I recently came back from a research fieldtrip to Hong Kong, Tianjin and Beijing. Within a short span of 4 days, I met with the finance folks at 22 companies along with 2 of our RBC analysts (London team). My intent was to find out for myself the health of the Chinese consumer.

As our clients, you already know that my team & I put in a lot of effort into building our portfolios from the ground up; doing deep due diligence on every single company we invest in. We do not simply follow our firm's recommended list. We are tactical in our strategy in order to minimize risk, while keeping our laser focus on growth.

China is the world’s second largest economy after the US (see chart below). With all this talk of trade wars, tariffs and a rising interest rate environment, China is extremely out of favour right now. On one hand, we have very poor market sentiment and performance while on the other hand, macroeconomic conditions and corporate earnings are still strong. The Chinese consumer is still spending. They still need shoes, clothes, electronics, cosmetics and they yearn for better lifestyle experiences (like travel). They aspire for growth and a better/richer life. They are no longer wearing Mao jackets; they want the latest fast fashion from Zara or a fancy Versace t-shirt.

Growing up in the 80’s, China was a place I didn’t want to visit. Poverty was prevalent, and it seemed to be a back-water village full of drab Mao jackets. Today, it’s a leading innovation hub and boasts the largest phone company in the world with 902 million subscribers. The people have a strong entrepreneurial spirit with large privately-run companies. Compared to the days of Tiananmen Square, the China we see today has vastly increased personal freedom and a much more market-driven economy.

The focus of this trip for me was the Chinese consumer. I wanted to know what they were buying (or not buying) and what they want to experience.

My trip included meetings with luxury, fashion apparel and sporting goods companies (Prada, Emperor Watch, WatchBox, Chow Sang Sang, Secoo, Esprit, Li & Fung, Yue Yuen, Xtep, China Dongxiang and Ted Baker), mall operators (Riverside 66 and Florentia Village Luxury Outlet), real estate expert CBRE, casino operators (Melco) and store tours (Zegna, Adidas, Louis XIII). Who would have thought that the #1 Apple Store in China (revenues) would be in the Tianjin Riverside 66 Mall?

I saw the new 55km Hong Kong-Macau-Zhuhai Bridge which just opened this week, which is truly exciting. In the past, if one wanted to visit the gambling mecca of Macau, one had to fly into the Hong Kong International Airport, catch a train to downtown Hong Kong, and then catch a ferry to Macau (time consuming). Macau’s airport serves primarily private jets. Today with the new bridge, one can easily catch a transfer service from the Hong Kong Airport to Macau. This will boost tourism to the area significantly.

Macau is the only place to gamble legally in China. Its gaming revenues is 5 times that of Vegas. In the past, 70-80% of their gaming revenues came from high roller VIPs. Today, 85% of their revenue comes from the mass-gaming sector. The industry in Macau has moved on from a serious gaming enclave to Vegas-like; with experiences like food & beverage outlets, spas and shows.

I wanted to know if they preferred Chinese shoe brands or the large international brands. If the latter, which ones they aspired to buy. I wanted to know how a country of tea culture could be convinced that drinking coffee is cooler than tea. I wanted to know if the Apple watch has become the watch of choice or is the traditional high-end Swiss watch still something to aspire to. If the latter, then which ones? I wanted to know how the Chinese consumer prefers to do their shopping, online or in-store. I wanted to know the profit margins of them all because I only want to invest in profitable companies with strong management teams.

My key takeaway from the trip was that there is a dichotomy between recent trends for for high vs low ticket items.

- Hard luxury goods (eg watches and jewelry) may be hit first

- Soft luxury goods (eg fashion) growth is slowing but not collapsing

- We met some companies exposed to secular growth avenues in China, which includes

- luxury e-commerce

- luxury outlet malls

- pre-owned watches (now, this was interesting)

- sporting goods

I came away with some fabulous ideas and thoughts for our portfolios' long-term strategy. My team and I will do more research over the next few weeks and will implement these ideas as part of our investment strategy when the timing is right.

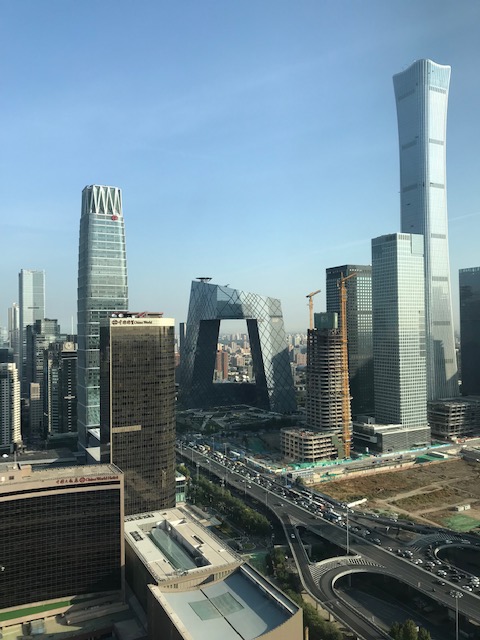

Here's a photo with a view from my hotel room in Beijing's Park Hyatt showing the traffic nightmare at 7pm in a city of 22 million people.

And here is a morning view showing decently good air quality.

And here is a photo of the location of Hong Kong's old Kai Tak Airport, being prepared for redevelopment into more housing. I remember, as a teenager, thrilled flying into Hong Kong's Kai Tak airport being very close to tall apartment towers and thought that that pilots must be very skilled to fly into a city like Hong Kong.

And this is a fancy-schmancy shoe made by Xtep, a local Chinese manufacturer selling locally in China.

p.s. No, I didn’t have a chance to do any touristy activities as I flew in, attended to meetings, and then flew back out. I have been to Beijing and Hong Kong in the past, so I think I covered all the cultural must-do’s.

Pam

October 2018