More Evidence that the Cheap Money

Economy has Ended: Part 2

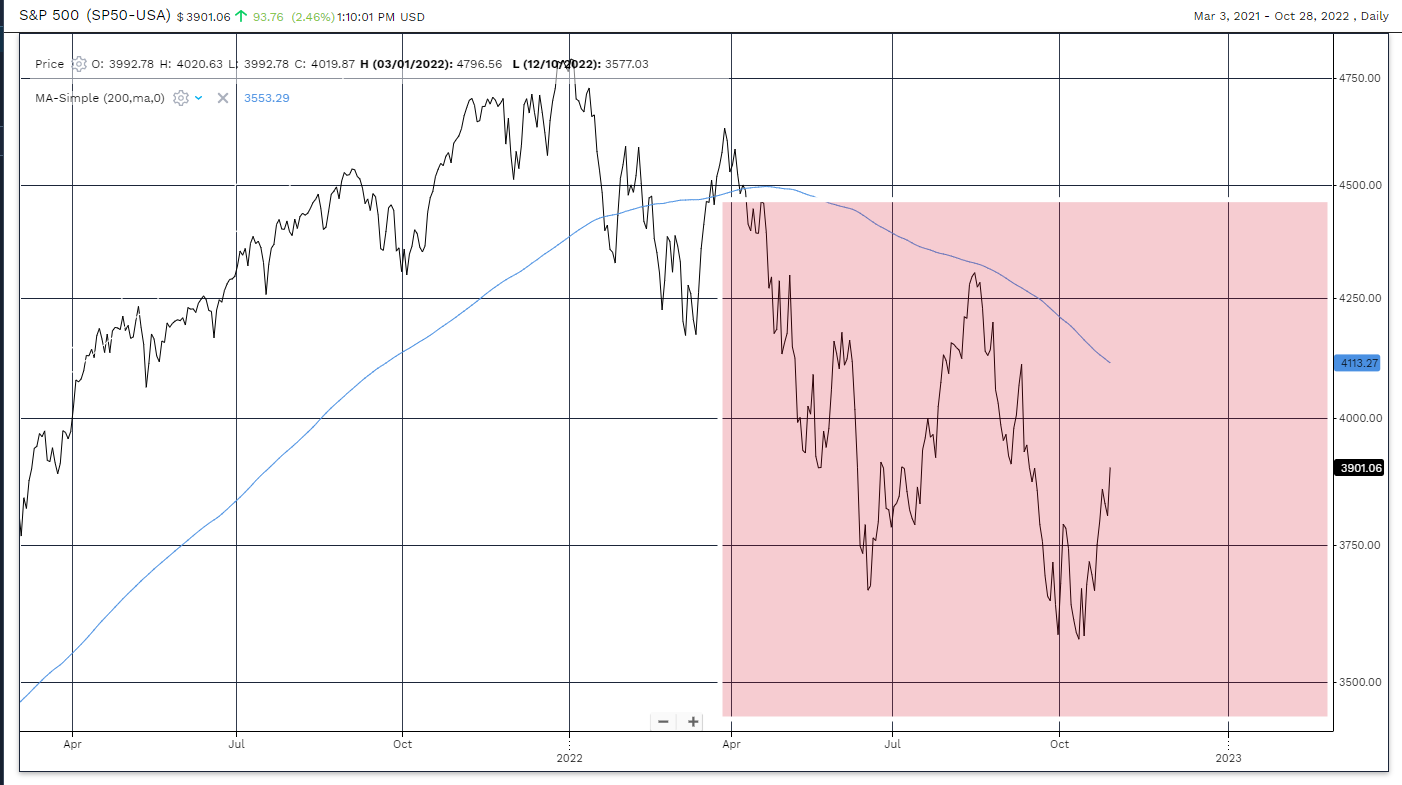

Last week we covered the general idea of the BEAR market ending and, rather than transitioning into a new BULL market, stocks and bonds would go into longer term, sideways ranges. (Possible range for next 18 months in red below).

