A Happy Ending

It is important that I begin this comment with a compliment to you all.

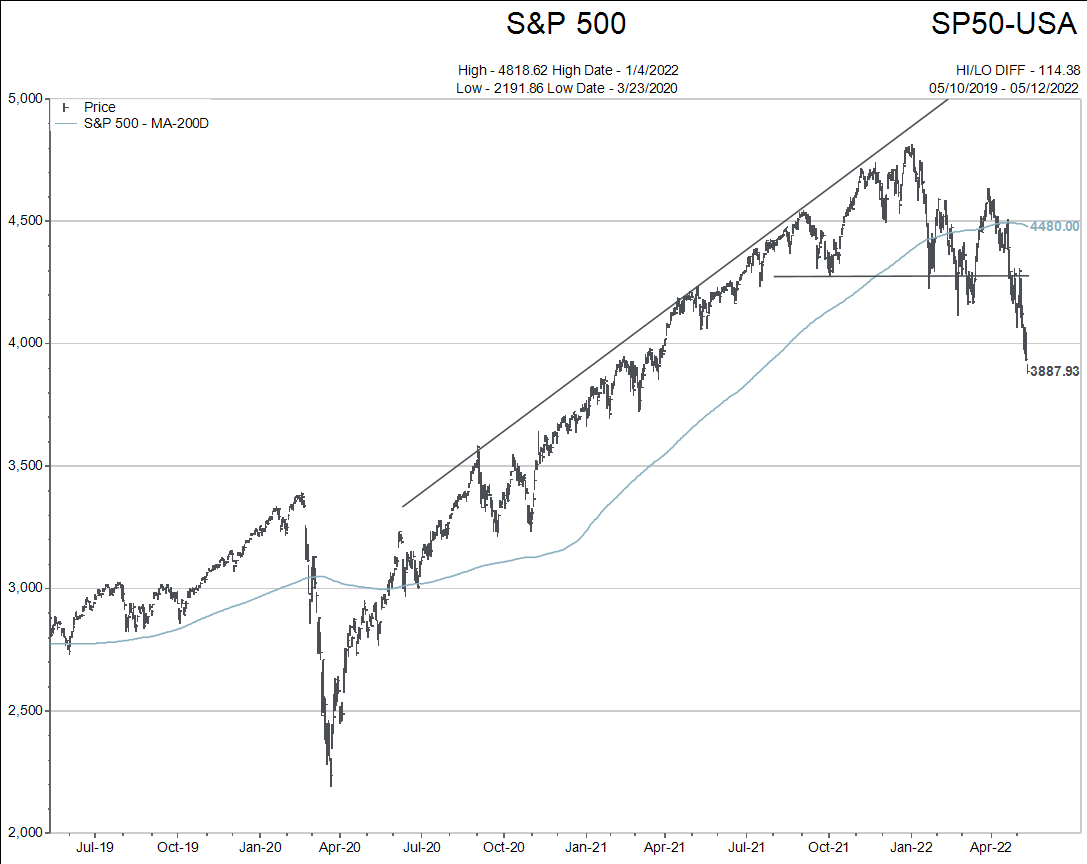

The swings in stock and bond markets have been quite unsettling. This BEAR market has been much more typical in how it has unfolded as compared to 2020. In March 2020, the markets were straight down, then straight up again once the Fed stepped in. This has been almost textbook “lower highs and lower lows.”

Anyway, I have not received a single panicked phone call or email. Actually, my phone has been quiet. Most of the calls I have received are general questions and “what do you think” type conversations. A few of you are looking at ideas to add to your cashed up portfolios.

I’m proud of you all.

This would normally be a time I would write a Triannual Review. There is so much I don’t understand about this cycle that I am going to omit that letter for now. Honestly, I’d be making stuff up if I try to write it.

This letter is going to make an OBSERVATION and then a SPECULATION about the future instead. I think this is good news to those who worry about a deeper recession. My sense is this recession is going to be mild but lingering in nature.

