“When I was a kid, I used to think, 'Man, if I could ever afford all the ice cream I want to eat, that's as rich as I ever want to be.’” - Jimmy Dean

Note that the contents of this memo are all my thoughts, and not the views of RBC Dominion Securities.

Friends & Partners,

I am starting this note while in my motel room in northern Ontario where I am stranded for 5 days – flying a small plane somewhere requires suitable weather in both directions, and it seems I didn’t get that for my return leg. So be it! Sometimes life throws you lemons… and markets have certainly felt that way in recent months, with balanced portfolios (typically 60% stocks and 40% bond allocations) down 20%+ this year, but there is an alternative, and always an eventual path home.

Things remain highly uncertain and volatile, so we continue to position portfolios defensively with this in mind. That said, this remains a broadly uncomplicated market (though not easy!):

This is not 2008, where speculation in housing was rampant and combined with years of dereliction of duty by risk management departments in banks, insurance companies, and other organizations resulted in a black hole of insolvent loans based on inflated home prices, leading investors to have to guess who was solvent and who wasn’t.

This is also not 1998, where an explosion of emerging market debt eventually collapsed under its own weight, sparking a liquidity and foreign exchange crisis that required action from global central banks and the bailout of a massive hedge fund (LTCM). Finally, this is not 2010/2011 where decades of fiscal irresponsibility from southern European nations collided with German frugality and sparked a sovereign bond crisis and left investors wondering if the newly formed European Union would band together to bailout Greece or disband the Economic and Monetary Union.

The point is that these were all “existential crises” that confronted investors with a lack of navigable information, which was a black hole into which investors peered and wondered how far contagion would go. This current environment is not that, and is actually more “run of the mill” believe it or not. The global economy has a big inflation problem. Recessions are better than entrenched inflation (neither are good but the former is better than the latter), so central banks will hike rates to cool inflation to a tolerable target (likely 3%-4%). Those rate hikes will cause recessions, which will help fix inflation. When that’s done, these same central banks will cut rates, stimulate the economy, and growth will resume (albeit with a higher level of inflation than you were used to). It is a process we must endure.

The market is currently struggling with the timelines around all of this. Inflation is not yet declining materially, which means we must endure more rate hikes and a slowing of the economy to get to the proverbial “other side”. Being at this stage of the process leaves the markets susceptible to shocks, and we’ve endured several this year that have not helped things – the first shock was Ukraine, which hurts the global economy via higher commodity prices, higher geopolitical risk premiums, and general anxiety. China has also decided to stray from the rest of the world in its handling of COVID, continuing to lock things down which hasn’t worked, so the global economy must deal with a “stop/start” Chinese economy as well. Then the U.K. had an historic bungling of the inflation problem, which caused an unwelcomed spike in global bond yields.

These shocks exacerbated market volatility, but at its core we are still dealing with an inflation problem that the Fed and other global central banks will fix, and that will bring slower growth and lower asset prices with it. The market needs to sniff out the other side, and needs proof of inflation receding. So far we have a number of data points that it should be soon, but it’s not conclusive yet. The Fed is going to break inflation (don’t fight the Fed!), and then they will eventually cut rates and re-stimulate the economy, and this will create a 2000-2002-type opportunity for investors.

Bear markets are brutal processes and often involve much volatility and false breakouts, which grinds on even the most patient investor. One’s own behaviour is usually the enemy as it feels agonizing at the time. But patience has always been richly rewarded, and from a weak market comes cheaper assets, and expected portfolio returns long-term are much higher than only a few years ago. I also expect that we will be ‘out the other side’ of this in shorter order than many market pundits will have you believe.

There are a number of strategies offering interesting opportunities already. So we remain defensively positioned while nibbling at and adding to a number of strategies and positions. As always, I can make myself available to discuss anything around markets, portfolios, tax & estate planning and structuring.

A Few Events to Highlight

I am honoured to sit on the Board of United Way Simcoe Muskoka, and I am proud to partner with Women, Worth & Wellness to bring an inspiring and important event in support of Women United on November 2nd in at Creemore Station on the Green. Women United is an inclusive, vibrant group bound by a powerful sense of belonging – to one another, to our communities and to the mission of transforming the lives of Simcoe Muskoka girls, women and their families. We have some great speakers, and I will discuss philanthropy and charitable strategies. For more details and registration go HERE.

We also recently hosted our annual golf event in support of Collingwood General & Marine Hospital which was another big success, and you can see a cool short video summary of that event HERE.

Where Could We Go From Here? What is History Telling Us*

It is difficult to quantify the potential upside when we get through the noise, and current conditions matter, but history is always a good starting point for evaluating where things may go moving forward.

