investors overestimated growth rates on a new technology, but other asset classes remained reasonably priced. Today, we’re within 10% of the 2000 peak in cyclically adjusted earnings, but value remains in many strategies and non-US assets.

As my old friend and Bay Street legend Bob Decker noted: “No longer can you throw your portfolio at the wall and expect everything to stick. It will take more skill now to outperform the market. Now comes a new phase that relies more on stock picking skills than herd-following. Now comes the real alpha generation.”

The outlook is mixed, but there are tailwinds to consider. We are heading into supportive fiscal policy, which is a serious tailwind for assets.

We can’t predict the future. But when I hear things like “buy the dip and never sell,” that’s faith, not analysis or judgement. You can get some insurance in your portfolio for this noise and potential scenario, which is precisely what we do. People get insurance on their houses, cars, and lives, but they don’t get insurance on their portfolios, which often is their most valuable asset. About 1 in 100 homes will have an insurable loss in any given year, yet we all buy insurance for that – VERY few investors I know do the same with their portfolios (outside of our client base of course). Maybe it’s because there is no friendly insurance company out there with a green lizard or an emu that helps us do it. Insure when you can, not when you have to.

Other Interesting Things To Highlight

I recently had the honour of attending the 73rd RBC President’s Club Conference, a long-standing tradition that brings advisors from across Canada together to learn, connect, and celebrate shared accomplishments.

The event was a powerful reminder of the dedication, mentorship, and relationship-building that define our profession, and I’m grateful to have had the opportunity to share this meaningful experience among colleagues. I am humbled to join the esteemed men and women who have come before me and continue their legacy of excellence.

My team and I share this with our clients and core partners – our clients as our sole focus, and our core partners who bring us best in class partnerships and collaboration. They are the reason we are here.

Being part of a community so deeply committed to excellence and client success makes the work we do at RBC Dominion Securities especially rewarding, and I’m truly thankful for the people who make this journey so special. This is a milestone in our journey together as we look forward from here.

I am excited to support the Georgian Triangle Humane Society again this year, pledging $10k match against donations made that day. December 2 is Giving Tuesday, a global day of generosity - and a powerful moment to change the lives of pets and people in our community. That means your Giving Tuesday donation goes twice as far to provide safety, care, and hope for pets who are counting on us. Your gift will help provide:

- Warm beds, nutritious food, and daily enrichment

- Medical care and surgeries

- Behavioral support and socialization

- Access to Care programs like pet food, emergency boarding, and low cost veterinary care

- A safe place to heal until each pet is ready to find a loving home

Every dollar ensures that every pet receives the compassionate care they deserve -not just today, but all throughout the year. Make your Giving Tuesday gift online at https://gths.ca/donatenow

I was pleased to be part of a panel that presented at an alternative asset manager forum hosted by McMillan LLP and Capoeira Partners. This was part of a series showcasing perspectives from emerging alternative asset managers, allocators and thought leaders. Topics included best practices in building and scaling an asset management business, the advantages of allocating to smaller, specialized managers, how to best position a strategy within a broader portfolio context, and insights from allocators on how managers can differentiate themselves and attract capital.

|

|

|

The A.I. Pullback Put Into Perspective, And Outlook Here*

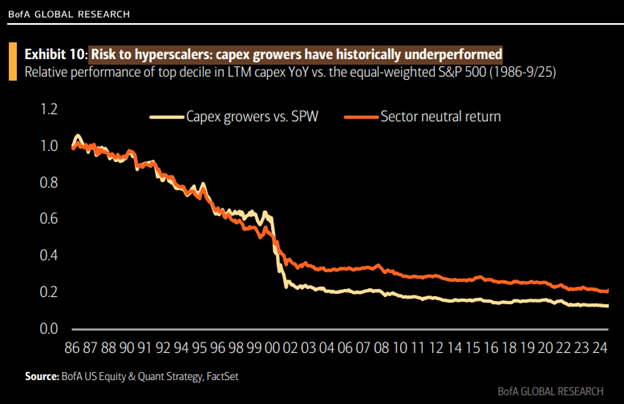

Is this going to end up the same as the dot-com boom? Time will tell. It's too early to identify the most successful companies, and we'll eventually see "winners" and "losers." The question is whether the current enthusiasm is justified. The surge in AI investments mirrors the late 1990s dot-com boom, with capital pouring into infrastructure and tech hardware at an unprecedented scale. Some investor caution is warranted as the US market's largest stocks transition from asset light to asset heavy business models, supported by that rapidly growing capex. Historically, capex growers have dramatically underperformed the market…

