April is the cruelest month

Canada’s economy buckled under the strain of COVID19 as measures to contain the virus locked down activity resulting in job losses and shuddered businesses. Additional pressure came from the sharp decline in commodity prices with oil falling to the lowest level in more than two decades. Assessing the damage has become a full-time job and we have updated our forecasts to incorporate the latest developments. After provincial governments declared a state of emergency starting in mid-March, economic activity collapsed with real GDP falling 9% in the month of March, a record-breaking decline. Job losses tallied more than one million and the unemployment rate jumped 2.2 percentage points to 7.8%. March’s sizeable decline however paled in comparison to April when 2 million jobs were lost and the unemployment rate surged to 13%. Hours worked fell by 15% and were off almost 28% from February which we expect will translate into a 11% drop in April GDP. Given this starting point, we revised our call for Q2 GDP to –40% annualized.

Darkest before the dawn

It is still too early to say with absolute certainty that April will mark the worst for the economy. However, Canada has seen the number of COVID-19 infections stabilize or decline in all provinces resulting in some announcing plans to re-open parts of the economy. Select provinces allowed construction sites, manufacturing operations and some service-providers to open in early May and articulated the timetable for additional areas to reopen. There are indicators that businesses have begun the process of adapting to a contact-less business model, even ahead of any reopening. Business confidence ticked higher towards the end of April and our own tracking of credit card purchases showed some easing in weakness in household spending late that month.

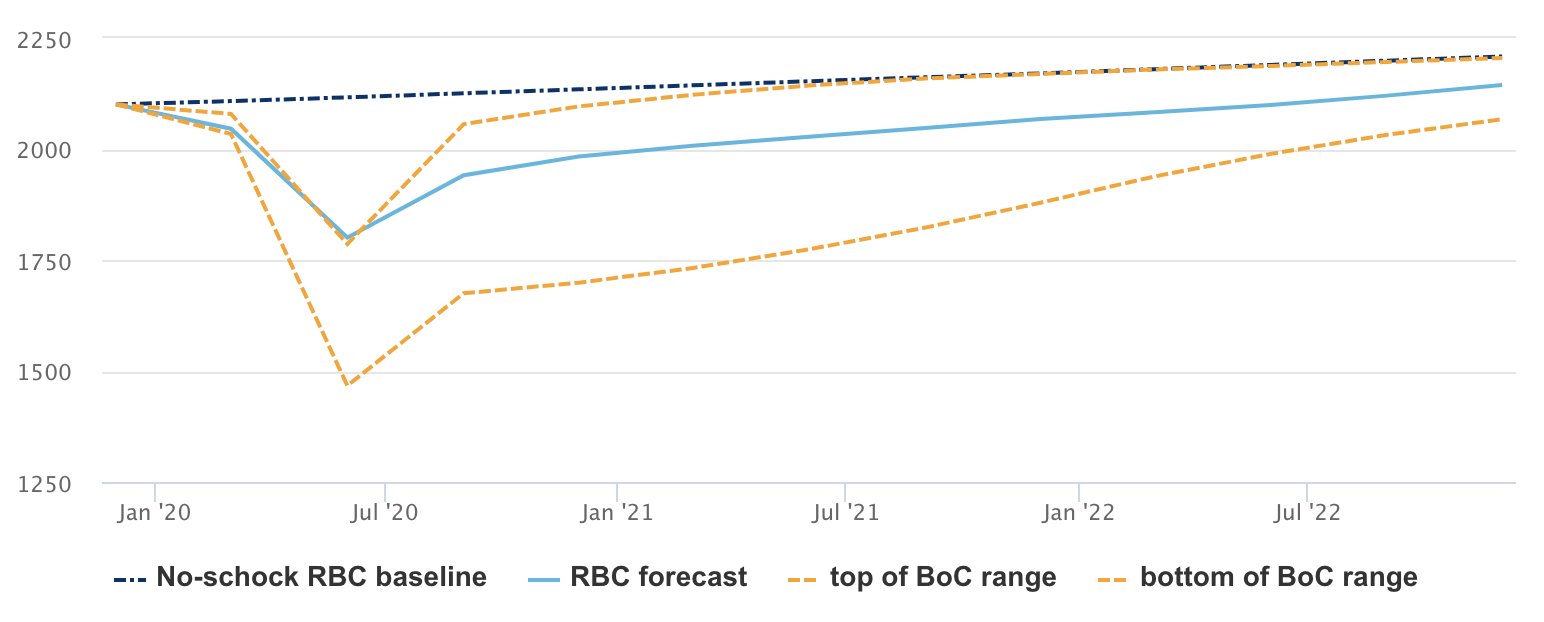

RBC vs. BoC Real GDP Scenarios

GDP, billions of C$ 2012

Source: Bank of Canada, RBC Economics

It looks increasingly likely that overall economic activity will begin to tick higher again already in May. The second quarter will still mark the largest drop in output on record – we are now tracking an 40% (annualized rate) decline. But the easing in restrictions and resumption of some economic and social activity tees up for a bounce in the second half of the year. Still, the sharp 2-month drop in economic activity over March and April will have lasting consequences. Some businesses will close permanently and social distancing measures are not likely to disappear entirely any time soon. The level of GDP we expect in the last quarter of 2020 would still be 5.6% below its level a year earlier – dramatically better than the drop we assume in Q2 but still far from a full economic recovery. Labour market conditions will also improve and even though the unemployment rate will ease from April’s 13% – we expect the year-end rate of 8.5% – it will still be almost 3 percentage points above year-end 2019. This forecast assumes that governments and health authorities won’t have to deploy another round of stringent lock-down and distancing policies this year.