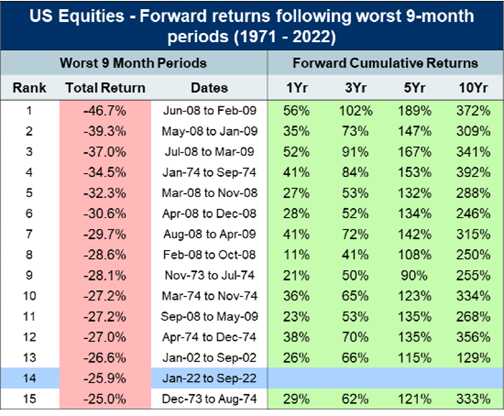

The economic outlook isn’t pretty as we all know, and equity corrections around recessions are highly variable – market performance can vary widely before and during recessions. The S&P 500’s average decline was -32% surrounding the previous 13 recessions, and magnitudes ranged from -15% to -57%. Interestingly, there has not been a strong correlation between the duration of recessions and the duration of the stock market declines. It’s also not a sure thing that the 25% loss in the S&P isn’t going to turn into something worse. But the chart clearly shows that returns are usually strong when holding equities following protracted drawdowns. The average 5-year forward return is 135%, while the average 10-year forward return is 300%:

Source: Compound Capital Advisors. As of September 30, 2022. Returns reflect the Wilshire 5000 Index (broadest U.S. equity index) in U.S. dollars.

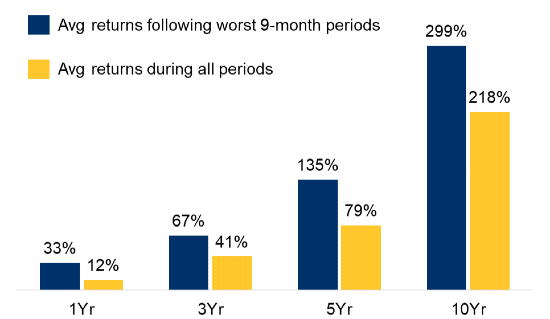

And if you’re buying on the ‘cheap’, your returns should prove stronger than average:

Source: Compound Capital Advisors. Data is from January 1971 to September 2022. Returns reflect the Wilshire 5000 Index (broadest U.S. equity index) in U.S. dollars, comparing the average forward cumulative returns following the worst 9-month declines (from the table above) to the average cumulative returns during all periods between 1971 and 2022.

One thing is a constant: the equity market ALWAYS troughed before the recession officially ended. The market bottoms well before the economic clouds part, often when headlines and investor sentiment are still very negative. If you wait for the financial media, IMF or consensus economists to let you know a recession is coming (or here), it is too late from an investment perspective as the markets have likely already moved or turned.

Attempting to time the market bottom is usually a fruitless exercise, but we can take advantage of opportunities as they arise, and some opportunities are already surfacing.

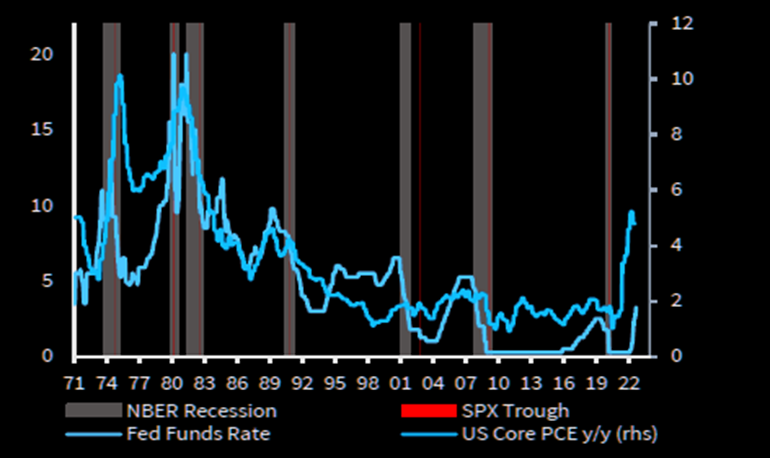

BUT, we need to watch our risk appetite, exposures and risk controls. In past recessions, equities never troughed before the Fed cut rates:

