The following is a client article produced by Russell Investments on the topic of working with a financial advisor and the value of financial advice. I find it contains good context on this dynamic relationship.

Why work with a financial advisor?

Because that relationship may be one of your best investments.

What can a financial advisor do for you?

The sustained market volatility and uncertain economic outlook experienced in the spring of 2020 serves as a stark reminder of the value of working with a financial advisor.

At Russell Investments we believe the biggest value that a financial advisor provides is as a behavior coach. As humans, we are vulnerable to behavioral biases – those emotional responses to market movements that have the potential to significantly impact our portfolios. Many of us were likely tempted to take our money out of the equity markets when they began to drop as the news flow on the novel coronavirus COVID-19 worsened. But doing so would have meant selling at a potential low point in the market, contrary to the tenet of successful investing: buy low, sell high. As we have seen time and time again, severe market declines are eventually followed by market rallies. A financial advisor can help mitigate emotional responses to the volatility, keeping you invested and on track with your plan.

While that is likely the biggest value a financial advisor can provide, they do so much more. Even when markets are calm, or steadily rising as they had been for several years, financial advisors provide a variety of necessary services. A financial advisor can offer holistic wealth planning: from selecting investments, to managing your portfolio through different life changes, to retirement and estate planning. They can also provide guidance on reducing the tax drag on your portfolio so that you have a better chance of keeping more of what you make.

We have developed a formula that can help you understand the value of working with an advisor.

What is rebalancing? Technically, it is the periodic buying and selling of assets in your portfolio to maintain your originally desired asset allocation—or mix of investments.

We believe there are two reasons that many investors don’t rebalance if left to their own devices

- Because it’s an easy thing to forget to do. Investors know they’re supposed to do it. We also know we’re supposed to change the batteries on our smoke alarms once a year. But do we really do it?

- Because, in many cases, rebalancing may be the equivalent of buying more of what’s been hurting the portfolio and selling what’s been doing well. It may run counter to what an investor’s gut feelings are telling them they need. Rebalancing takes discipline. Your advisor can help deliver that discipline and help position your portfolio for long-term success.

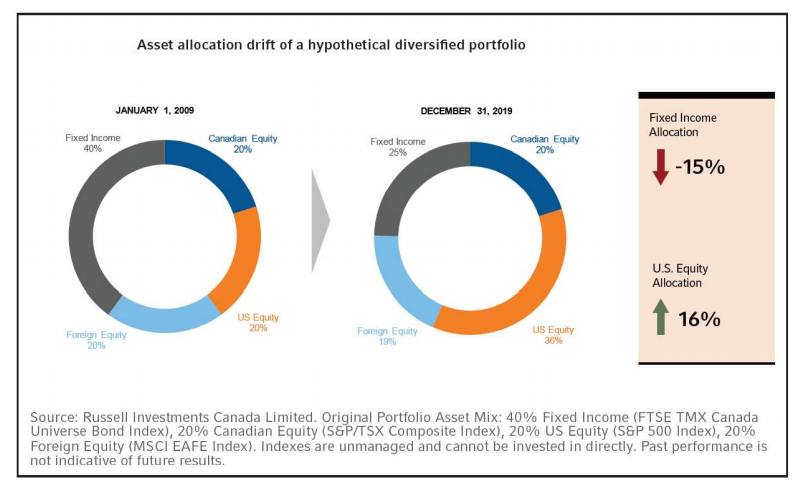

We believe rebalancing is a vital service, because it helps you remain on track with your plan. You may have started out with a balanced portfolio of 60% stocks and 40% fixed income, but under certain market conditions that ratio can change significantly. As the illustration below shows, without rebalancing, over the years you could end up with a larger exposure to U.S. stocks and a smaller exposure to fixed income than you had originally determined. This leaves you with greater exposure to the risk of any potential sharp shock in U.S. stocks.

The difference may seem small, but the simple act of rebalancing can help capture gains, reduce volatility, and help your asset allocation remain in the range you initially determined was right for your desired outcome.

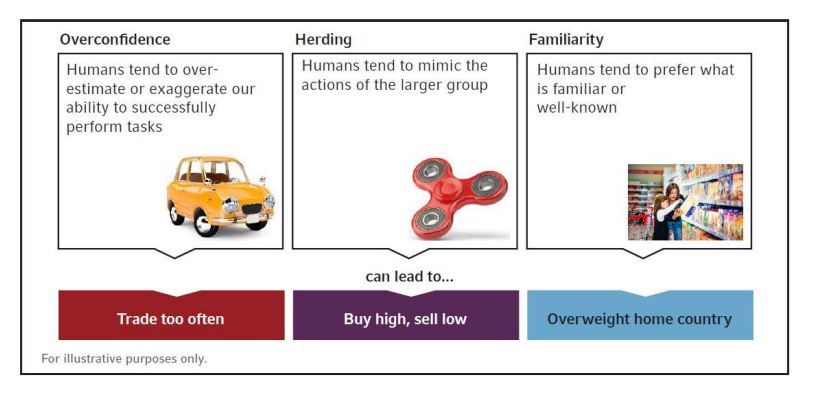

People tend to let their emotions and other human tendencies influence their decision-making. In many parts of life, that’s perfectly reasonable. But when it comes to investing, acting like a human may actually cost you money.

