Higher Interest Rates Change Everything

Before we begin, permit me to answer a question from a reader brought about by the last (almost) weekly comment.

Question: How closely do (corporate) earnings track the returns in the stock market?

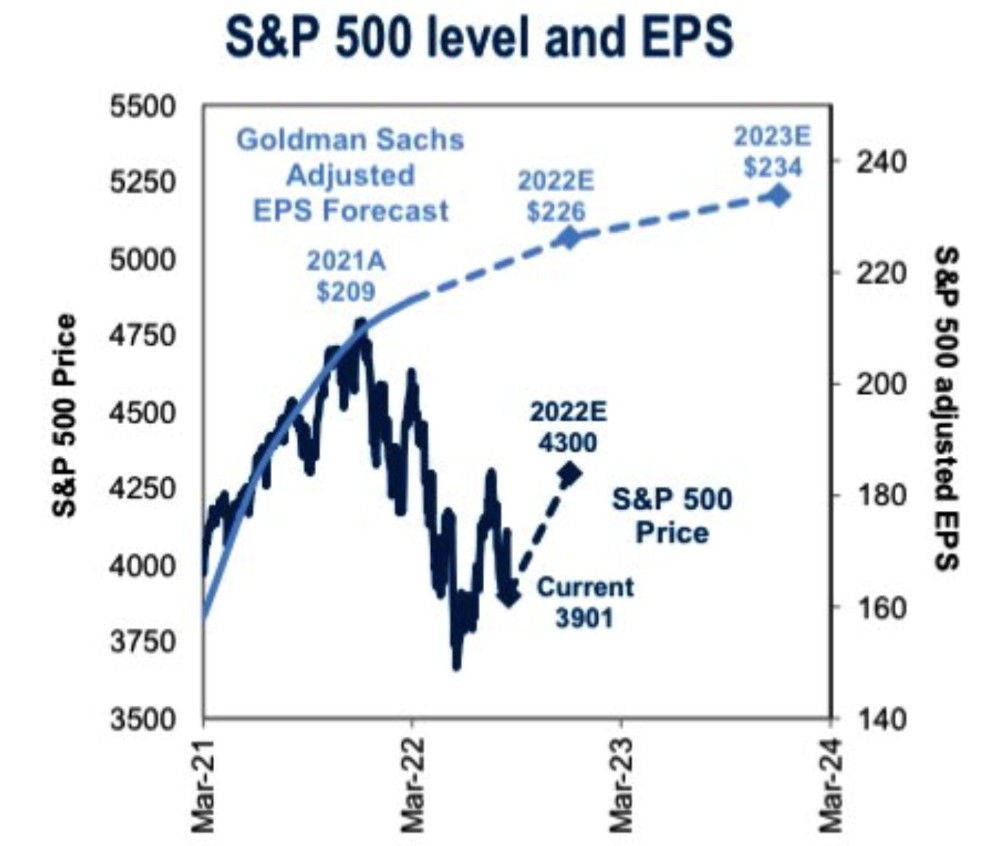

Short answer: Directionally the tracking is well correlated. Where it gets messed up is at economic inflection points. The key to understanding what happens at inflection points shows up nicely in the chart below.

You can see how the stock market has diverged negatively from the still positive, yet slowing, earnings rate of change expectations.

The same thing will happen at the end of the recession as well. When earnings estimates fall at a slower rate, the time to repurchase stocks and real estate holdings will be near.

This process is more of an art than a science. That said, it simply requires patience and attention.

Stated another way, when the media is screaming about the depths of a recession and how bad it is going to get, keep watching for the rate of change of the earnings decline to slow because that is the time to go “shopping.”

Since the Goldman Sachs chart above was published, they revised the data into a new chart. (Below)

For those keeping score at home, here is how Goldman Sachs has shifted their S&P500 targets in 2022.

Goldman Sachs started the year in their Look Forward piece from December 2021 using a 5100 target for the S&P500 at the end of 2022. That forecast was (finally) lowered to 4300 in early September 2022.

As of Friday, September 24th the view was shifted again to the chart above. A “soft landing” year-end target for 2022 was set at 3600 with a 4000 target for year-end 2023. The “hard landing” view from Goldman is now looking at a 3400 target for 2022 and 3750 for the end of 2023.

This type of change in forecast is common in a BEAR market. Goldman kept with the BULLISH forecast for far too long given the macro changes in the US economy AND the message that the US Federal Reserve was signaling. Then they proceeded to capitulate to a forecast that leaves investors without much of a choice.

With the S&P500 sitting at about 3700 at the time of writing and a forecast level of between 3750-4000 now for the end of 2023, what does a person do?

My point: Don’t follow analyst projections, follow the rate-of-change in macro economic data.

Let’s completely shift gears here and do some real life role playing.

Imagine you have come into a windfall of cash equaling $1,000,000.00. You do not need this money for anything right now so your intension is to invest the funds for at least 3 years.

What we are going to do is pretend that in example 1 you received this money on November 15th 2021. In the second example, all assumptions remain the same but you will be deemed to have received the lump sum on September 26th, 2022.

Example 1: November 15th 2021

- 90 Day Canada T-Bill – yield 0.12%

- 1 year Gov’t of Canada bond – yield 0.12%

- 1 year GIC - yield 0.80%

- Canada TSX Comp Index - 21,708 (2022 target 23,500 or 8.3%)

- US S&P500 Index - 4718 (2022 target 5100 or 8.1%)

Looking at the investment choices above and considering that meme stocks were still racing higher, Bitcoin was up over 100% for the year and forecast to top $100,000 in 2022 and even the stock market indexes were up 30% on the year…what do you choose?

It’s not the bonds or GICs…that’s for sure!

Why would you?

Example 2: September 26th 2022

- 90 day Gov’t of Canada T-bill – yield 3.57%

- 1 year Gov’t of Canada bond – yield 4.05%

- 1 year GIC - yield 4.40%

- Canada TSX Comp Index - 18,327 ( -15.6%, 2023 target 20,850)

- US S&P500 Index - 3655 ( -22.5%, 2023 target 4000)

What a stark set of differences to consider for what investments you would make with your new-found wealth!

Having a $1,000,000 draft in your pocket in September 2022 will most likely see you choose to put a sizable amount of money in the guaranteed investments. A clear difference from making choices to invest less than a year earlier.

This same difference plays out when looking at real estate rental properties too.

A year ago, the investor was looking at the low rates of returns on GICs relative to the higher income they would receive on the rental house. Plus all the capital gains they were going to make on the house on top of the higher income.

Quick example: $1,000,000 rental house, rented at $4167/month. Subtract costs and taxes = net $30,000 per year or 3%.

Good return versus the less-than 1% GICs available in 2021.

In 2022, the costs of maintaining a house have skyrocketed higher than the ability to raise rent so now the house nets $25,000 per year but the GIC income is $45,000 per year with no tenant hassles.

And with a lot more uncertainty surrounding real estate investing now there is a real choice for an investor to make.

So what you need to understand about the impact of higher interest rates is that it is a two-fold dampener on asset prices.

First, the mathematical valuations of assets decline relative to the higher costs for capital in terms of higher interest rates.

Second, the investment advantage of real estate and stocks over fixed income and GICs is greatly diminished or actually gone away in many cases. The fixed income pays more without the capital risk.

This means there is less cash on the sidelines waiting to buy these investments. It was waiting in 2021 if it was on the sidelines because it paid nothing. But today, cash pays 3.6% in a Bankers Acceptance and 4.5% in a locked in GIC.

I’d argue, cash is no longer waiting in the same quantities as it was a year ago.

Feel free to email back if you would like a call….