In light of the recent market stress that is happening I wanted to reach out to provide some context and perspectives. We certainly live in interesting times and have endured a fair bit over the last 3 years which would capture the onset of COVID 19 to where we are now which (thankfully) appears to be a world which is relaxing restrictions relating to the pandemic so that people may move more freely and begin to live their lives again.

Let’s build on those positives and talk about the good things going on right now from an economic standpoint:

Firstly, the earnings of North American companies have been very strong in the most recent quarter. In fact of the companies that reported Q4 2021 earnings, approximately 80% of companies beat expectations. This confirms that in fact the bulk of public companies are seeing strong demand for their goods and services. This is despite the ongoing ‘supply chain’ disruption which have reduced the ability for goods to exchange hands.

Secondly, the strength of the consumer in North America is very strong. As we wrote about last year, household savings in Canada and the US are currently 3 to 4 times the long term average which means they have lots of savings that they could spend in a variety of ways to drive the economy forward. As we know, consumption is a major input for any country’s GDP (approximately 70% actually) and as COVID restrictions ease, its reasonable to expect that consumers will start to do more with their money- including travel.

OK, so what’s the issue you may ask? Well, in order for these factors to really play out in a positive direction for markets, there is a degree of confidence required for all participants. At the moment, this confidence is being under-minded by a few factors. Firstly, at the beginning of 2022 it was the threat of higher interest rates but more significantly the main issue as I write this is the escalating conflict between Russia and Ukraine.

Here is the main point: None of these things are new. Interest rates move up and down over time and given the very robust recovery we have seen in the global economy throughout the pandemic, it makes sense that the emergency low levels of interest rates start to move higher. The bottom line is that rates would only move higher on the back of a strong economy as governments try to cool and control inflation. This is a good thing, largely speaking, but it is a change as the proverbial ‘punchbowl’ is leaving the party and so markets will react to that change.

Regarding Geo-political risks and events- While the Russia/Ukraine conflict is concerning on a number of levels, you may recall Russia’s invasion & annexation of the Crimea peninsula back in 2014. This was very alarming when it happened but is very similar to what we are seeing play out at the moment. They have done this before- strangely in another Olympic year.

