Stock Market Range Update, History of Asset Bubbles

And A Little Light on FTX Saga

Stock Market Range

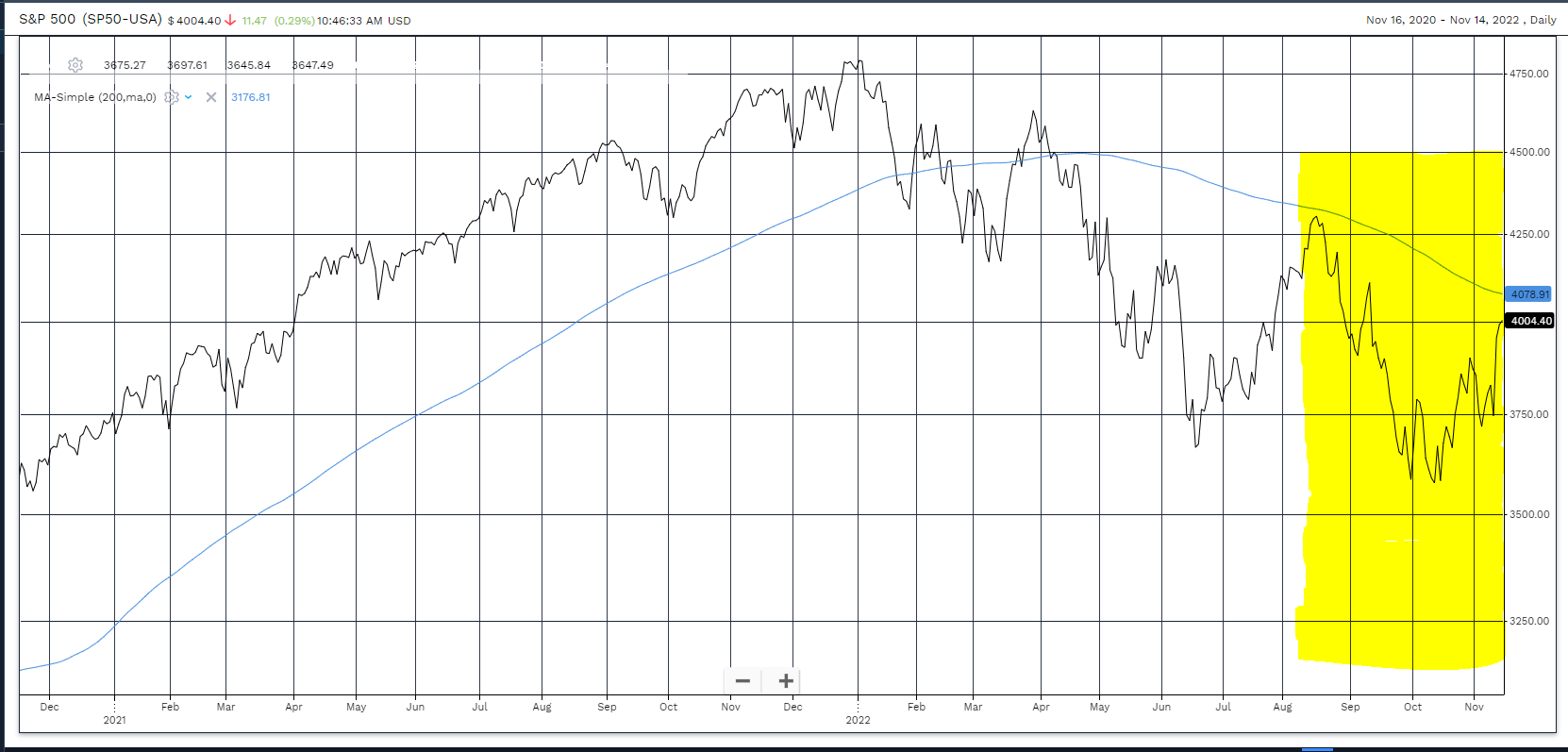

The short term risk range for the S&P 500 US stock index is about 3600 to 4000. In the very short term, the stock market is ahead of itself here.

The 12-18 month range forecast for US stocks is shown below in the yellow highlight.

Numerically, that risk range is 3150-4500. The present valuation in nearer a top than a bottom so it would now be appropriate for anyone who feels they still have too much stock market exposure to take some money out of stocks into cash.

As far as I know, most of you have been at the low end of your stock market asset mix exposure since March. If you do not feel that way, please give me a call and we can make some changes.

My goal and hope is that the stock market sees the bottom end of this chart in the first 5 months of 2023. This is where I would add long term, buy and hold exposure again for portfolios above the minimum asset mix.

Stay patient….

