I felt it was timely to share some thoughts and context relating to current market sentiment. It does not take a Harvard degree to know that many factors are weighing on people’s minds since we began 2022. The conflict in Ukraine, Rising interest rates and inflation and the ongoing pandemic are the main culprits. It is quite a confluence of factors and some are especially difficult to stomach with the humanitarian aspect as the atrocities persist in Ukraine.

Building on past information we have provided regarding market volatility, we know that these current layers of uncertainty are clearly weighing down the sentiment and outlook regarding the economy and investment markets. This is fairly normal and common although not enjoyable for any investor to endure. Most importantly, we must remember that these are not permanent conditions. Typically, we know that on average, markets will see a correction of 10% or more in a given year with a probability factor of 71% (Read previous blog ‘Living with Volatility dated April 2021’). A greater number of uncertainties can amplify these price moves but they are normal when we examine history and watch markets digest news at the time which could have a short term impact on the economy. It is very important to remember however, that these news items are temporary and constantly changing.

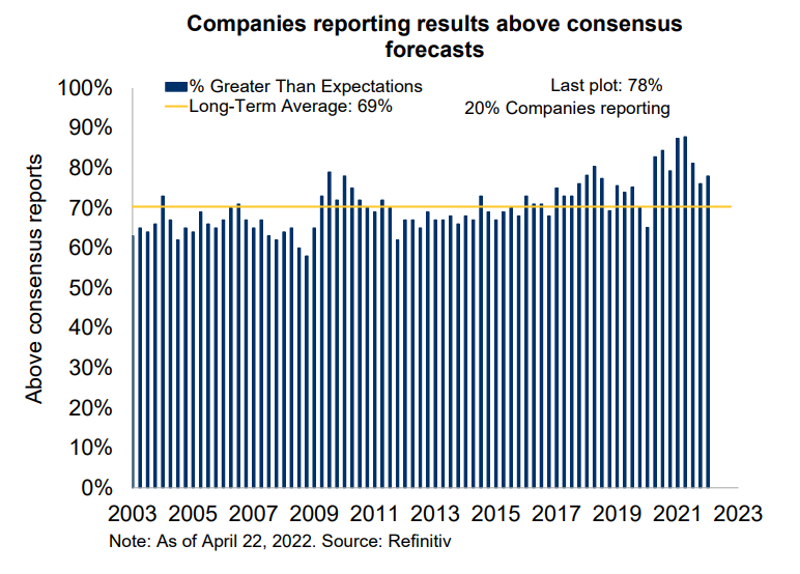

As we discuss the current outlook with our clients, we anticipate an improved second half to 2022 as the current pressures evolve. We do not know how or when these will change but remaining patient is key and understanding the importance of time for market and business cycles to play out. It is especially important to keep this discipline in our approach to avoid making any behavior mistakes that could be costly. Underpinning the fundamental case for investing continues to be the fact that we see strong earnings from global companies. This was true to finish 2021 where US companies beat expectations 80% of the time and even very recently with the Q1 earnings releases.

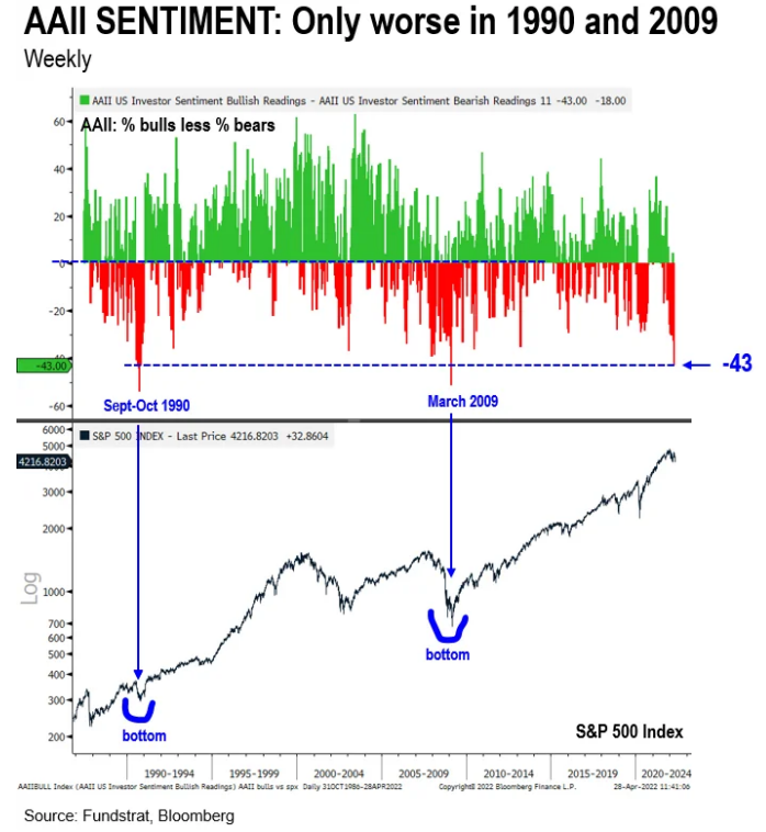

While providing short term guidance is always very difficult, I will point out that the current survey of Investor sentiment by the AAII (American Association of Individual Investors) is showing a reading that has not been this low since March 2009- the bottom of the Financial Crisis. As such, I believe that current negative sentiment has had an exaggerated impact on the value of underlying investments. If we examine the past 5 instances where sentiment has been this low, the average rebound has been 24%+ in the following 12 months. Please see the associated charts but I thought this would be helpful information to share and review as we all hope for a prompt resolution in Europe. While anticipating these declines is basically impossible, understanding these sentiment inflection points is useful to ensuring we stay disciplined in our approach.

Keep Calm and Carry On. J