***Before we begin – Over the summer months my goal is to write a series of editorials on either the BEHAVIORAL aspects of investing or the PROCESSES used to create portfolios. Hopefully these will provide some food for thought to help us all be better investors and will be good for sharing with people. I invite feedback from both clients and non-clients on these comments.

If there are specific market related topics that require attention, my goal is to send out short emails when the changes occur to address those situations.

I will use the header – “Special Update #_” for these emails. (As I did last week).

“Resulting”

The poker pot has grown to the largest of the night. You have slow played your “full house”, kings and tens. You were lucky because another player was the early focus of the table and decided to fold. You flew under the radar with your exceptional hand and now is your moment of payoff.

The player left in the pot with you is drawing for a “straight flush” and there are only two cards left in the deck that give them the win. You are both all in for the pot.

As luck would have it, on the last card, the other player hit one of their two outs and you lost the pot. In that moment the odds said that 37 out of 39 times you should win. As they say, that’s poker…

No doubt, when that happens to a poker player, you are extremely disappointed. The losing hand played everything right but the “luck of the draw” beat them. It’s fine to feel disappointed but it is important you see your loss for what it is: Bad Luck.

As a player, you have to see the loss in terms of HOW YOU PLAYED THE HAND, not out of HOW IT TURNED OUT. (“Resulting”). You have to understand that your process was excellent and you lost because of bad luck.

Investing in the stock market encompasses the exact same mindset. This is true whether you are a “buy and hold” or “trader” oriented investor.

Investing is a process that considers an uncalculatable number of variables and, therefore, luck plays a huge role in an investor’s success in any single instance. (Similar to one poker hand).

By employing a solid investment process the investor minimizes the role of luck. Diversification, non-correlation, risk control protocols, and just plain hard work in terms of research help get rid of individual outcome risk.

During long BULL markets like the one that ended in 2021, people forget how much hard work goes into investment process. Poor process does not show itself as damaging in BULL markets. It is only during the BEAR phase of the market cycle that people realize their process was flawed.

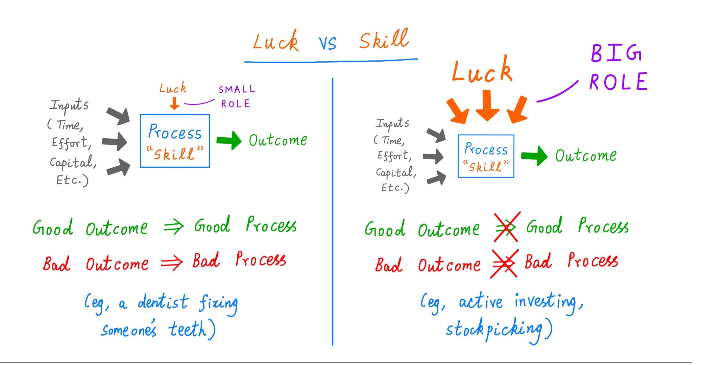

Let me borrow a chart from Twitter handle 10-K Diver to make this point a little clearer.

In the first window 10-K Diver outlines a highly controlled process where skills far outweigh the role of luck influencing the result. He notes the example at the bottom of the window of a dentist fixing someone’s teeth.

But investing (and poker) don’t work that way. One can work to tilt the odds in their favour but LUCK is always going to play both a positive and negative role in the outcome.

The most important thing to remember here is, if you have good process in your investment strategy, you cannot let the results of a single bet influence the way you bet in the future.

Let me use an example of where the “results of an investment choice I made were not good but I would make the same choice again EVERY time given the same circumstances.”

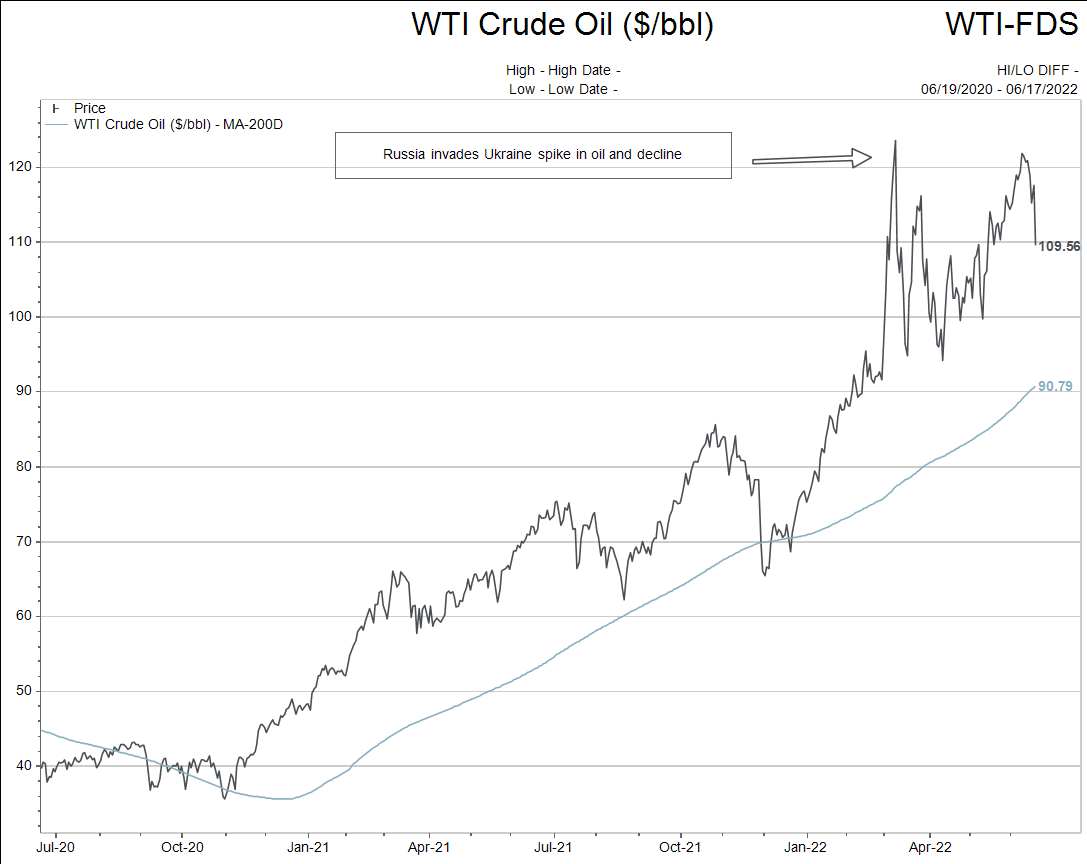

Everyone knows that oil prices are at all-time highs and oil stocks have been a great place to be invested. Our clients had lots of oil exposure for most of 2021 and in early 2022. Then the Russian invasion of Ukraine happened and oil spiked even more. The oil stocks followed the price of oil higher.

Macroeconomic data was already weakening at the time of the invasion. The higher oil prices directly related to the Ukrainian invasion would normally be the final straw to break the camel’s back and push the economy into recession. In a recession, oil prices decline as demand is destroyed in the economic downturn.

Using my process, the correct trade was to sell most of my oil holdings AFTER the peak in oil prices in March 2022 since historically the economy would be close to peaking and demand destruction was to follow.

But, in our present reality, supply destruction was also a huge part of the equation since Russia was being sanctioned and is a huge oil exporter.

Therefore, using my process, the choice to sell down oil shares in April/May of 2022 was incorrect in terms of results.

Now, if I was mentally “resulting” this outcome I would criticize myself and ask why was I so stupid. But I don’t have a problem with the result.

Why? Because I followed my process.

One of the reasons I want to write a series of fundamental articles about investing over the summer is to help you understand there are ways to control the unknowable complexity of the present financial markets.

For all those with a background in science or medicine reading this comment, you will be comfortable with the idea of controlling for variables in your process. Investing is different than science or medicine but it gives a good framework for those who are indoctrinated in those fields.

Next week I will outline the “risk range” concept that I use to manage money. A few of you emailed back after my first two “special updates” last week asking what the term meant.

As always, your questions are welcomed!