History of Asset Bubbles (Updated)

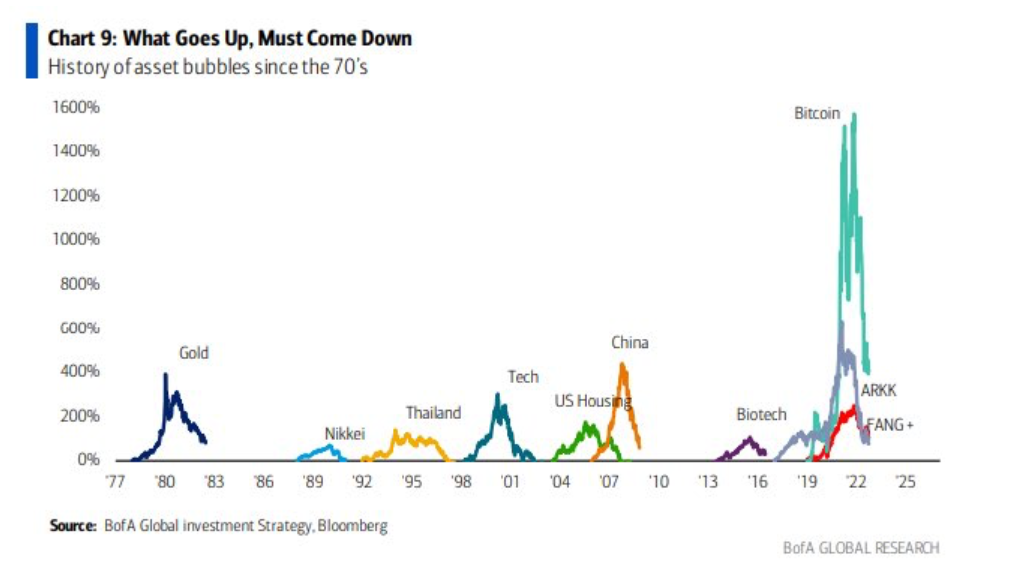

It was about a year ago (I could not find my exact editorial in the archives) that I used the graphic below to show the consistent pattern of asset bubble inflation and deflation.

When I ran across it again, I could not resist publishing it again since it showed the Bitcoin, ARKK Innovations and FANG bubbles doing what all bubble seem to do…crash.

There are two reasons why these crashes are so damaging:

- Far more people buy near the tops than the bottoms.

- Even those who are early on the bubble keep adding more and more to the bubble on the way up and rarely sell on the way down.

There have been articles about how the movements of prices in any given bubble has far more to do with psychological characteristics connected to fear and greed than anything financial. I would tend to believe that is true.

Which leads me to my next segment that has completely engrossed my free reading time the past 8 days or so.

The FTX Saga – (please click on the “backed out of a deal” hyperlink to recent details in chronological order before reading from here).

FTX, one of the world’s largest cryptocurrency exchange platforms, is in major financial turmoil. At its peak, FTX was valued at $32 billion. It filed for bankruptcy exactly one year later on November 11th after a competing crypto exchange, Binance, backed out of a deal to acquire it and the withdrawals continued. ($6 billion net withdrawals in a week).

The story above is just another example of bad financial behavior that becomes a crime of opportunity under the right conditions. But for me, the financial angle is not the most interesting part of the story.

The story is interesting because of the cast of characters that owned and ran FTX. It also fascinates me as to how many prominent people got attracted to the lure of easy money. Don’t these individuals have enough money already? Remember the Matt Damon advertisements for Crypto.com with the tag line: “Fortune favours the bold.”

As you will see there are two competing narratives about what happened with the FTX leaders; the first is a familiar tale of too much free money trying to capitalize on the cryptocurrency craze and simply driving the valuation of a company far beyond anything it was ever truly worth, enriching the founders in the process. The second is much more sinister. Nobody knows for sure yet, but there are a lot of signs that FTX was just a gigantic Ponzi scheme from the beginning.

So what are you trying to say Nick? Do you think it was a Ponzi from the very beginning?

I guess the world will find out but I don’t really think so. The main characters at the center of the controversy (Sam Bankman-fried and Caroline Ellison) do not strike me as being wired in the way that many financial con artists are wired. My guess is that FTX got completely out of their control. Going from being worth $0.00 as a startup, to $40 billion and back to $0.00 in under 3 years must be some kind of adrenaline rush.

But it appears that, once things got out of control, FTX really fell into the age-old traps that all financial Ponzi’s end of getting caught in: Excessive leverage and creative accounting.

If you decide you want to know more about this topic, just Google FTX or Sam Bankman-fried and you will find thousands of posts.

If you are an investor in cryptocurrencies and the likes, do your homework carefully here.

There are only two options for the crypto-universe of assets that I can see from here:

- Crypto stays unregulated and the frauds continue to get exposed slowly.

- Crypto gets regulated and all the frauds get exposed at once.

Neither of those sound like much fun to me….do your own due diligence since myself or RBC take no positions in recommending crypto currency investments.