The observation is that the economy is still growing slowly and has solid demand. What appears to be happening is that overinvestment in technology is getting crushed in valuation and the high end services industry is weaker. (Crypto currencies included here).

Stated another way: We need fewer tech company employees, bankers, realtors, middle managers and high-end service workers in general and we need more plumbers, electricians, truck drivers, farmers, restaurant staff etc.

Let’s assume this observation is relatively accurate for a few more paragraphs. What would that mean?

The good news as I see it…a milder downturn in the economy with less job and demand loss than typical recessions.

The bad news as I see it…more persistent inflation and continued higher interest rates for a longer period of time.

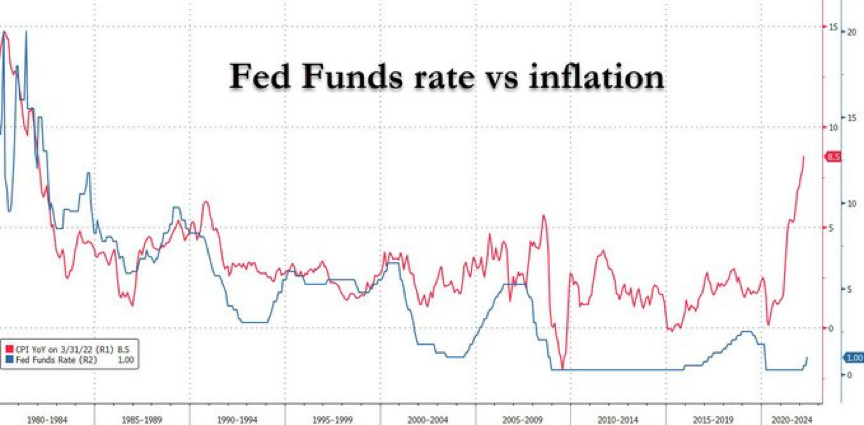

The chart below is rather graphic. It shows the long term relationship between Fed Funds interest rate and inflation.

Higher inflation is definitely taking a bite out of household budgets.