Part 1 of this editorial will use quotes from US Federal Reserve Chair, Jay Powell’s press conference after the 0.75% interest rate hike last week to clearly lay out what we should expect. (These are his words, not the words of all those wishing he would stop raising interest rates to spike asset prices again).

The official statement came out from the Fed exactly like the growing chorus of “Pivot Chasers” hoped it would. It signaled the intention of the Fed to slow the rate of interest rate increases from the 0.75% rate of increase to 0.50% or lower.

Then came the cold shower—more like an ice-cold waterfall – of clear communication from Jay Powell laying out the Feds intentions:

Don’t think about the pace of hikes, said Powell—what matters now is how high rates go. They will go higher than the Fed previously thought, he said, and they will stay higher for longer—it’s very premature to even think about a pause. The Fed has not done nearly enough yet, he added. Inflation is still way too high and core inflation shows no sign of coming down. And the Fed is not worried about overtightening—policymakers know how to correct that if it happens. He said the Fed worries—a lot—about not tightening enough (or cutting too soon) because then inflation will become really entrenched.

These are not ambiguous words. Interest rates are still going higher and will go higher than previously thought.

We will take him at his word. (Last spring, I wrote an editorial where I admitted I spent more time reading what other people “thought” central bankers said than actually reading what was being said…not planning to make that mistake again).

My message to you, gentle reader, is to plan your financial life and investment decisions accordingly. Interest rates will go higher than we expected last summer and will stay higher for a longer period of time.

Remember, the Fed believes it can solve any weakness in asset prices at its discretion with the tool box of monetary policies of the past 20 years. Therefore, the central banks aren’t afraid of lower asset prices.

Investor behavior has fortified the Fed’s opinion of its ability to fix whatever it breaks financially by ripping higher on poorly grounded rumours of pivoting monetary policy to a less aggressive level.

As investors, we can take advantage of what the market dynamics at play in the above situation. But it requires an active hand in the markets, buying the low end of the range and staying invested as long as

- The low end of the range holds and then

- Sell in the higher end of the range.

It is different than investing in a BULL market and requires different skills. Consider if this is applicable for your situation.

Part 2 is back to real estate.