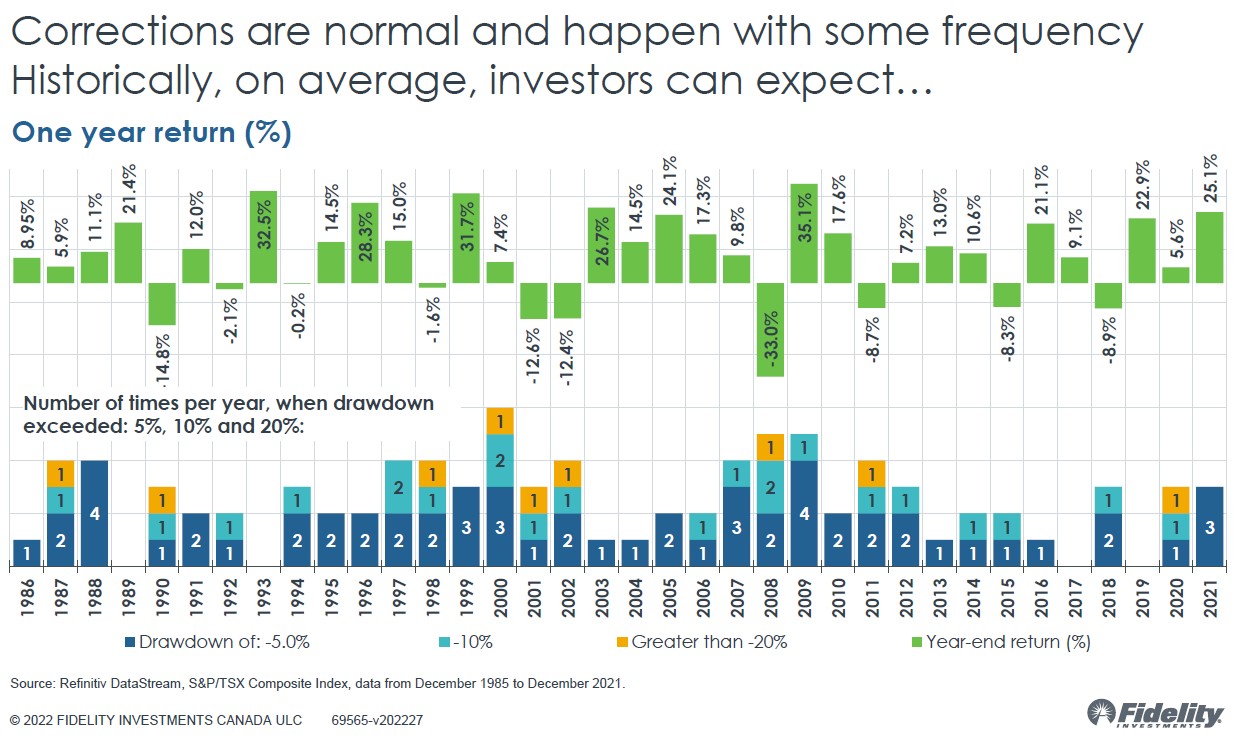

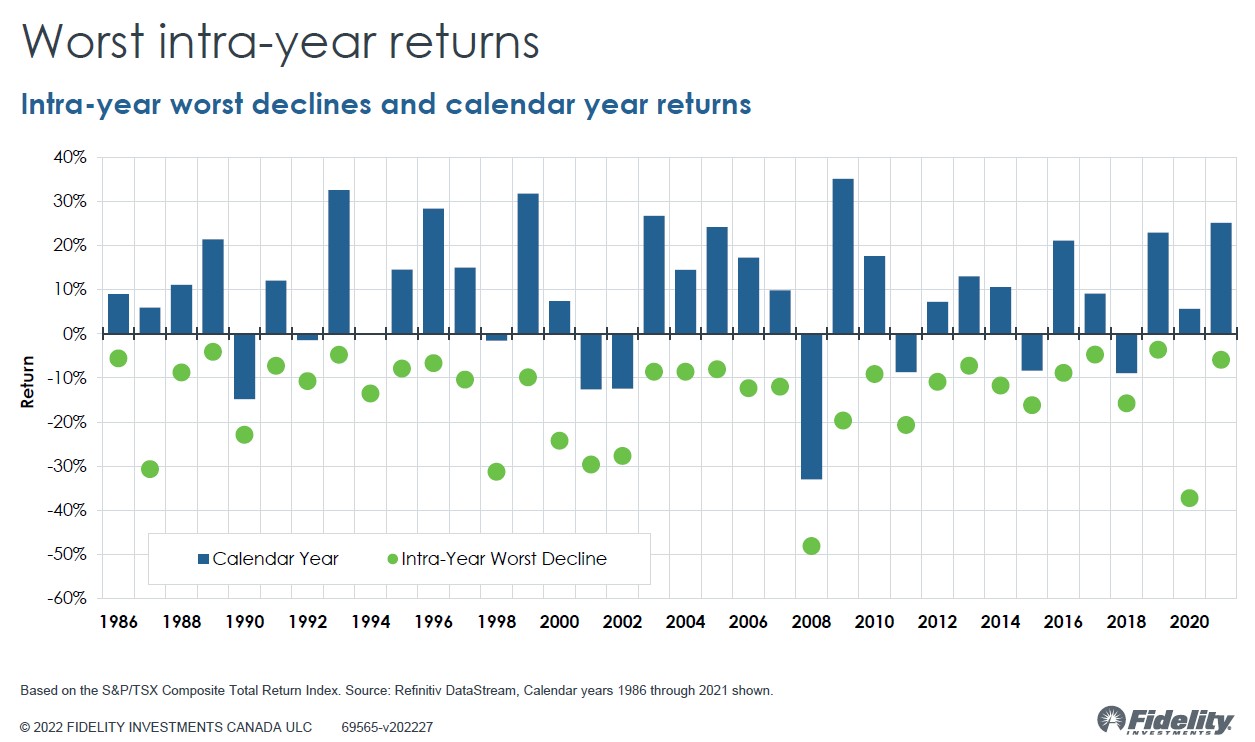

So that is some perspective for you- in terms of current events- What about context? How normal is this market move and where are we headed? Well, stock markets have a long history of reacting to negative news events in an exaggerated manner. This has not changed. As of now, the markets have corrected by about 10% (give or take) in the U.S and Canada in response to these factors. Believe it or not, 10% corrections historically have a probability factor of occurring 70% of the time. That is to say in any given year you have 70% odds that you will endure a 10% correction. They are more normal and frequent than many realize often because the headlines which drive the sentiment are constantly changing.

For your reference, please view the two charts below which help provide historical context on volatility. Most importantly these should help demonstrate how markets deliver good returns over time despite the disruptions that arise.

A good investment strategy should always contain at least 2 factors: A commitment of time and consistency in the approach (i.e. discipline). Volatility and disruptions are short term events which do not play into equation.

I have confidence in our approach and also in the fundamentals for the market as I’ve outlined. Given the uncertainty we are seeing I thought this would be helpful info to share with you.

The Moral of the Story? Keep Calm and Carry On.