That’s because volatile markets can spark our “blink” reflexes: those intuitive “fight or flight” responses that we make when faced with danger or uncertainty. Daniel Kahneman, a leading behavioral scientist, has divided the human thought process in two different ways: blink, and “think’, which is when we are rational, systematic and controlled. Researchers in the fields of economics, psychology and neuroscience (which together make up behavioral science) have uncovered more than 200 types of unconscious biases in humans.

These biases can drive our “blink” responses and can lead us to make decisions that can ultimately jeopardize the health of our wealth if left unchecked. To be a successful investor, it is important to be objective and disciplined when making investment decisions. This means making sure decisions align with your long-term goals. While you would be forgiven if ongoing trade wars, a global pandemic, and an uncertain economic outlook has prompted you to second-guess your investment strategy, making changes off the back of these events may be detrimental to your portfolio.

Your advisor can help you remain objective and disciplined through the cycle of emotions that volatile markets can cause. Avoiding behavioral mistakes is a significant contributor to total value. In fact, sometimes it’s the decisions you choose not to make that count more.

Many investors feel overwhelmed when markets become volatile, as they did earlier this year. Our inherent inclination to avoid losses may have spurred them to bail out of the financial markets altogether. But that could mean they would miss out on any potential market rally.

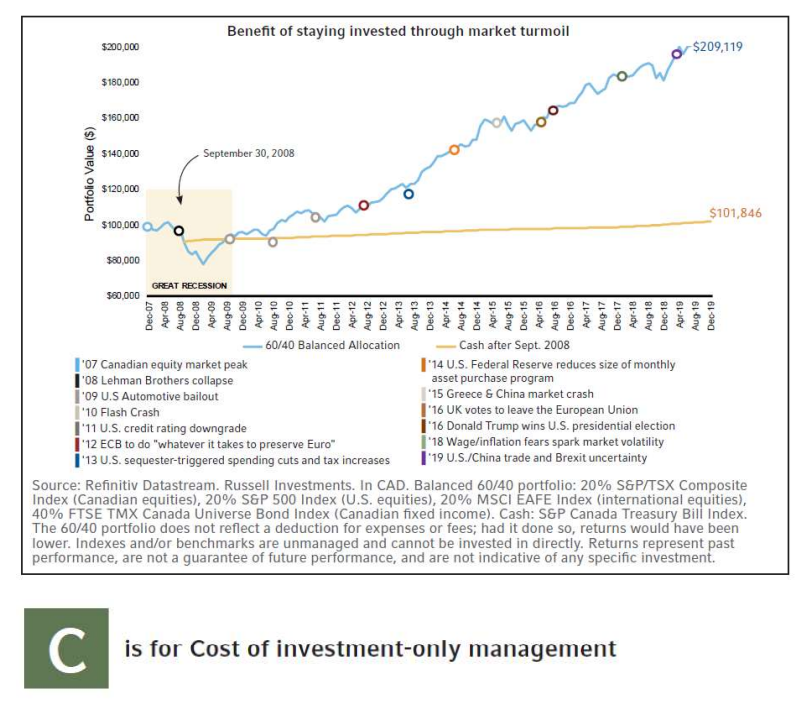

Let’s look at what happened in September 2008, when U.S. brokerage Lehman Brothers collapsed. That was the largest bankruptcy in U.S. history1, and was a key event leading to the 2008 financial crisis.

If an investor with a $100,000 portfolio had moved to cash on September 30, 2008—and remained in cash—their portfolio would only have been worth $101,846 at the end of 2019. But if they had just remained in a balanced portfolio of 60% equity and 40% fixed income, their portfolio would have continued to decline until the market bottom in March 2009 and then begun to rise. It would have doubled in value by the end of 2019.

Robo-advisors are automated platforms that provide basic investment management—taking your hard earned money and purchasing specific funds or securities. The fee is typically minimal, but in most cases all you get in return is an annual statement, a website where you can monitor your portfolio, and a phone number to call in case of questions.

Your advisor also purchases specific funds or securities for your portfolio—but he or she doesn’t stop there.

Advisors advise. That can start with building and regularly updating a financial plan that fits your needs based on your specific goals, circumstances and preferences, conducting regular portfolio reviews, and being available to answer your questions, guide you through market volatility and make recommendations when you go through one of life’s big moments—such as getting married, buying a house, sending a child off to college, or entering retirement.

They can also offer additional services such as investment education, assistance with annual tax return preparation, retirement income planning, and helping you make sure you have proper insurance coverage.

