WHAT ABOUT REAL ESTATE?

Back in 2000, people surrounded me at cocktail parties to ask about stocks. By 2009, no one invited me to any cocktail parties. Today, everyone surrounds the real estate agent to ask about housing prices.

-Comment made by a colleague of mine circa 2012

One question I am asked regularly is, “What about real estate? Why don’t I just buy a condo/buy another house/put my money in real estate?”

Given the significant and sustained growth in residential real estate prices in the Greater Toronto and Greater Vancouver areas, and several parts of the United States, it makes sense that this comes up again and again. Many of our clients, colleagues and other contacts have benefited tremendously from rising home prices.

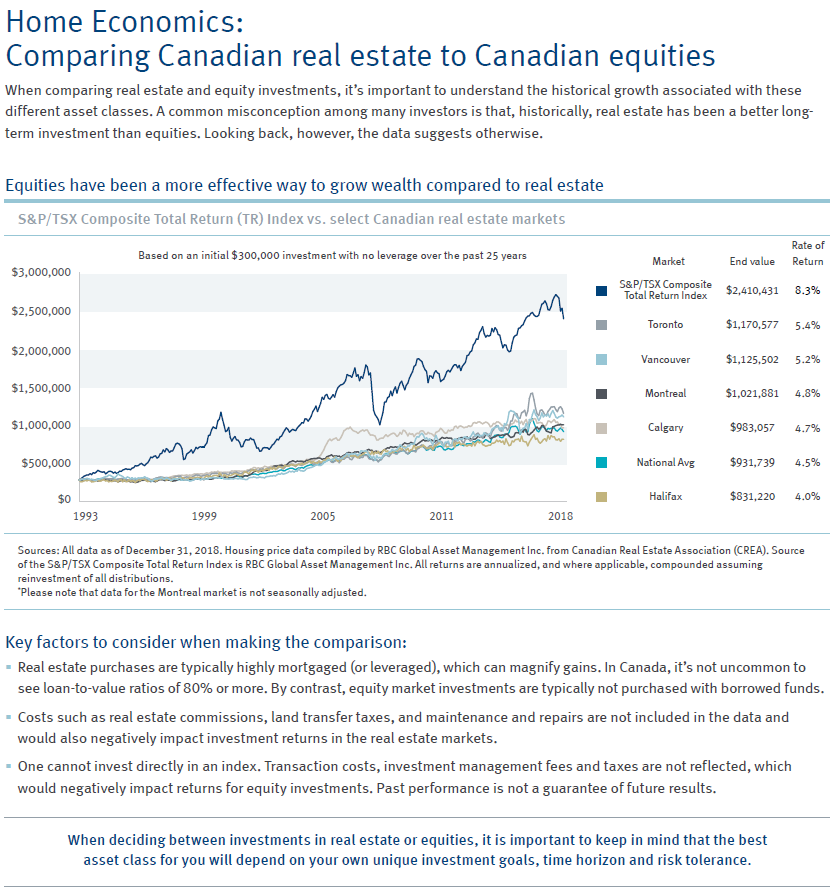

Since Knowledge is Power, and I am a believer in the benefits of smart and thoughtful diversification to grow and maintain wealth, I am sharing this piece by RBC Global Asset Management comparing the returns of real estate in major Canadian cities to the S&P/TSX Composite Index.

Contrary to apparent popular belief, equities have in fact outperformed residential real estate over the past 25 years. Here are a few reasons why it might not feel that way to many people:

- Not many people check the price of their home every day, or even every year! If you only checked the value of your investment portfolio every 2 or 3 years, you would find it had increased in value most of the time.

- The Principal Residence Exemption means Canadians do not pay capital gains tax on the increase in value in their primary home when it is sold. Capital gains tax will apply to secondary homes or investment properties upon sale.

- Homes are often purchased with a mortgage. This leverage serves to amplify the rates of return when home prices rise (or fall!)

- It’s possible some individuals (who are not our clients) have poorly structured investment portfolios; or have made poor investment decisions at inopportune times.

Another consideration when comparing real estate to equities is ongoing cost. Real estate investments come with costs such as real estate commissions, land transfer taxes, and maintenance/repairs. Equities can have investment management costs, but these are more predictable, and often lower, than the costs associated with real estate. When comparing investment real estate (or secondary real estate like a cottage) to a non-registered investment portfolio, note that BOTH of these can benefit from deferring capital gains for as long as possible.

As RBC Global Asset Management points out in its article:

When deciding between investments in real estate or equities, it is important to keep in mind that the best asset class for you will depend on your own unique investment goals, time horizon and risk tolerance.

It is critical for each investor to look at his or her investments with a view to the above. Real estate is best matched with a long time horizon and low liquidity needs. You can’t sell only a portion of your real estate to pay monthly bills, nor can it be sold with 2 day settlement like equities. Real estate is often associated with cash outflows to cover costs, as opposed to the positive cash inflow dividend payments on equities can provide.

Most people undervalue liquidity until they need it.

-Michelle