Lately we think the message emanating from the market has been that S&P 500 profits are at the cusp of an inflection point, and that Q2 earnings results—which companies started reporting this week in earnest—will be the trough quarter.

The S&P 500 has rallied about 10 percent since early May and has clawed back to its highest level since April 2022. The market has advanced as the pace of downward revisions to consensus earnings estimates has slowed notably, and as inflation has receded and economic concerns have eased among investors.

While much of the market’s year-to-date gains have been dominated by seven large technology-oriented stocks, performance has broadened out to other sectors and industries since early June—another sign that a change could be brewing on the earnings front.

Is the market painting too rosy a picture?

We think the U.S. economy’s growth trajectory will be the ultimate arbiter. Projected 2024 earnings gains are highly dependent on whether the economy manages to avoid a recession, in our view.

Q2 earnings results and management guidance for upcoming quarters could provide some hints about the future path of the economy and earnings.

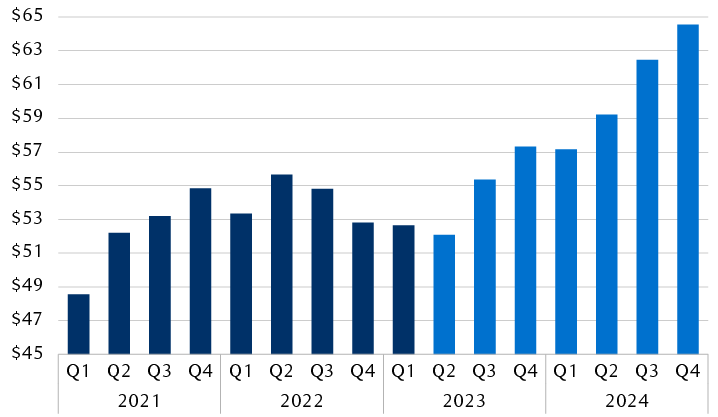

The consensus forecast calls for earnings to trough in Q2 2023

S&P 500 quarterly earnings per share

(dark blue are actual data; light blue are consensus estimates)

Column chart showing S&P 500 quarterly earnings per share from Q1 2021 through Q4 2024. Data from the start through Q1 2023 are actual results. Data for Q2 2023 and onward are consensus forecasts. In Q1 2021, S&P 500 earnings were approximately $49 per share. It rose each quarter to a peak of almost $56 per share in Q2 2022. In the three subsequent quarters it declined, reaching about $53 in Q1 2023. For Q2 2023 the consensus forecast is for an additional decline to $52 per share. The consensus forecast then calls for earnings to increase in the next two quarters of this year to $57 by Q4 2023. The consensus forecast calls for further increases in 2024 to roughly $65 by Q4 2024.

Projected earnings growth in 2024 is contingent on the U.S. economy avoiding recession, in our view.

Source - FactSet, Refinitiv I/B/E/S, national research correspondent; data as of 4/12/23

Profits in perspective

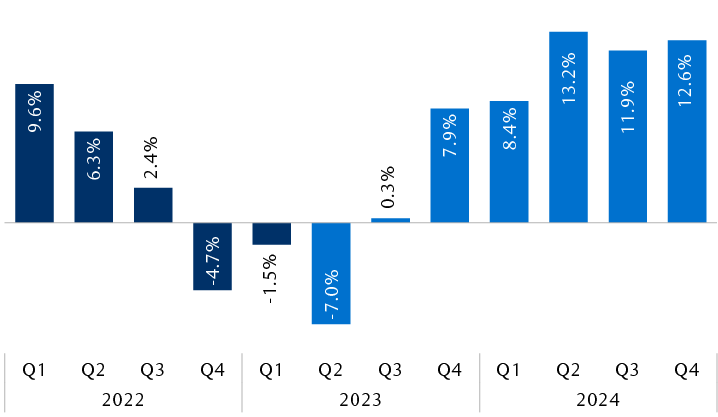

The consensus forecast is for S&P 500 Q2 earnings to decline 7.0 percent year over year.

We believe the outcome will be better than feared—and, importantly, that this is widely expected. This is part of the reason market performance has broadened out lately, in our view.

