Market Recoveries: Using History as a Guide

These are certainly interesting times we are living in. It’s a highly unusual situation as we collectively work together to focus on slowing the pace of infections. Health is our focus as it should be. Health, after all, is your #1 asset. As we all continue to grapple with the current reality, obviously there has been an impact economically speaking- it just remains unclear how big the impact will be and for how long. There are no simple answers. We will simply have to work through this period of interruption together. Even though these events have been highly disruptive, it seems to me people have been remaining extraordinarily busy which I think could be a good sign in terms of measuring productivity. I think it is also clear that there are certain industries which appear more valuable in today’s climate if you examine Healthcare and technology, as examples.

All that said, there are no past precedents to really help us to forecast how things will resolve back to normal and what ‘normal’ will look like moving forward. One thing that is historically true is that we have always recovered from past forms of crisis whatever form it has taken. We have always overcome adversity and threats to our way of life. This scenario is no different but we must heed the call of our authorities and obey this lock down period to control the threat.

On the economic front, what is especially unusual about this situation is that it has been induced. Government authorities have essentially engineered a recession by asking everyone to stay home and ‘pause’ normal life. Meanwhile, as I’ve said productivity overall is not on full pause. Now recessions, aren’t an abnormal economic ‘boogie man’ that we should all fear dreadfully. It’s just a technical term for economic growth slowing for 2 consecutive quarters (6 months). In a sense, what is positive about our current reality is that we know the causes of the slow down. In addition, if governments have induced a recession, they have also made it very clear they want to revive the economy as soon as it is smart to do so. They are bringing extraordinary measures to bare on a magnitude which we have never seen before. This is also a positive in light of the fact that the normal economic damages caused by a recession could be muted if not offset altogether. The more efficiently that these measures can be executed upon will greatly improve our path forward. So, there is some risk that the aid doesn’t get properly allocated and quickly enough. We will have to wait and see, but even the notion that governments are saying that the normal rules don’t apply is a big positive in my view.

So, what is my point you may ask? Well, in addition to what I’ve said above, if we examine past recovery periods from past market downturns I think we have reason to be optimistic. Firstly, as I’ve said, because markets have always recovered but also because of the extra boost of accommodation that government continue to bring forward to assist with this current downturn.

If we look at the recoveries from corrections over the past 70 years in the range of -30% to -40% (the current peak to trough decline has been -34%), then the ensuing performance average is 33% in the immediate 12 months, performance of about 50% over 3 years and 61% higher over a 5 year period. Again these are downturns where normal rules apply regarding the side effects of a market contraction such as Mortgage defaults, loan defaults and business bankruptcies. Not all of this will be avoided but much of it hopefully can.

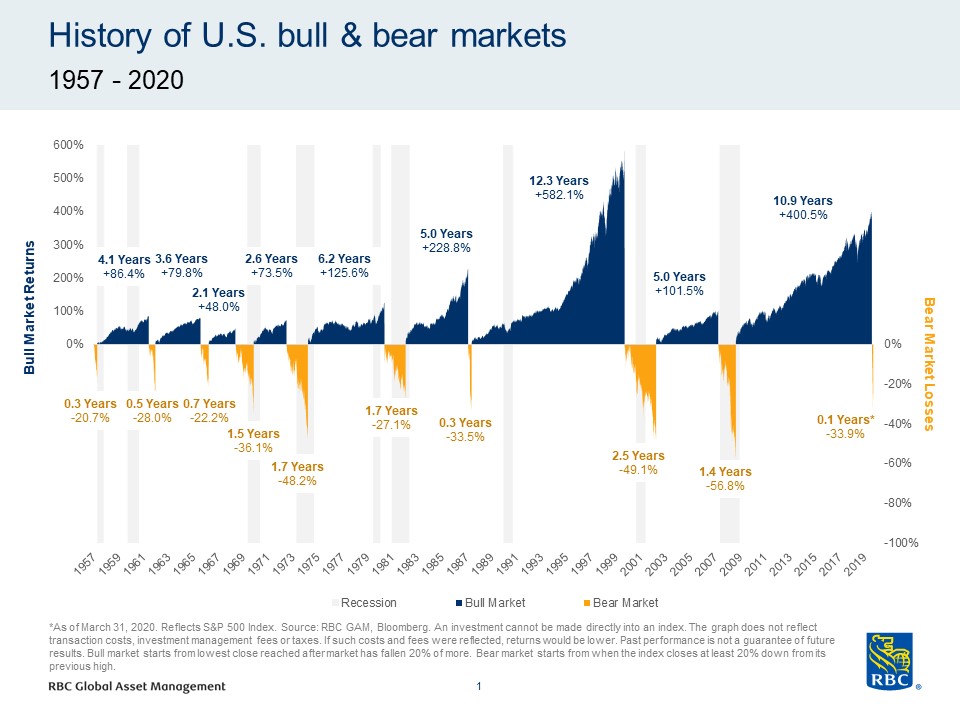

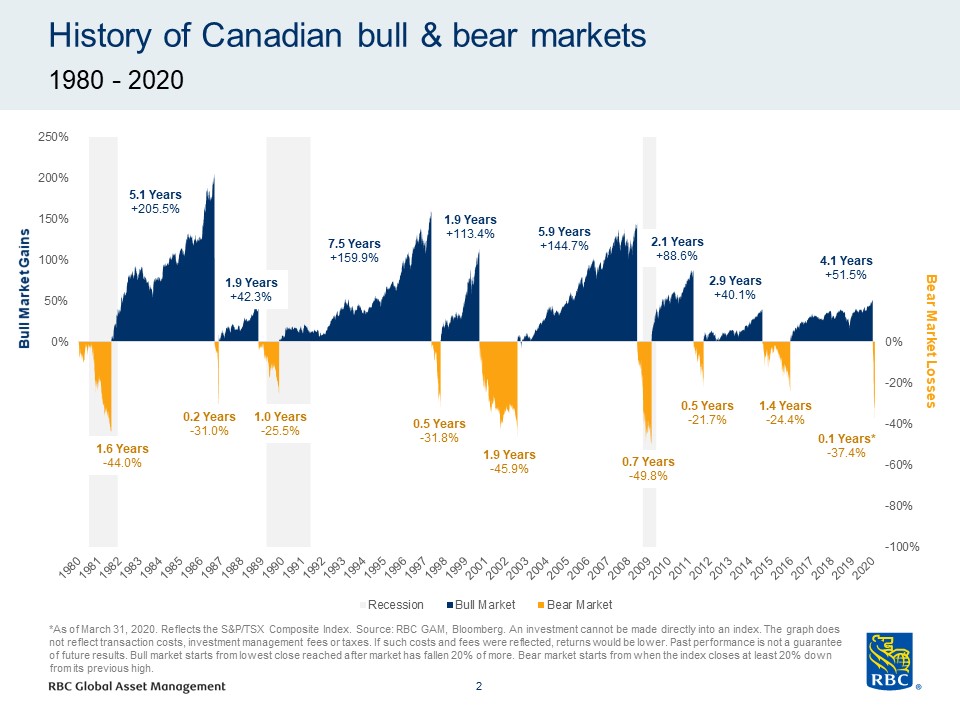

The other historical data I wanted to share relates generally to the duration of market cycles. While it is true that markets do drop and it can be scary and unsettling, the duration of bear market or corrective phases is dramatically shorter than those of bull markets (Canadian and US Market charts are shown here). It pays to stay invested as generally markets move higher over time despite the occasional disruption. Again, back to my original point, we have always overcome the adversities of various threats to our way of life. Why should this be different?

Be well, stay safe and looking forward to seeing you on the other side of this!