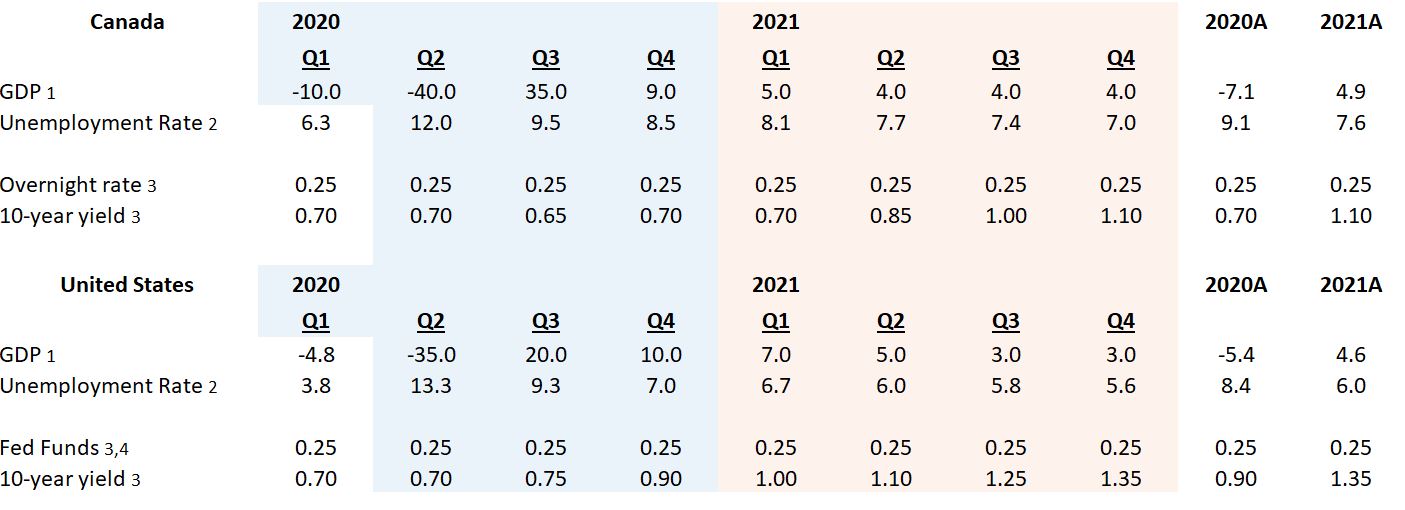

Economic forecasts

1 – QoQ annualized % change | 2 – %, period average | 3 – %, end of period | 4 – upper bound of 25 basis point range

Policy-makers bridge the gap and grease the wheels

Unprecedented policy support from governments and the central bank are working to offset revenue and income losses and keep credit flowing. The federal government has committed about $317 billion in support with about half going directly to individuals and businesses and the remainder in loan guarantees, tax deferrals and relief for specific industries. The Bank of Canada similarly has expanded its balance sheet by purchasing securities to alleviate frictions in financial markets and ensure that credit is accessible at the lowest possible cost. To that end, the bank lowered the policy rate to 0.25%, which we expect will be maintained throughout 2020 and 2021 as attention shifts from making it through the crisis to rebuilding the economy.

Moving forward

The reopening of the economy will be slow and uneven and our forecast assumes that even if the economy returns to a more normal level of activity in 2021, it will probably take an additional year before the economy gets back to its pre-covid-19 trend. In the near term, some industries will continue to be impacted by social-distancing measures that will curb their capacity and limit their ability to get back to pre-COVID-19 levels. The initial stage of reopening will see a bounce in retail and wholesale trade although neither is forecast to get back to pre-crisis levels this year. RBC’s proprietary tracking of consumer spending showed purchases continue to run well below a year earlier although the depth of the decline was starting to ease in mid-April. And even though consumption of good and services will gradually return, we expect it will take some time before housing market activity ramps back up with the heavy job losses incurred during the crisis not expected to fully reverse quickly.

Increased demand for goods will be positive for manufacturers and agriculture and we expect will underpin a gradual ramping up in activity. Disrupted supply chains may challenge manufacturers although may also see some pivot into new lines of business similar to what was done during the crisis. Demand for locally grown food may also spur the creation of different supply chains within the country. One area that will remain under pressure will be the energy sector with prices forecast to remain well below year-ago levels and investment unlikely to recover significantly until excess supply has been eliminated.

Canada’s dollar is holding up surprising well in the face of the sharp drop in commodity prices in particular oil. Optimism that policy support will help the economy emerge from the crisis in the months ahead plus a partial recovery in risk assets is keeping Canada’s dollar in a relatively tight range about 71 US cents. As economies come back on line, there is scope for Canada’s dollar to come under some downward pressure especially in oil prices remain around current levels.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.