When all is said and done with the reporting season, and earnings beats are factored in, our national research correspondent anticipates Q2 earnings will decline about 3.4 percent rather than 7.0 percent.

- The Energy and Materials sectors should be big drags on Q2 results due to very tough comparisons when commodity prices were much higher a year ago. The consensus looks for earnings for these sectors to decline 45 percent and 28 percent year over year, respectively.

- Excluding Energy and Materials, the picture is brighter with the consensus forecast projecting 1.4 percent growth. This figure has room to rise a few percentage points if earnings beats materialize as we expect.

- Technology-oriented stocks within three sectors (otherwise known as Tech+) and the Industrials sector have higher hurdles to clear than most segments of the market. Consensus estimates were raised heading into earnings season, and the stocks rallied. To hold on to their recent gains and build upon them, these companies would need to deliver strong Q2 results and constructive guidance, in our view. There could be some hiccups. We will be closely monitoring comments by Industrials firms and semiconductor companies to gauge U.S. and global economic trends.

- The consensus forecast is for Tech+ earnings growth to exceed the rest of the market in Q2, Q3, and Q4. Whether this is already priced in following the group’s year-to-date surge is unclear. The stocks’ responses to management guidance should provide us with clues.

- Health Care faces difficult COVID-related year-ago comparisons. But we think the earnings outlook will improve in future quarters, which is a key reason we like this sector.

- S&P 500 profit margins will be under scrutiny. Inflation has receded, yet wage growth has remained sticky thus far. This combination could be a headwind for margins in future quarters because of less pricing power due to lower inflation alongside higher wage cost pressures.

- Management guidance about future quarters will likely play a big role in the market’s performance during earnings season, as is usually the case. Given the economic uncertainties related to the Fed’s aggressive tightening cycle, we don’t expect a lot of companies to go out on a limb. Most management teams will likely stick to providing outlooks for Q3 and Q4, which will leave 2024 earnings projections in a gray zone.

- This is another reason we are not inclined to give the 2024 consensus estimates a lot of weight at this stage. We view next year’s estimates from Wall Street industry analysts more like “guesstimates,” as most companies have said very little about their expectations for 2024.

The consensus forecast calls for roughly flat growth in Q3 and then increases

S&P 500 earnings growth year over year

(dark blue are actual data; light blue are consensus estimates)

Column chart showing the year-over-year percentage change in S&P 500 earnings growth from Q1 2022 through Q4 2024. Data through Q1 2023 is actual; data for Q2 2023 and onward represents consensus estimates. Q1 2022 begins with 9.6% growth, and declines throughout the year until reaching -4.7% in Q4 2022. It declined 1.5% in Q1 2023. For Q2 2023, it is projected to decline 7.0%, and then climb back to roughly flat in Q3 2023. Thereafter, the consensus estimate is for increases, ending at 12.6% in Q4 2024.

Projected earnings growth in 2024 is contingent on the U.S. economy avoiding recession, in our view.

Source - FactSet, Refinitiv I/B/E/S, national research correspondent; data as of 4/12/23

Constructive, but circumspect

We remain Market Weight U.S. equities due to economic and earnings growth uncertainties later this year and next.

Our leading economic indicators are still pointing to heightened recession risks. Given the binary nature of potential earnings outcomes over the next 12–18 months—lower in a recession scenario, or roughly where the consensus forecast is projecting in a no recession/economic acceleration scenario—we think it’s prudent to keep U.S. equity exposure dialed to the long-term recommended level in portfolios.

The market’s stretched valuation is another factor that keeps us from shifting to Overweight. The S&P 500’s price-to-earnings (P/E) ratio of 19.2x the consensus forecast for the next 12 months ranks in the 84th percentile of observances since 1985, according to Refinitiv I/B/E/S calculations. In other words, the P/E ratio has been at such a high level on only 16 percent or less of occasions. Based on the S&P 500’s price-to-earnings-growth (PEG) ratio of 1.99x versus the 1.3x long-term average, it’s even more expensive—in the 98th percentile of historical readings.

The market’s stretched valuation and what we view as optimistic consensus earnings forecasts for Q4 2023 and 2024 leave little wiggle room for economic disappointments.