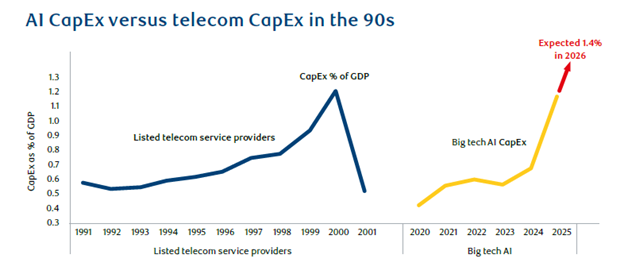

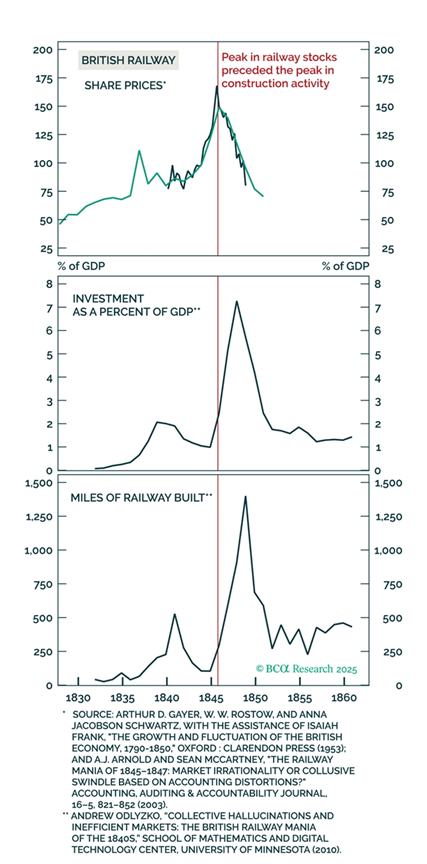

Jim Bianco sees may similarities to the internet boom: “Here’s the problem: every AI company is priced as if it’s going to win, which is reminiscent of the dotcom bubble in the late 1990s. Back then, every internet company was priced as if it was going to win. Yes, the internet was important. It mattered, and there were huge winners, but not everybody won. The issue is everybody looks at their deal to build a data center. On paper, it all makes sense, the economics work. But the problem is there are dozens of other people making the exact same decision, all at the same time, and collectively this leads to a massive overbuilding. Excesses like these are a recurring theme throughout history, from the major railway bubble 150 years ago (roughly 70% to 80% of the trackage added in the 1880s entered receivership by 1900) to the fiber-optic buildout during the dot-com mania (enough fiber to circle Earth 4,000 times). Every time, so much infrastructure was constructed that a portion of it was never even utilized.”

Here is some fun numbers: Morgan Stanley estimates AI infrastructure spending will reach $2.9 trillion over the next four years. According to ChatGPT (irony), hyperscale data centers enjoy operating margins in the high teens. If we say 20% operating margin and 20% tax to generate a 20% ROI in four years on a $2.9 trillion spend, you would need about an extra $3.6 trillion in revenue by 2028. That’s $440/year from every person on earth. Hmmm.

The chart below shows how the 1990s dot-com boom became a bubble that burst in 2000 as capital expenditures into the industry reverted to where it started.

Source: RBC GAM

Despite investor optimism, three considerations are creating skepticism around AI today.

- Rising leverage: AI investments consume a growing share of cloud service providers’ free cashflows, while many new entrants are relying exclusively on leverage. Off-balance sheet financing and private credit funding raise red flags around the sustainability of AI growth.

- Monetization challenges: Investments in graphics processing units (GPUs) and data centres typically begin 2-3 years before AI revenues materialize and 5-6 years before profits are realized. The monetization pathway for AI capital expenditures remains uncertain.

- Infrastructure & energy constraints: Private construction spending on data centres has nearly tripled since December 2022, and AI-related power consumption doubled in 2025. This rapid growth has strained the U.S. energy grid, with estimates suggesting a potential shortfall of ~45GW by 2028. That’s equivalent to powering a country like Italy.