Reasons For Optimism*

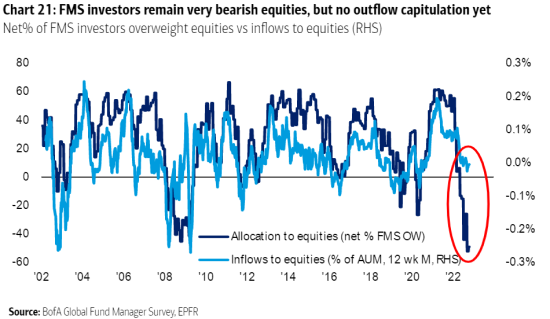

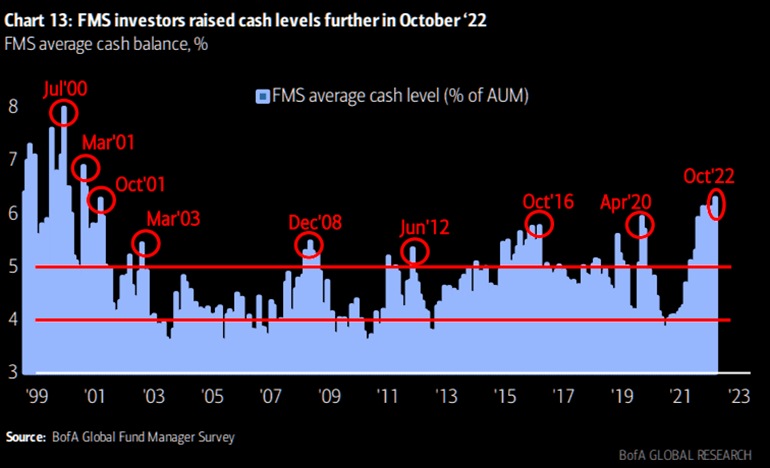

It may not feel like it during the storm, but bull markets are born out of pessimism, every time. It is certainly consensus thinking that we are going to continue to go much lower from here – and one of the cardinal rules of the markets are that when everyone thinks something is going to happen, something else will happen. Today, we are facing a near-panic moment that, on many measures, is worse than even the 2008 financial crisis. Consumer and business confidence has fallen by the most in a decade, and investors have driven record dollars into cash and short-term bonds. Even the ‘pros’ have buried their head in the sand and are VERY cautious, with average allocations to cash at the highest since 2001 and allocations to global stocks at an all-time low – these are usually counter-indicators. Current levels of investor sentiment are now consistent with past bottoming processes:

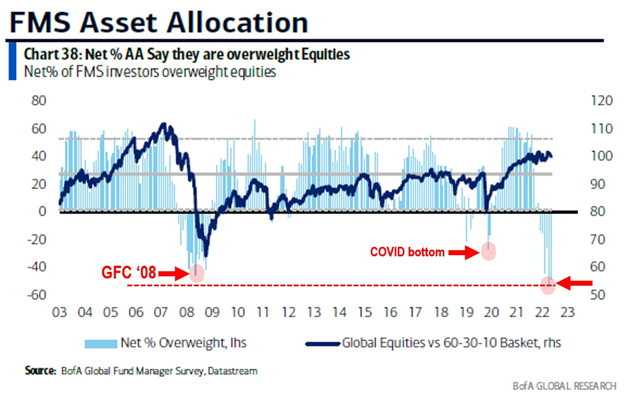

While the "net allocation" to equities is lower than COVID-19 low and the Financial Crisis:

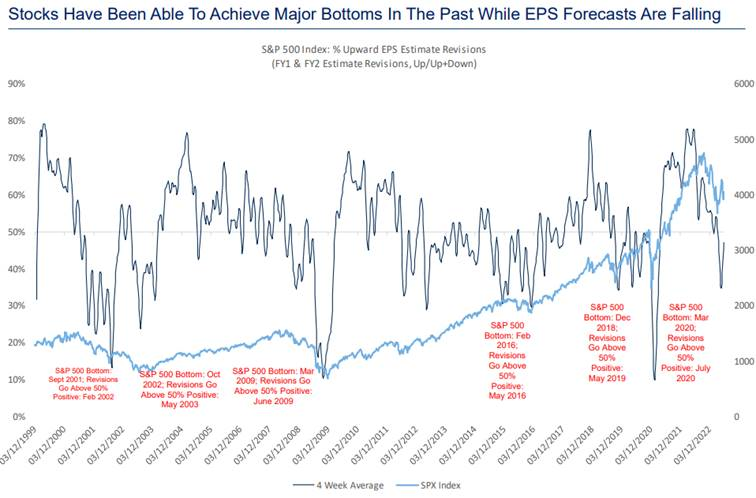

Earnings outlook likely needs to weaken further, but stocks can bottom before this has fully played out:

Source: RBC Economics

Overall, upside surprises can come from several areas. China, the second largest economy in the world and a crucial driver of global growth, is a case in point. Lockdowns will not last forever. Hong Kong has seen easing quarantine restrictions in recent weeks, and hopefully that makes its way to the mainland sooner than later.