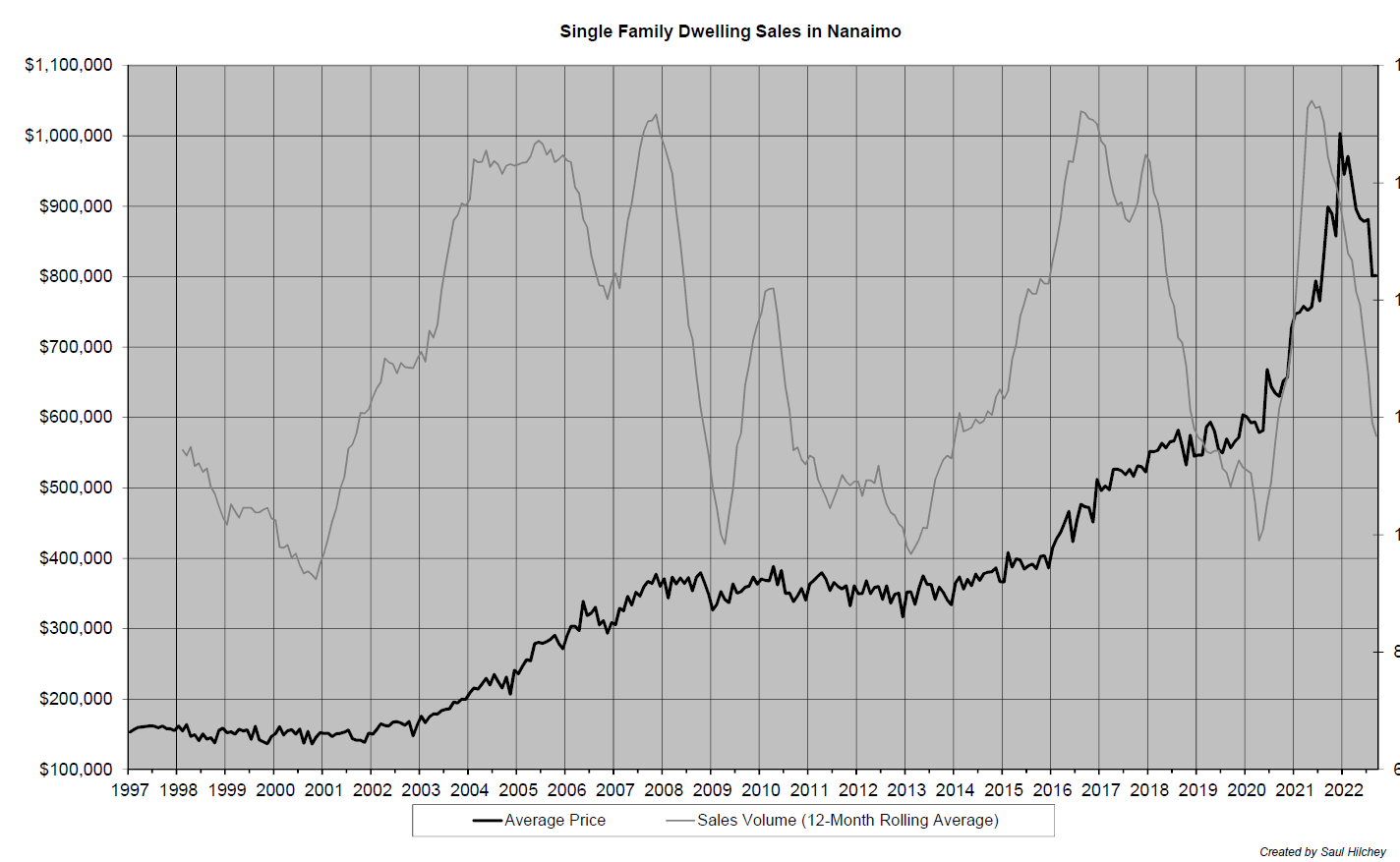

Here is the most up to date chart for average Nanaimo Real Estate prices and volumes courtesy of my RBC Dominion Securities colleague, Saul Hilchey.

You can see the sharp declines in both average price and smoothed out volume of sales.

So how has this price drop translated into the real world life of the average purchaser? Has real estate become more affordable?

Well, if you are a cash buyer…yes, real estate is cheaper today than before. Especially if you are an American cash buyer since the Canadian dollar has weakened against the US dollar by about 7% this year too.

But for the average purchaser buying the average house the market has changed very little even though it is down 20% from its peak.

Let’s plug in the variables and do some examples.

- Assume a person purchasing a home for average price at the given time in the example. Let’s assume all purchasers put 20% down for their purchase.

Example #1: January 2022 purchase date

Purchase price: $1,000,000

Mortgage amount: $800,000 at a rate of 2.5% interest (or less if floating rate).

Monthly payment: $3583.73 ($43,004.76 annually)

Example #2: October 2022 purchase date

Purchase price: $800,000

Mortgage amount: $640,000 at the present rate of 4.75%

Monthly payment: $3631.72 ($43,580.64 annually)

So even though real estate prices have dropped 20% on average in the Nanaimo area from the peak price, the mortgage costs to buy a home have remained almost exactly the same! That’s the difference between a 2.5% interest rate and a 4.75% interest rate.

Next I am going to speculate on what things might look like near the Terminal interest rate of 5.5% expected around February of 2023.

Example #3: February 2023 purchase date

Purchase price: $700,000

Mortgage amount: $560,000

Mortgage payment: $3418.19 ($41,018.28 annually)

You can see that, even with another $100,000 decline in the average price, there is not much relief coming for buyers.