Your financial plan is a key element to help your reach your goals. A robust financial plan may incorporate coordination of your multiple financial goals, considerations for investing at different stages in your life, and implementation with a variety of financial professionals dedicated to your financial health.

Your advisor may provide:

Financial planning topics

- Savings & distribution analysis

- Investment & cashflow analysis

- Retirement plan options review

- Tax & estate planning

- Student loans

- Stock options

- Employee benefits review

- Education funding

- Regular plan updates and reviews

Ancillary services

- One-off requests for advice

- Investment education

- Property & casualty

- Long-term care

- Disability insurance

- Life insurance

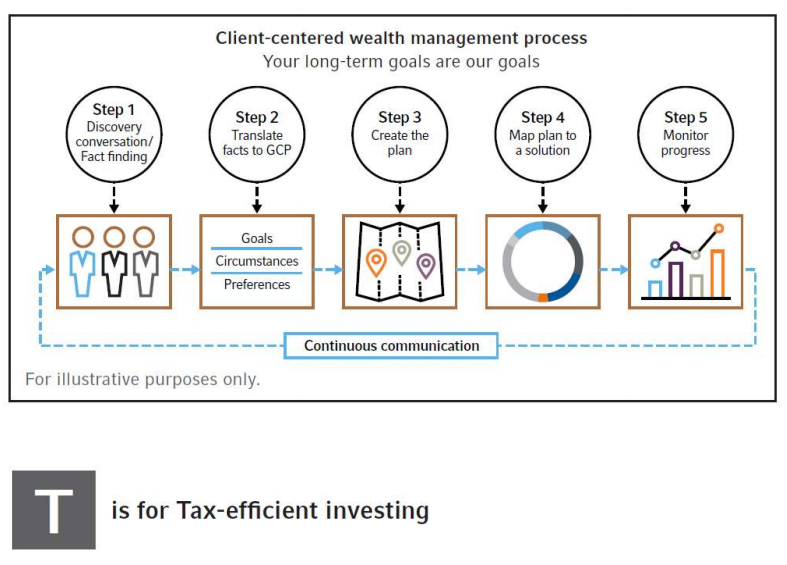

Your advisor will likely work with you to tailor your custom financial plan and investment solutions to what matters most to you. The process begins with a deep discovery conversation, followed by translating what is heard into goals, circumstances and preferences. And because your priorities and circumstances are likely to change over time, your advisor may choose to engage with you continuously to help you reach your desired goals.

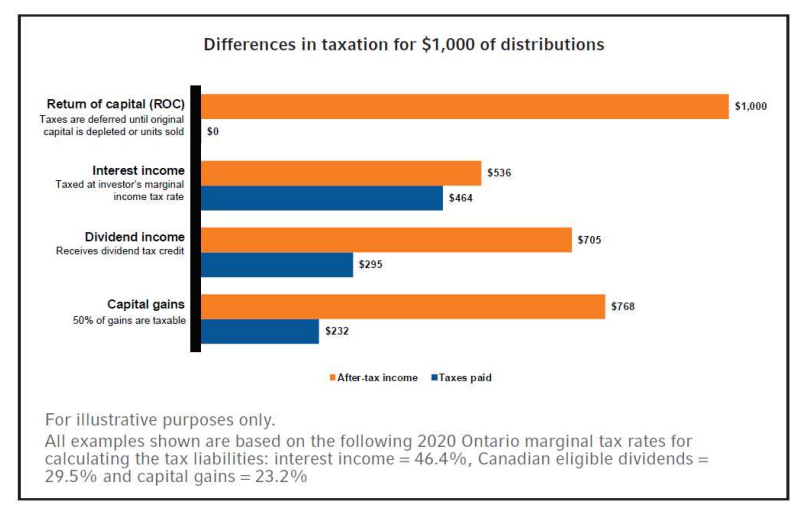

When it comes to investing, it’s not what you make that counts. It’s what you get to keep. Your advisor can help you navigate the complex world of tax implications of your investments— asset location across taxable and non-taxable accounts, tax-smart withdrawal strategies, taxable trusts, and more.

Taking a tax-efficient approach to investing and incorporating strategies designed to help reduce the impact of taxes on investment returns may help you achieve better outcomes.

We believe it’s important to take a long-term view when building wealth. At the heart of this belief is the power of compounding returns. Maximizing after-tax returns can play a big role here. Since you don’t pay taxes until you realize gains, deferring taxes into the future has the potential to significantly compound returns over time.

Let’s take a look at the examples below. Different types of distributions from your investments receive very different tax treatment. Your advisor can help you determine how to structure your portfolio to minimize the tax payable on distributions, or defer taxes into the future.

The bottom line

Your advisor charges for the service he or she provides. As we demonstrate below, your advisor can play many roles, each of which has significant value and can ultimately help you and your family reach your long-term financial goals.