Things can’t get much worse in Europe, and assets and expectations there reflect this outlook. Believe it or not, expansionary policies will drive growth higher over there in the coming years.

Inflation is set to recede soon no question, and I wrote two months ago that inflation had likely peaked. The US Dollar has been on a tear of late, which pressures many corporations’ international operations. However, here is the positive takeaway in this: USD strength leads global inflation by 8 months, meaning this is another data point pointing to the fact that we have likely seen peak inflation which should begin receding soon.

The Fed needs to stamp out inflation, and needs hard data before letting off the pedal. There are signs this is coming, and perhaps sooner than many expect. Food, transportation, and housing account for almost 90% of the recent CPI, and each of these is showing decelerating price momentum. On top of this, commodities have corrected, and supply chains are easing up. Rental and home prices are finally easing, and the wage-price spiral looks increasingly unlikely. All of this will pave the way for a declining trend in core inflation in the coming months and take pressure off the Fed.

So, we can perhaps expect a Fed ‘pivot’ sooner than many expect – possible contagion from uncertainties in the UK gilt market and euro area bonds, combined with lack of liquidity in all markets (especially credit and currency markets) increases financial stability concerns for central bankers. They will be balancing all of these concerns.

Some Reasons To Remain Defensive Near-Term – The Short List*

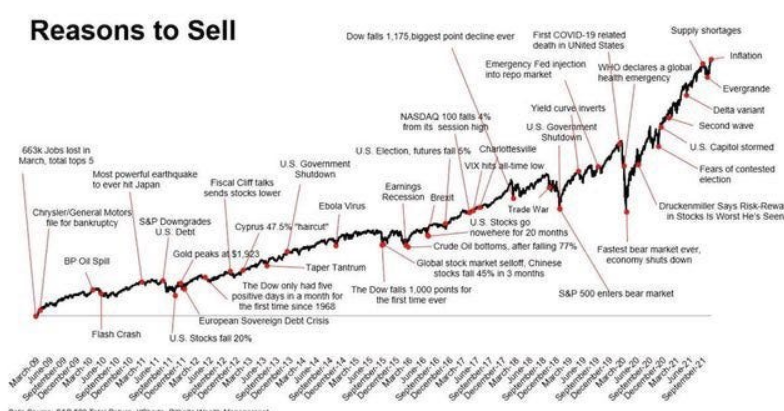

There will always be a long list of reasons to be cautious, even in bull markets:

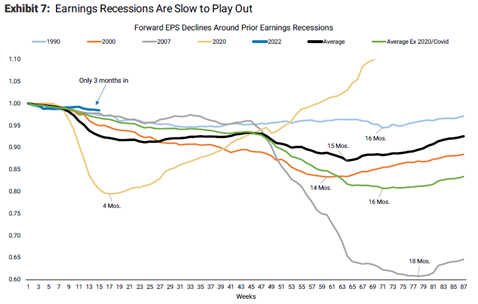

I have been harping on earnings estimates as having to come down for months now as you know, and that still appears to be the case, especially if the past is any prologue:

Source: Goldman Sachs

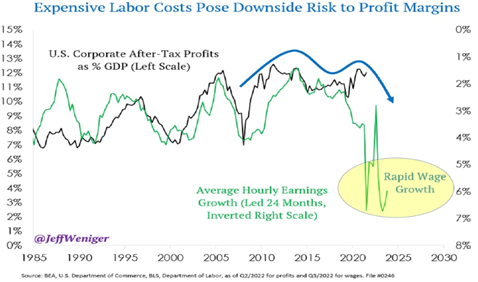

And on this note, inflation in wage costs could be a main culprit for corporate earnings soon to take a big hit:

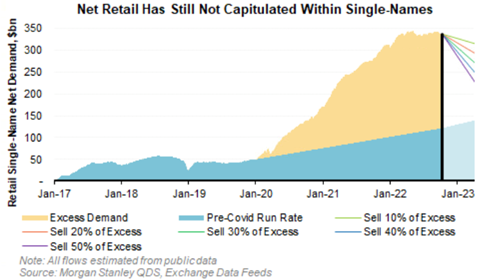

Finally, ‘retail’ (i.e. individual investors, not institutions) has still not capitulated fully by any means. Investors have sold a lot of stocks, but still hold a lot of stocks. We usually see them blow it out and give up hope before putting in a sustainable bottom. Interestingly, retail investors are more bearish about stocks than at any time since the survey started (remarkably even including 2008), but somehow flows into equities are still positive: