Do They Mean What They Say?

Have you ever found yourself reading an article that is quoting someone of importance and influence where the writer seems to ignore what they are quoting and decides to interpret their words according to narrative?

You might say, “Everyday”.

I caught myself doing this last week. There were two stories speaking to the US Federal Reserve raising interest rates to combat inflation quoting voting members of the Fed. After finishing the articles I found myself thinking “no they won’t, they don’t have the courage to risk a recession.” My mind completely shut out the Fed member quotes and stuck to my mental narrative.

This made me decide to do some more research to try and see if I should be believing the Bank of Canada and US Federal Reserve leaders or was I quite right to assume the central bankers are full of hot air when it comes to the tenacity with which they will raise interest rates.

Let me walk you through a long period of history in terms of interest rates and try to lay better odds at estimating just how far the central bankers might go in terms of cooling inflation pressures.

(One quick aside: what I am about to write pertains to Canada and the US, not Europe. The European Central Bank is still talking a much better game of monetary toughness than it is playing).

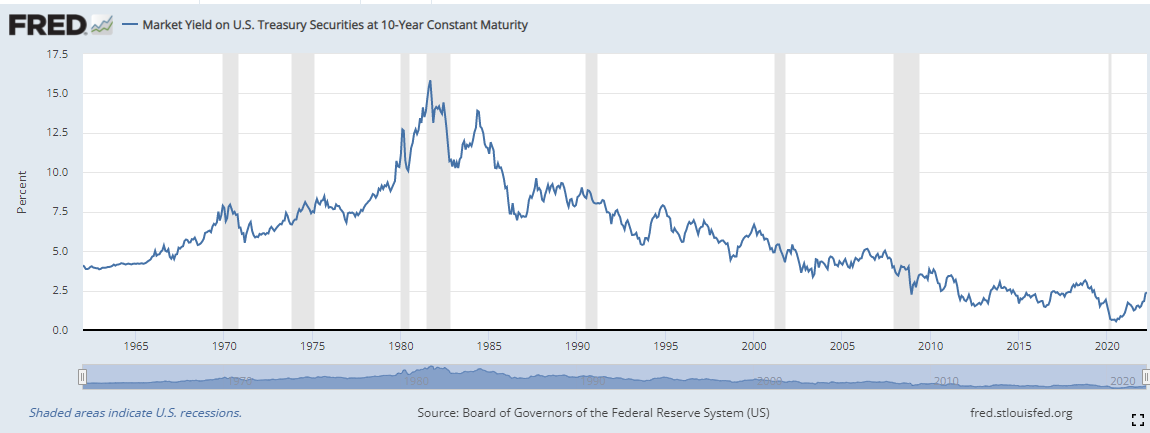

The longest chart I could find of 10 year bond yields was the one above that goes back to 1962. I was hoping to find one that went back to 1950 because it would show the symmetry of “the bond yield mountain.”

The 1950s had US 10 year bond yields that bounced between 2.5% and 3.5%. The 1960s yields were in the 3.5%-5.5% range right up until 1969. This is where the story gets interesting.

Remember, it was 1971 when Richard Nixon made it so the US dollar was no longer convertible into gold bullion. This is when the US dollar was made fiat. Look back at the chart at what was happening to interest rates at the time Nixon closed the gold window of dollar convertibility. Interest rates were moving sharply higher along with inflation.

Next there was a severe recession in 1973 and interest rates fell again back to the 5.50% range…but inflation kept raging forward.

The rest of the decade of the 1970s into the early 1980s is famous from the financial perspective because it saw then Fed Chairman Paul Volker keep raising short term interest rates to the low 20% range to finally slay the inflation beast.

Since that inflation spike the developed world has seen a continued decline in interest rates to the extremes seen in 2020 where over $19 trillion in global bonds had NEGATIVE interest rates.

Nick, why do you bring this ancient history up?

It comes back to this idea of believing what the central bankers were saying. Back in the 1970s, Paul Volker was saying he was going to defeat inflation. They wore buttons on their jackets (Whip Inflation Now – WIN). They blamed OPEC for high oil prices. They threw shade at their political opponents to lay fault at their feet. But the people in the 1970s BELIEVED the Federal Reserve (and Bank of Canada) would do as they were said.

What that did was cause long term and short term interest rates to rise in tandem.

The interesting part of this story is that is exactly the opposite of today.

North America is facing the exact same inflation rates that were prevalent in 1976…around 8% inflation. Yet our 10 year bonds are stuck down at 2.5% rather than 8% at that time.

Why? Because investors don’t believe the US Federal Reserve or the Bank of Canada have the courage to stop printing money and raise interest rates to really tackle inflation.

Just stop and think about that for a minute. It really is quite amazing. Investors spend all this time listening to every word these central bankers speak and then they decide not to believe them.

Investors are the proverbial spoiled children of the rich parent that always smooths out every bad situation they created for themselves by bailing them out. Why would such a child ever worry about the consequences of their decisions if the parent was always there to take away the pain?

What would happen if that parent tried to tell their kids, “Ok, this time you are really on your own? If you screw it up again, I won’t be there to help you.”

“Yup, ok, sure, thanks…we know…ha ha…..” Can’t you hear investors doing the same thing?

Man, that’s exactly how I feel about the situation. How many times have I written about the “Sugar Daddy Fed” etc.?

Which brings me back to the change in the tone of the speeches given by the Fed members and Tiff Macklem of the Bank of Canada. They are talking tough. They are trying to tell us they are going to do things differently.

This brings me to my conclusion:

- Either the Fed is going to stay true to form for the past 40 years and will go back to bailing out the markets at the first signs of trouble. (Save the spoiled kids once again).

- Or the Fed is really going to take a stand against inflation that is anchoring itself deeper in the economic landscape no matter what financial markets do.

I find myself still favouring number 1 but that is what everyone else is doing too.

What if I’m wrong?

There’s the most important question an investor can ever ask themselves. What…If…I’m…Wrong? The cost of being wrong is high today given the leverage and debt outstanding at every level of the economy.

It will take more than a 20% correction in asset prices to tame inflation at its present levels. Especially given the extremely low interest rates.

Next week I will write a piece that looks at preparing for “what if I’m wrong”.

Until then….