There was a recent MIT study suggesting most companies aren’t yet seeing a meaningful impact to their bottom line from AI unsurprisingly – this technology will take time to integrate and monetize. I would generally agree with the view of NY Fed President John Williams, which he articulated in a speech to the financial community in September in NYC, that AI may end up being a chapter in a longer-term story about American productivity, and will likely take some time – similar to other general-use technologies – to have a meaningful impact on productivity.

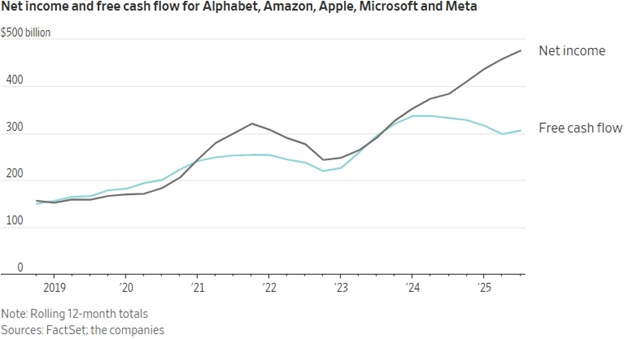

AI cash flow is what matters… you can’t hide from cash flow like you can earnings. There’s one key difference between the AI players of today and the dot-com names of two decades ago – the leaders of this market are making plenty of money. But all the AI spending is starting to take a toll: The 12-month cumulative cash flow for Meta, Alphabet, Microsoft, Apple and Amazon has dropped in the past few years.

AI has clear echoes of past capital cycles, including the fastest capex ramp in history, speculative spending on data centers built ahead of steady revenue models, GPU shortages creating a false sense of scarcity that results in overordering, and an unclear determination of return on investment as the cost of inference rapidly declines. If forecasts of AI use prove overly optimistic, the capex boom may have lasting consequences for the market.

Stock prices tend to peak before capex (see exhibit below). As such, evidence that capex has rolled over may not be visible until the equity market has already done so.

Regardless, this excitement may not end soon, as we may have another phase to play out. During the last three years of the 1990s tech bubble, the NASDAQ rose by over 300%. But it also endured 11 corrections measured by drops of greater than 10%. That’s almost four corrections per year.

Reasons To Remain Cautious & Vigilant*

If AI capex reverses, the Fed announces a pause, growth starts to rollover and tariff chaos causes corporate and macroeconomic uncertainty, the outlook for this market will change substantially for the worse, and we’ll have to talk about the end of the bull market.

There is a torrent of cash going into chips, data centers and all the infrastructure around AI. Think electricians, plumbers and air conditioning installers who are all reaping rewards from this spending, which trickles down through the economy. Add that to the “wealth effect” felt by stockholders and there’s enough spending to keep corporate earnings, and the economy generally, rolling along well, even in the face of tariffs and other uncertainties out there.

This creates a vulnerability as the economy is “all in” on AI-driven growth. The risk is that any crack in that narrative could lead to a rapid unwinding, and negatively effect the economy and markets together fairly quickly. Some estimates show GDP growth is running close to zero if you back out the AI spending.

The US and Canadian economies are still doing ‘fine’, though there remain cracks in the armour.

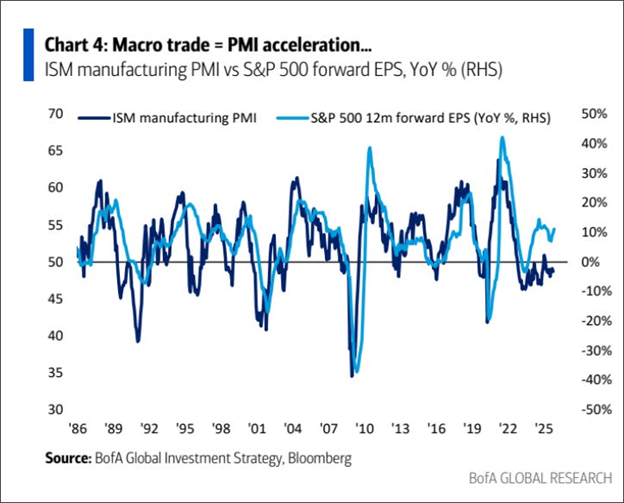

Purchasing Managers are cautious, and when they become more optimistic, stocks usually follow reluctantly. This time, it’s the opposite! Stocks are more excited about the economy than Purchasing Managers:

Equities trade at quite the premium to bonds, and that dynamic is likely to continue but is not good.