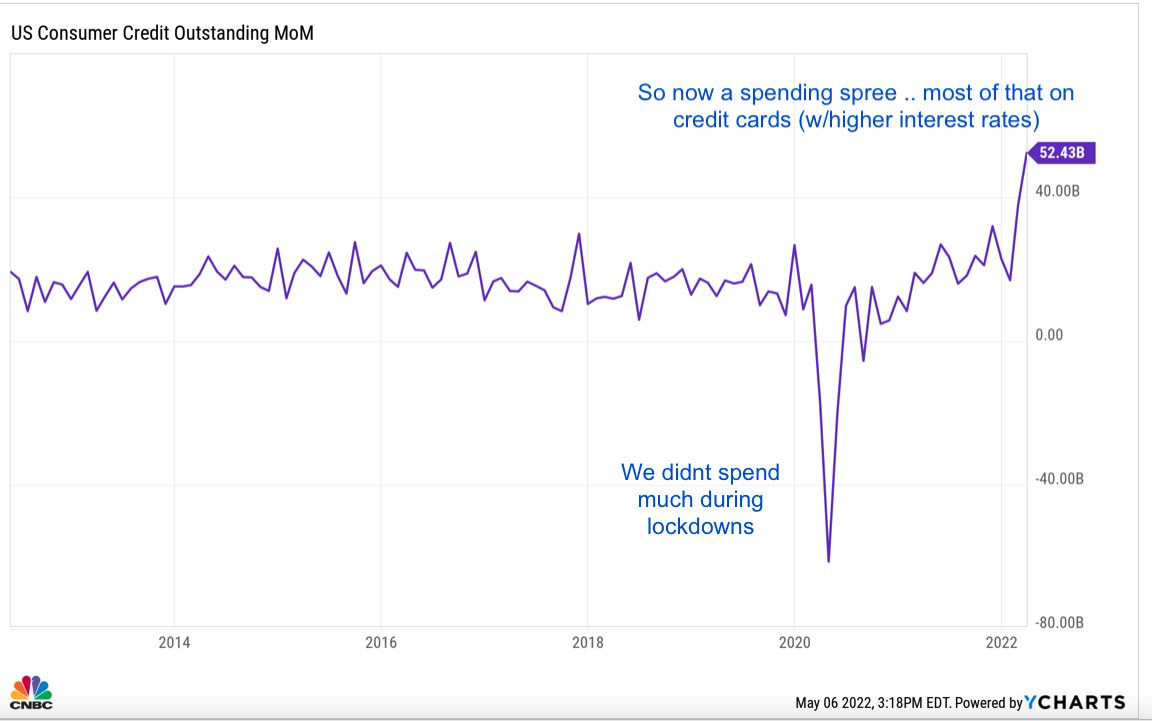

The following chart confirms that the excess savings accumulated during the COVID crisis among working and middle class households were exhausted. The credit trend below is not sustainable and requires a slowdown in spending.

The chart refers to a “spending spree.” I agree that people have gone a little crazy on travel spending and some pent-up demand purchasing. My guess is that higher debt levels will peak very soon right along with the inflation rates.

The challenge is the inflation is going to be persistent. (Unless I am totally wrong and the coming recession is deeper than I am seeing).

So let’s see what comes. Hopefully the real economy stays relatively strong to support working people and their budgets.

Update on my “go-to” chart.

The S&P500 has now clearly dropped below my support line that has been in place since the beginning of the year.

