Being Better

“There are no bad mistakes if we learn from them.”

After investing and trading in financial markets for nearly 34 years I can certainly attest to my share of mistakes. I can also attest to not being the quickest learner too.

The activity that helped me get better the most was taking good notes about what I was doing and not letting my memory bias what actually transpired. (We all tend to remember our wins and suppress our losses).

What became clear by being analytical about my biases was I was a sucker for buying a chart that had declined significantly on a small bounce trying to call “the bottom.”

To improve my batting average I had to find a way to NOT follow what my gut was telling me and use a mathematical process to act.

It took a while but I finally found some successful investors that had solid process to copy for myself and apply.

But this was only the first level of process that was required.

Next I learned how to correlate asset prices to gain a greater insight into market behavior. It shocks me how many people watch the Dow Industrials, NASDAQ Comp and the TSX daily and think they are “following the markets.”

There were many more steps to go that would require a longer formatted editorial than this to cover. Let’s explore what I consider to be the most important lesson I learned over the years beyond process.

By far and away, the most important lesson I have learned investing is always asking myself the question, “What if I am wrong.” (Back to the three part series written in April, this idea was the focus of the April 6th editorial).

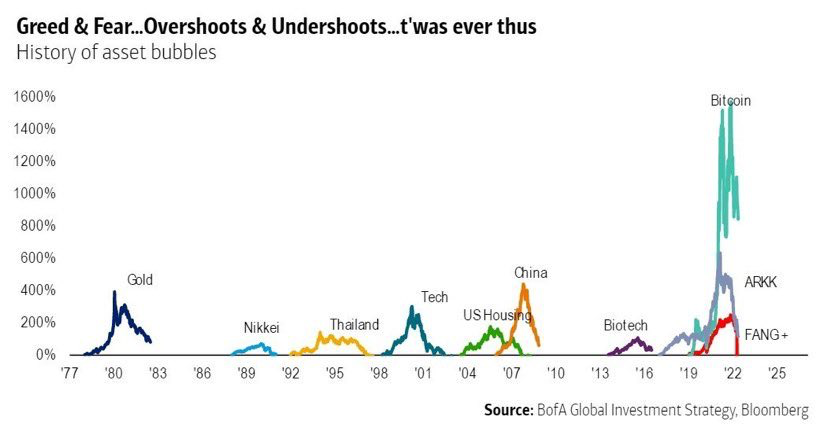

Before I start I want to show you a cool chart depicting the greatest bubbles in financial assets the past few decades. The chart shows the gain in price as a percentage once the bubble took hold.

I can say with complete confidence that speculators in these great bubbles all believed the bubble was never going to end…yet, that is exactly what happened!

What I have learned is there is no shame in speculating. The shame comes when you don’t have a system in place to filter out the narrative of the bubble so you can exit once it breaks down.

Our human minds are wired to see linearity. Take a rising straight line and make it go parabolic and you will whip the human brain into a frenzy!

So here is the thing. Investors have the ability to make any investment choice they wish with their capital but they do so at their own peril without a defined disciplined approach that takes into consideration what if they are wrong about their assumptions.

Let me share a real time example of how this process works:

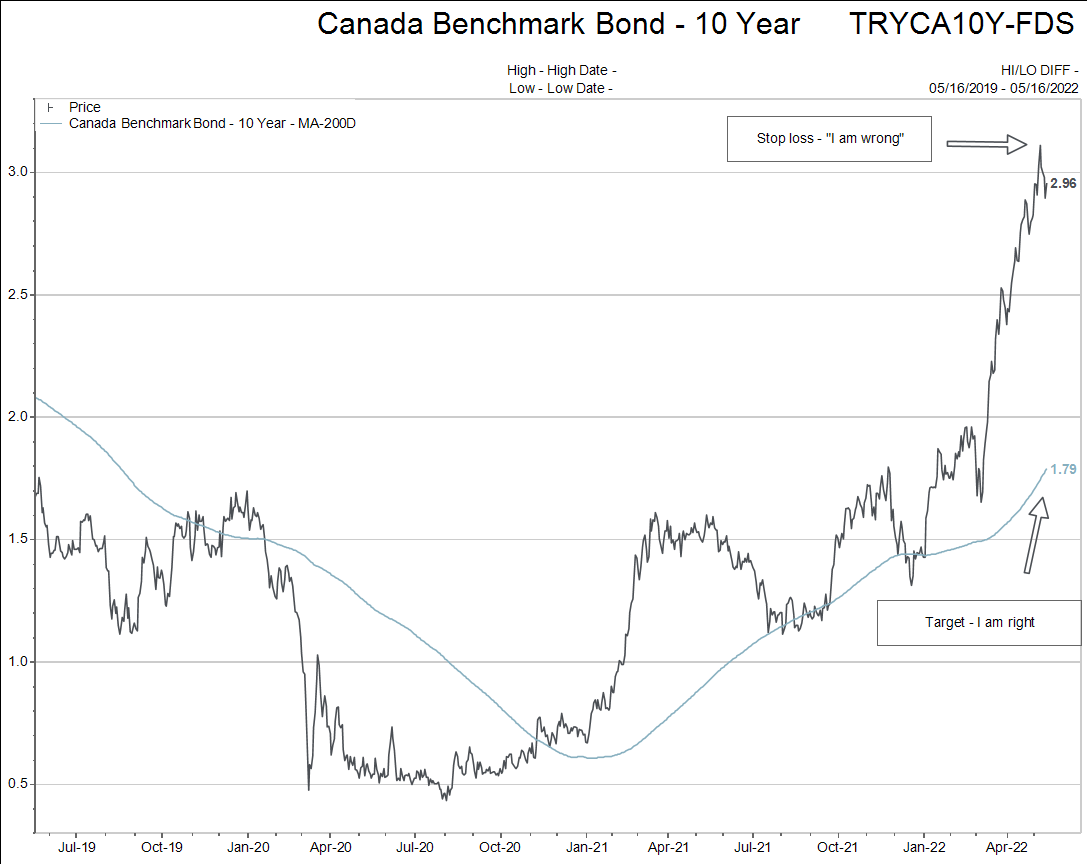

- At this moment the way 10 year yields are behaving tells me there is a growing chance that the yield highs are in. (That conclusion is based on a lot of correlating evidence).

- Therefore, this allows me to add my MINIMUM sized position (based upon my process) to my portfolio. (My personal minimum is 8% of my investable capital and maximum is 16% when it comes to bonds).

- Now I must adjust my strategy as to whether I am correct or I am wrong.

If I am right, I will likely trade these bond positions ranging from 8% - 16% of my portfolio based up the structure I have adopted. But the key to understand is that if 10 year interest rates make a new high (3.12%) on the chart I will not own any more bonds and I will take a small loss to close the trade out.

The rationale behind this investment is as follows:

- Inflation has gone up to a level that the central bankers are not comfortable with. (Neither are politicians).

- The Fed and the Bank of Canada NEED a recession to bring down inflation.

- Inflation will not come down without lower real estate, stock and bond prices.

- Therefore the Fed wants a mild recession to accomplish their goal.

The investment thesis I am using IF THE ABOVE LOGIC IS CORRECT.

As asset prices decline and the mild recession takes hold, interest rates will fall again along with asset prices.

That’s my thesis. The editorial outlines the process I am using to manage the risk of investing in my thesis.

Hopefully that helps you see that taking risk is not all that risky if you have a process.

Feel free to email questions if you have any.

P.S. – I am away from the office Wednesday afternoon on this week. Please call Markus at 250-729-3266 of you need anything.