“It’s not the behavior of the Investment that matters most; it’s the behavior of the investor”

One of the most important concepts to understand in order to maximize your success with investing is how your emotional programing can play sabotage to your long term plan. These are facts and conversations that are strangely absent from today’s world of TV ads which promote ‘do it yourself’ investing and suggestions of saving all the costs that are associated with working with a professional advisor over the long term. The information below will suggest a different outcome to those who have decided to take that path.

In many respects, the world of investing is littered with things to worry about. Fear and Greed are very real and polarizing motivators that have played with our emotions and driven Human behavior since the very beginning. The world of investing is no different as it is very normal to become defensive or opportunistic based on the information you see, hear and read about.

The truth of the matter is that human behavior is slightly flawed when it comes to the arena of investing in the way we digest information and decide to react.

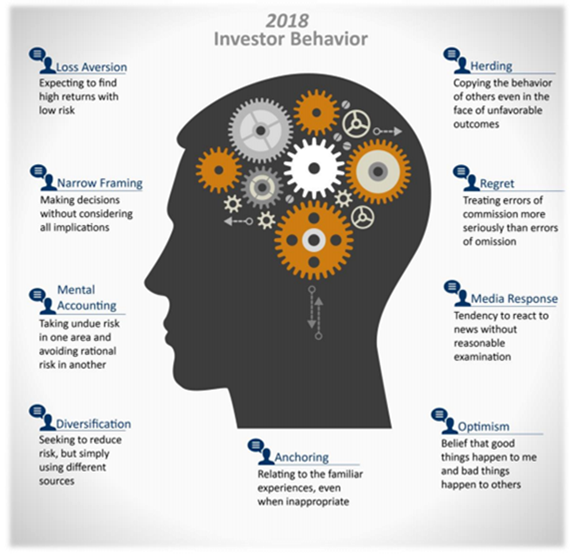

According to DALBAR, an organization which produces an annual report on the topic of Investor behavior, there are 9 distinct behaviors that tend to plague investors based on their personal experiences, personalities and human behavior. They are shown in the visual below:

It is very important to understand and recognize that these behaviors and mental processes are entirely normal. They just DO NOT help you when it pertains to investing and actually increase the likelihood of poor decision making. Poor investor behavior is not just buying and selling things at the wrong time, it is the psychological traps, triggers and misconceptions that cause you to act irrationally. It is the irrationality that leads to buying and selling at the wrong time, which leads to your investments under-performing.

How big can this gap be? According to DALBAR, the annualized performance gap between the average US equity investor and the US stock market is over 50%. It’s a staggering difference. In looking at the 20 years from 1992 to 2011 (which includes the great recession of 2008-2009), the average equity investor underperformed the US stock market (as measured by the S&P 500 index) by 4.3% per year! So while US stocks gained 7.8% per year for 20 years, the average stock investor only gained 3.5%. This while inflation is eating into their return by a clip of 2.6%. The only obvious reason for such a large difference would be that the average equity investor is playing considerable interference driven by their emotions with no evidence of a plan, disciplined strategy and on-going coaching. The recent market downturn in October and December of 2018 was a good example of a recent anxiety event for investors where if left unchecked could have produced emotional and irrational decisions that would contribute negatively to your investment results. Good advice also matters in strong markets so you can maintain investment discipline and avoid becoming greedy and venturing into stocks or sectors that everyone is raving about at dinner parties. As you've seen, market bubbles are very real and the consequences when they burst can be devastating.

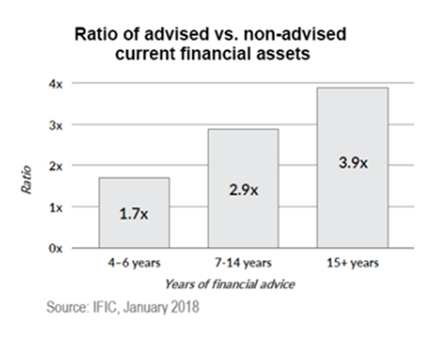

Consistent with all this is the data which IFIC (Investment Funds Institute of Canada) produces frequently to highlight the value of advice in working with a professional as it relates to financial assets. As of January 2018 the recent data shows that Canadian investors who work with an advisor have 4 times the financial assets as those who are ‘non-advised’ or doing this work themselves. Again, this information is not shared in the TV ads you see during the Raptor playoff run this past spring.

So how do we do it? Well, with the extremes of emotional responses being from Fear and Greed as well as the 9 distinct behaviors listed by DALBAR, it’s important to have a very firm process to safeguard yourself against the risk of derailing your success. In working with my clients here are some (not all) of the things we do:

1) Use a financial plan to create your investment context. By framing your investment goals and expectations using a financial plan, we know what risk we need to accept in order to reach a stated goal. Without context, Investing can be a bit of a guessing game. You need to have goals to provide for yourself in retirement.

2) Discipline- We apply a series of complementary investment strategies that are ‘rules based’ and have discipline and diversification.

3) Tax planning: We do considerable work on the tax side to structure accounts to benefit from tax-preferred investments (such as dividend stocks), Tax-free growth (using TFSAs) and Tax- deferred growth (when to really use RSPs to reduce taxable income). We also help people with decisions about where to draw retirement income from and when- a process referred to as income layering. This can help minimize estate tax risks as well as minimize claw backs of government benefits. As the old adage goes: ‘It’s not what you make, it’s what you keep’.

4) Communication, Coaching and Regular reviews. We are always available to discuss what you are worried about and to keep you on track towards your goals.

With all that said, we know for sure that that news headlines will continue to drive concerns and provide us all with things to worry about. Being an advisor is not just about protecting you from poorly behaving investments that can hurt you. We take it a step further- we want to ensure you don’t somehow hurt yourself. Your financial well-being is too important and we are all fighting human nature.

As always stay in touch with any questions and feel free to share this with anyone you care about.