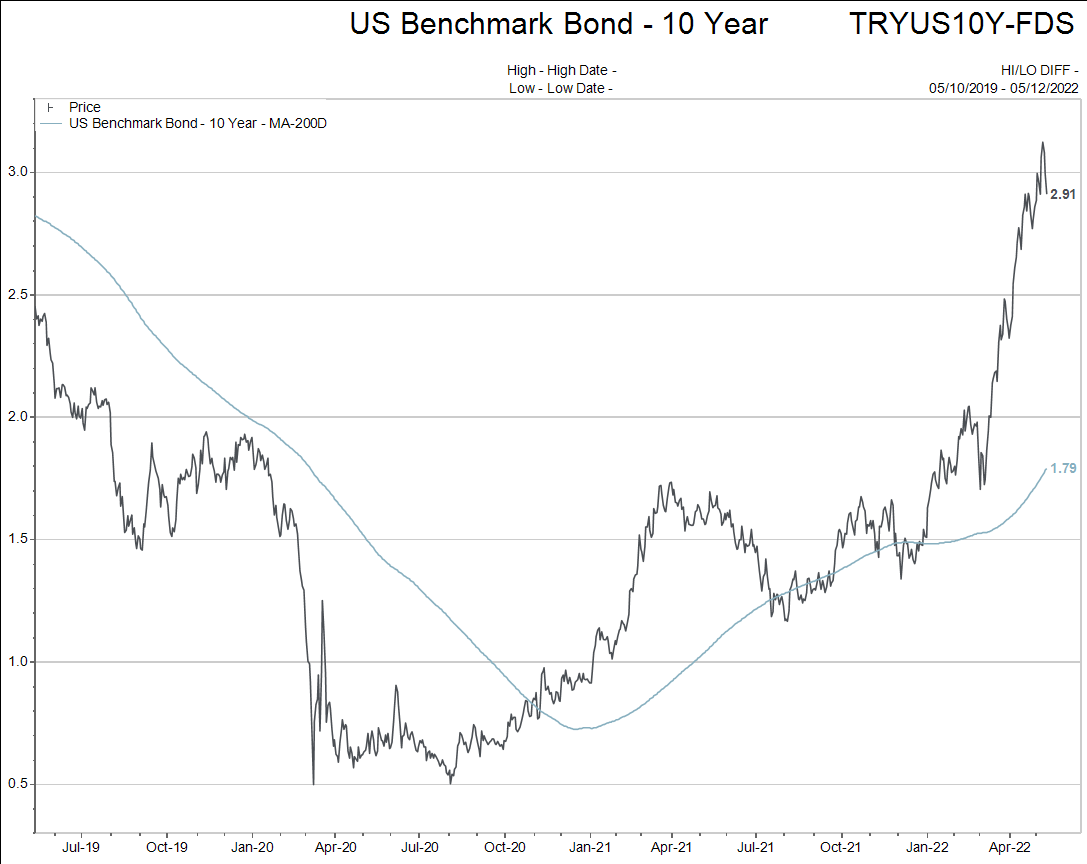

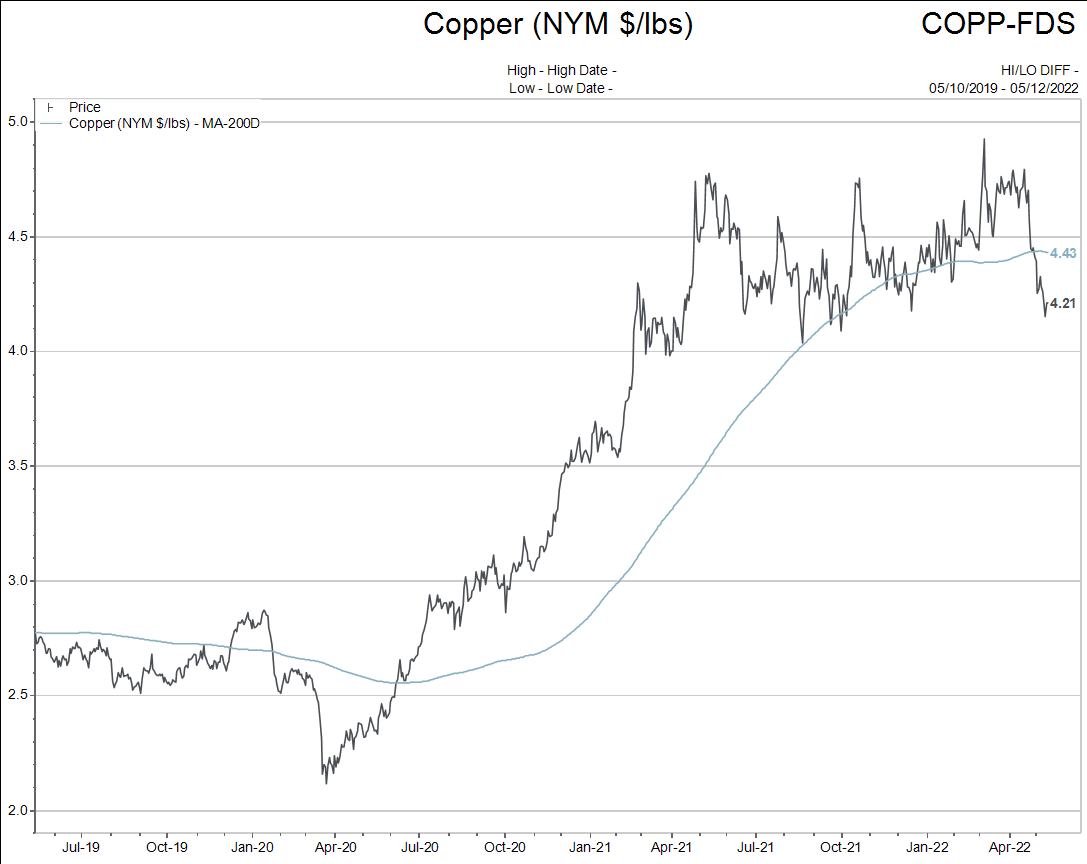

Two other charts to note are 10 year bond yields and copper prices.

Are 10 year bond yields close to peaking even though short term interest rates are still rising? That will very likely happen if my recession call is correct.

Copper looks to have peaked too.

There are a few positions that can be added right now if you want to risk manage some cash. They are not in the stock markets.

Email me back if you want to chat….