Welcome to the inaugural edition of Nickel’s Notes. The purpose of this publication is to keep our valued clients and contacts informed about current events in the world of business and economics, and important concepts and developments in portfolio management and personal finance. Please contact us with you questions and feedback.

WHO WANTS TO BE A MILLIONAIRE (WITH THEIR TFSA)?

Many of us have learned about the time value of money, i.e., the idea that a dollar today is worth more than the identical sum in the future, due to its potential earning capacity. Those who set aside savings earlier in life end up further ahead, as they can take full advantage of the Power of Compounding. Compounding your investment means you reinvest each year’s gains, and achieve gains on those gains year in, year out.

In this topsy-turvy world of negative central bank-set interest rates, and consumers that seem increasingly comfortable with high and growing debt levels, it seems timely to revisit one of the major benefits of saving, especially saving early and often.

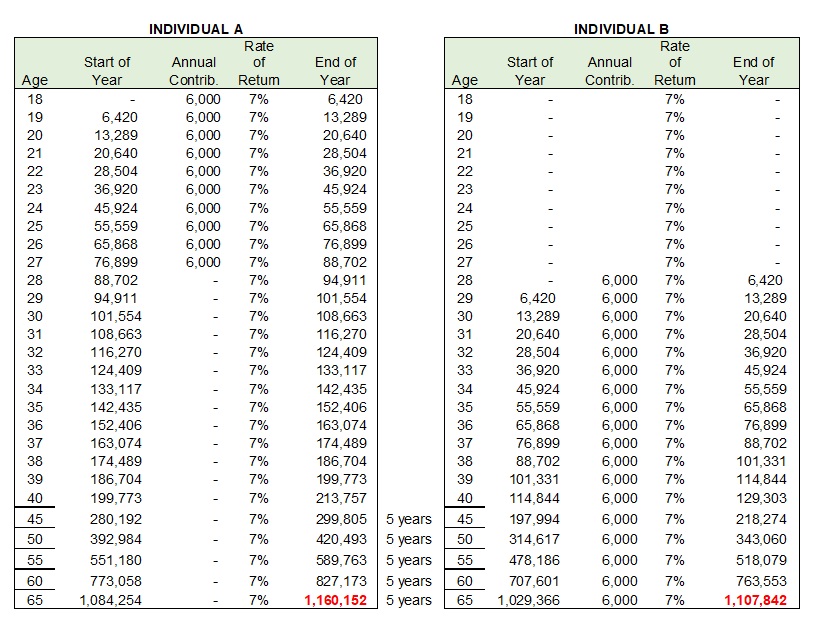

Let’s take an example of an individual who invests $6000 per year ($500/month) for 10 years, starting at age 18, and ending when the individual turns 28. Then that individual never saves again, but lets the investment compound until retirement at age 65. (Total saved: $60,000).

A second individual waits until age 28 to start saving, and then saves $6000/year until retirement at age 65. (Total saved: $222,000).

Both individuals earn a rate of return of 7% every year.

Who will have a larger portfolio at retirement?

Contrary to many people’s intuition, the individual that saved $6,000 for the first 10 years ends up with a larger portfolio at age 65 than the individual who saved $6,000 per year for each year after the 10th year, up to age 65!

I purposely picked $6,000/year because it is the current annual contribution limit to a Tax Free Savings Account. TFSAs are available to all Canadian residents age 18 and over. If you don’t have one, you should. And parents – consider funding this great tool for your university student or early career child.

The savings add up.

-Michelle