This is why I maintain that stock and bond markets have endured the majority of their downward price action and can end their BEAR markets becoming sideways range bound but real estate still needs to adjust lower to find the same type of equilibrium.

We will see….

Part 3: Cryptocurrencies – what just happened?

To be absolutely clear…this is not an opinion to buy, sell or hold cryptocurrencies. I have never taken an official side in recommending cryptocurrencies. DO YOUR OWN DUE DILLIGENCE IF YOU CHOOSE TO INVEST IN THESE SPECULATIVE ASSETS.

With that said, the liquidity structure of the entire cryptocurrencies world has been challenged.

If you are an investor in these things and you are not aware of what is happening in the news about cryptocurrencies from the past 24 hours I strongly recommend you go back to your information sources and get up to date.

Part 4: Canadian Savings relative to GDP

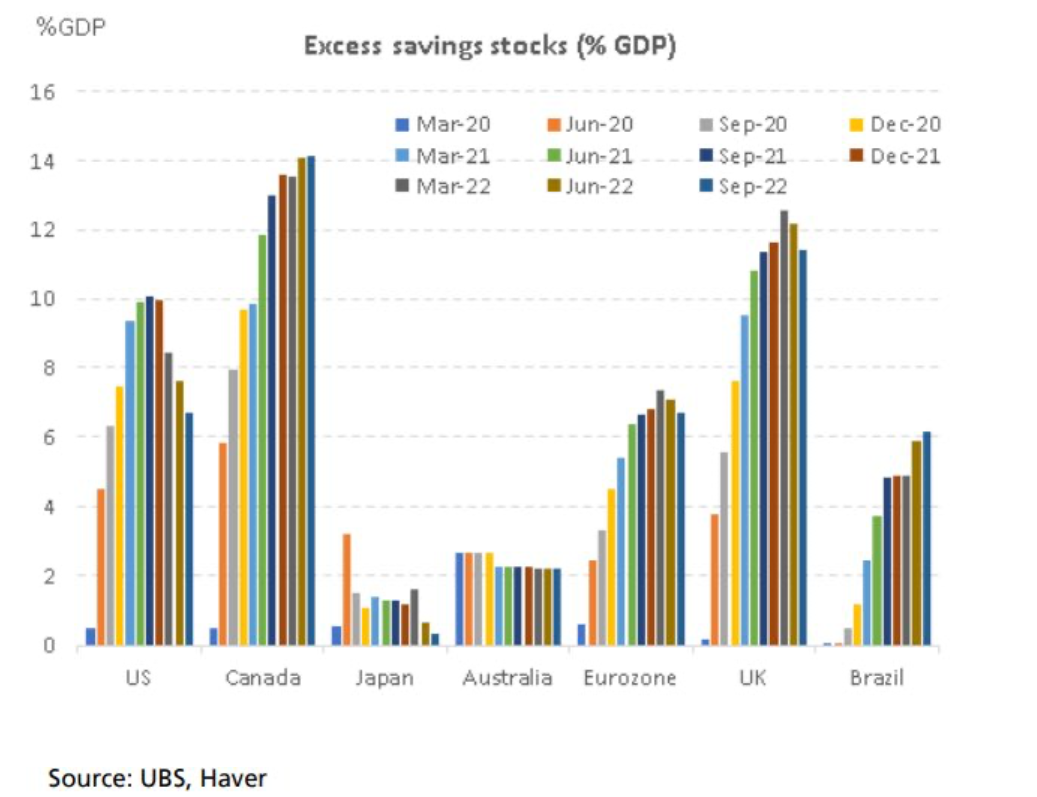

The chart below shows that, even though Canadians are deeply in debt relative to GDP, they still have a high level of savings to be drawn upon.

With this amount of savings still left in the bank accounts of Canadians I would expect inflation to remain sticky-high and interest rates to continue higher.

Again, it is only one data point but one I watch closely.