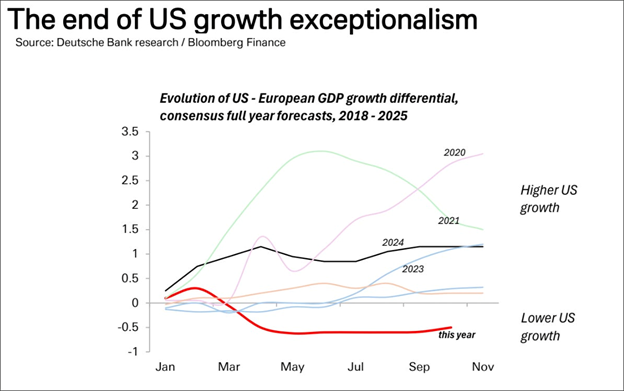

Opportunities will continue to come from more geographies and strategies than in recent years past I expect.

But As Always, The Market Can Climb The Wall Of Worry And Focus On The Positives*

Do not take all of my cautious analysis as my effort to downplay potential positives out there. Front running that scenario based on marginal deterioration is often premature. And while all of the cautious concerns are real, the reality is that the facts haven’t deteriorated enough to warrant the outlook shifting materially more negative and the bullish case has deteriorated, but not by that much.

There is plenty of focus on the US Fed, and how the voting members don’t vote or see things in unison any longer. This is actually a positive. The 12 policy committee voters no longer feel obliged to agree with the chair. For 40 years, Fed policy has been effectively set by one person, and votes were typically 12-0 or 11-1. Now this is changing. The FOMC is evolving toward a system of 12 independent voters instead of a chair-driven consensus. Independent voting doesn’t mean the Fed will make better decisions; but it does means voters will more quickly recognize mistakes and change their course. This could mean more short-term policy volatility but better results in the long run. Groupthink and consensus voting led by the Chair has arguably been an issue in the past and led to policy errors.

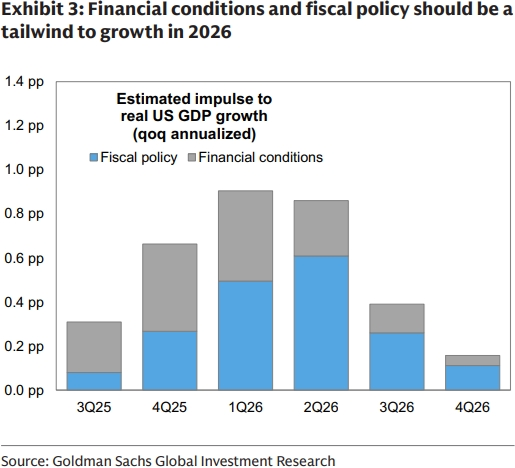

We are heading into supportive fiscal policy, which is a serious tailwind for assets. While the 2025 economic outlook was mired by uncertainty over trade and fiscal policy, the passage of the One Big Beautiful Bill (OBBB) Act set into motion a strong fiscal impulse for 2026–2028. Tax cut provisions are front-loaded, while spending cuts demanded by the deficit hawks are backloaded. The economy and the stock market should enjoy a fiscal growth tailwind in 2026 due to this. This year we had a 1% of GDP fiscal tightening thanks to the tariffs. Next year, that swings to a 1% easing due to the tax cuts, assuming the tariffs stay in place. In addition, the Trump White House’s influence on Fed policy is expected to keep pushing the central bank in a dovish direction. This combination of easy monetary policy and fiscal policy are reflationary.

91% of the world’s central banks are now in easing mode - the highest share since March 2021 – which has historically been aligned with favourable conditions for global equities. That said, most major central banks have either concluded or are nearing the end of their cutting cycles, implying that the boost from monetary easing may be less pronounced in the year ahead. Fiscal policy is also providing a tailwind, with large economies such as the U.S., China, Germany, and Japan implementing additional stimulus measures.

As I have noted a number of times, even though there are pockets of speculation and overvalued sectors, selected strategies are interesting. This is but one to put on your radar (I highlighted the opportunity in private infrastructure last month as another), and is something our clients have exposure to: