What is Tax Planning and why is it so important?

It’s tax time again, which means we all have to reconcile our outstanding tax bills with the government. It’s a fun time to be sure! We have all heard the old adage that there are 2 certainties in life and that is death and taxes. While our personal health to ensure one’s survival is constantly at the forefront of our daily routines, not enough time is spent proactively addressing one’s tax situation. This is known as Tax Planning and it’s an essential piece of what we do with our investor clients. Investing is not just a matter of creating the required amount of growth or income from your wealth, it’s also about how you use various account structures, Investment vehicles and monitoring your annual tax windows. I’ll get to some examples later.

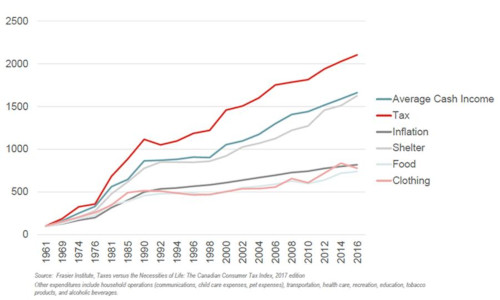

According to the Fraser Institute, in 2017 taxes accounted for 42% of the average family’s expenditures as a percentage of cash income. This is enormous and represents the largest overall household cost. As Canadians I think we inherently know this to be true and have somewhat become accustomed to our tax reality. More shockingly perhaps is that taxes are also the fastest growing expense for Canadians (as per the Fraser Institute). In light of these two metrics, it would seem logical that there should be ample appetite for tax planning among Canadians at large. As it pertains to investing over the long term, I would submit that the proper tax planning can greatly enhance a family’s net worth picture over time. It is as important as having good investments. After all, it’s not only about what you earn but also what you keep.

Tax planning is more than just tax deferral. Certainly the use of RSPs have their place with those earning more today than they expect to withdraw from their plan in retirement. With diligent saving and consistent returns, RSPs can grow nicely into very large accounts. Once you reach an older age and begin to draw from your registered savings, things can get complicated. For example, among some of the investors we have been introduced to over time, we have seen issues with partial or full Old Age Security (OAS) clawback. This is caused from individuals allowing their reported net income to exceed certain thresholds set by CRA. Clawback of this benefit begins when your net income is at about $75,000 and is fully clawed back when net income is about $120,000. Too much RIF income can be one culprit but so too can excess savings in non-registered accounts. This is because non-registered accounts can create taxable income every year (unless some strategy is applied). In the work we did recently with a retired client we were able to defer about $20,000 in interest income from a bond investment within their non-registered account. Not only did this reduce their total net income from near the OAS clawback zone but it also created extra room from which we could draw additional funds from their RIF. Making use of one’s annual tax window every year in retirement is important because as it relates to registered accounts (RSP/RIF), upon death, they are fully taxable (i.e. the balance of the account is taken into income). All investors should avoid too much tax deferral because unless you manage the process of drawing down your RIF, a $300,000 RIF could be cut in half by tax.

Another repeat issue I continue to see among investors is no use or not the most ideal use of the Tax Free Savings Account (TFSA). The TFSA is a tax holiday from our government, whom don’t often grant holidays. A tax free account should be utilized by all who can afford to do so to benefit from tax free growth and compounding. More typically, if a client is investing with some aspect of growth then the TFSA is the ideal account type towards this goal. The logic here is that if a growth investment could double in 7 years or so (estimated), then this is a much larger tax free benefit than having an interest bearing investment within your TFSA paying you only 3% per year.

It is for all these reasons (and more) that I very much prefer to collaborate with my client’s accountants on these matters over time. The tax savings can be considerable and greatly add to the net worth picture over time.

Tax Planning can get complicated and everyone’s situation is slightly different but these are some examples of tax planning logic as it pertains to investments and financial planning.

Please feel free to share with anyone you feel would benefit.

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy.