The Butterfly Effect: Interest Rates

“Brad’s day had taken a turn for the worse. Actually this entire week had not gone well. Work was stressful and there appeared to be no breaks coming up soon. His family life was becoming the proverbial shrinking image in the rear view mirror. Even his dog had problems that he felt pressure to solve.

He was late for an appointment and was trying to squeeze one more conversation in on his hands-free set in the car on the way. The issues the caller was describing were going to take many more hours of his time to get to the bottom of in coming days.

Brad pulled into the left turn lane nearly at his destination. He was still talking on the phone and was now looking at his notes on the front seat of his car trying to see the address he needed to get to his appointment. In his distracted state he stopped about 1 meter too soon in the left hand turn lane to trigger the signal so, when the light was supposed to change for him to go left, it did not work.

Of course the barrage of horns echoed in the background making Brad more stressed and frustrated. Then he smiled and thought at least I will finish this conversation before getting to my appointment while he pulled ahead slightly and kept on talking on his hands free…

Denise was coming to the left turn lane where Brad had not tripped the light. Now the turn lane was full and her car would not fit in. She had to make this turn so she put her blinker on and stayed in the fast lane of traffic waiting for the light to change so she could pull forward…

Robert had been driving for 4 hours straight. He had to go to the bathroom and he was going to be late for a date with a woman he had known for only a short while. She was going to think he was unreliable if he didn’t get his butt in gear. Robert was trapped in the slow lane. This is taking forever…

As the rain pounded down, Denise looked in her rear view mirror…nobody coming behind her…good because she hated having her car sticking out in the fast lane of traffic.

Robert had most of his attention focused on his driver’s side mirror waiting to jump out into the fast lane. He hit his accelerator and his car leapt forward into the fast traffic lane…he had no time to react before he smashed into the rear end of Denise’s car that was just about to pull forward as the left hand turn lane finally started to move ahead...”

The butterfly effect is defined in chaos theory as the sensitive dependence upon initial conditions in which a small change in one state of a deterministic nonlinear system can result in large differences in a later state.

When the police come to sort out the accident that happened above they will look at Robert’s decisions as being the cause of the accident and lay the fault at his feet. Denise will be the victim in the analysis. But is that really true? What were the small mistakes that created the conditions that allowed the accident to happen?

The irony in the story above is that the left hand turn light had changed seconds before the accident and Brad, who made the original small and seemingly inconsequential error of not pulling ahead in the left turn lane far enough, is not even aware of the carnage that took place behind him with Robert and Denise. He might read about it in the newspaper the next day, not realizing he played a huge part in the accident.

The Butterfly Effect is alive and well in our financial system today.

Inflation has shot up to levels that seriously impact society. Interest rates have run higher even before the central banks have started to make any real inroads with their own policies to raise them. The gaps between incomes and costs are growing every single day.

We hear politicians talk about the Ukraine invasion or COVID causing the inflation today. But don’t you think it can be linked back to many years of monetary policy decisions before?

Much like our friend Brad in the story above…these decisions that seemed inconsequential at the times they were being made are part of the reason the world faces the situation it does today.

I

Above is a chart of the 1 year Government of Canada bond since 1996. The bounce in interest rates is just getting started. Remember, inflation is running hotter now than any other time since the 1970s.

We, as investors, should be very careful not to assume what the future of this chart looks like. There is a huge Butterfly Effect that could impact the outcome.

But Nick, if the Butterfly Effect is alive and well in financial markets, how can anybody know what they should do?

Truth is, you can’t know and nobody can tell you either. Ok, so then what?

Annie Duke, the well-known former poker player and author of Thinking in Bets makes an excellent case as to how people can sharpen their decision making skills.

“What makes a great decision is not that it has a great outcome. A great decision is the result of a good process, and that process must include an attempt to represent our own state of knowledge. Contained in that state of knowledge, is some variation of “I’m not sure”.” - Annie Duke, Thinking in Bets.

As an investment advisor, I fight my natural decision making tendencies every day. My goal is to stick to my process. Staying true to what I do increases the odds of a higher percentage of positive outcomes.

Let’s apply these thoughts to the real estate and stock markets of 2022.

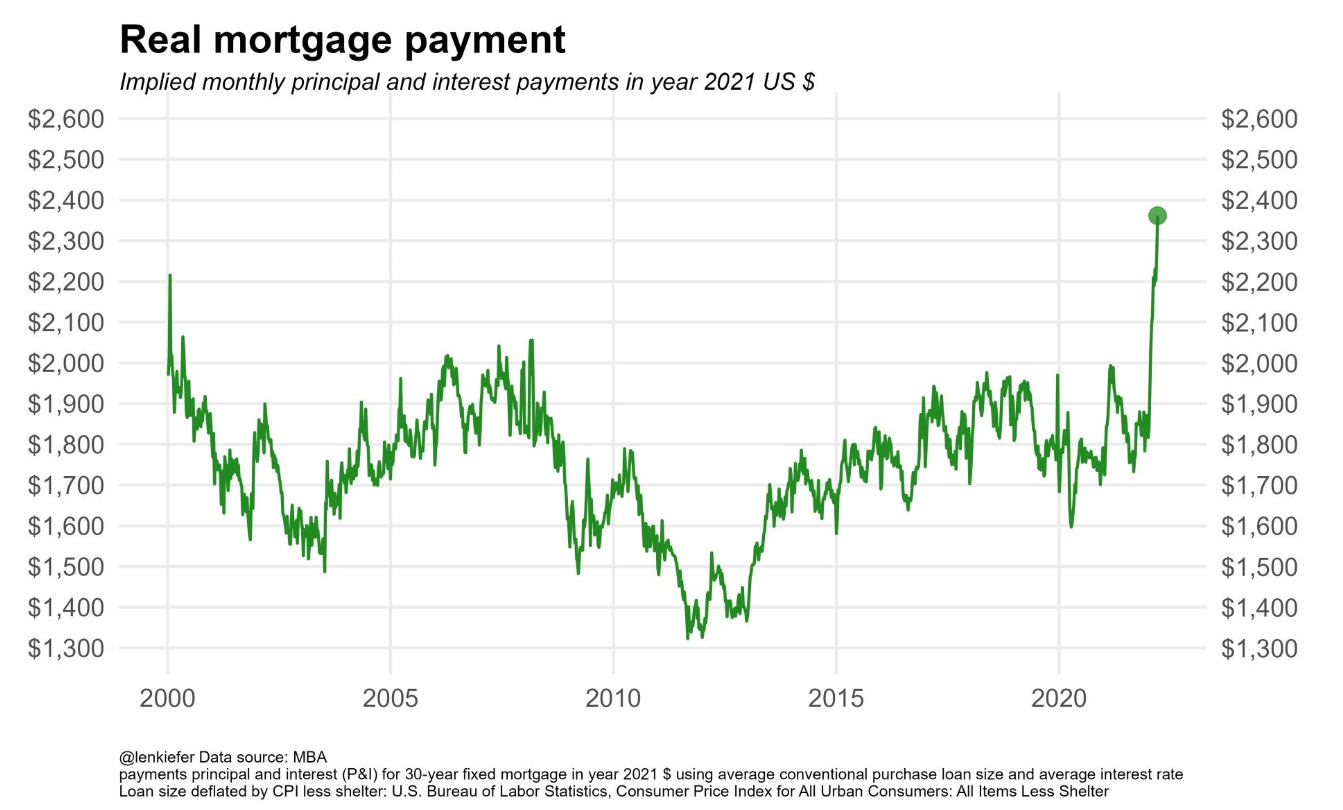

People line up to put in offers on properties 50% more expensive than they were two years ago. The mortgage and maintenance cost are jumping higher too. Why? Because our brains are wired to think of the price of real estate in a linear manner. Chasing higher prices is an error as old as finance itself.

(Note: the chart shows payments adjusted for inflation. See fine print).

Let’s use another example from the stock markets. The ARK Innovation exchange traded (ETF) fund run by Cathie Wood was seen as a pure way to gain exposure to the future of tech. In the run-up in the share price after the March 2020 COVID decline, ARK attracted many billions of dollars of investor money into early 2021. (Shown below).

As the price kept rising, more money poured in. The stories about Cathie Wood’s prowess and brilliance grew in stature, drawing more FOMO (Fear of Missing Out) investors into her fund.

Of course, what happened next was relatively predictable.

Investors lost 70% of their money and Cathie Wood’s reputation was severely tarnished.

(For the record, Cathie Wood was never as smart as people made her out to be on the run up in her fund, but she is not as inept as people say she is now. For long term investors a small position in ARK at these levels is fine).

So let’s wrap this almost weekly comment up…

Nobody knows what the future holds. The radical change in inflation and interest rates has been long predicted and now appears to be upon us. How high interest rates go in this scenario remains to be seen.

Higher interest rates and inflation are pressuring earnings of companies. Higher costs of living are eating into wages that, even though they are increasing, they are not increasing fast enough to keep up.

The ultimate result will be some amount of demand destruction in an over-leveraged world.

One more little side note before I leave this topic.

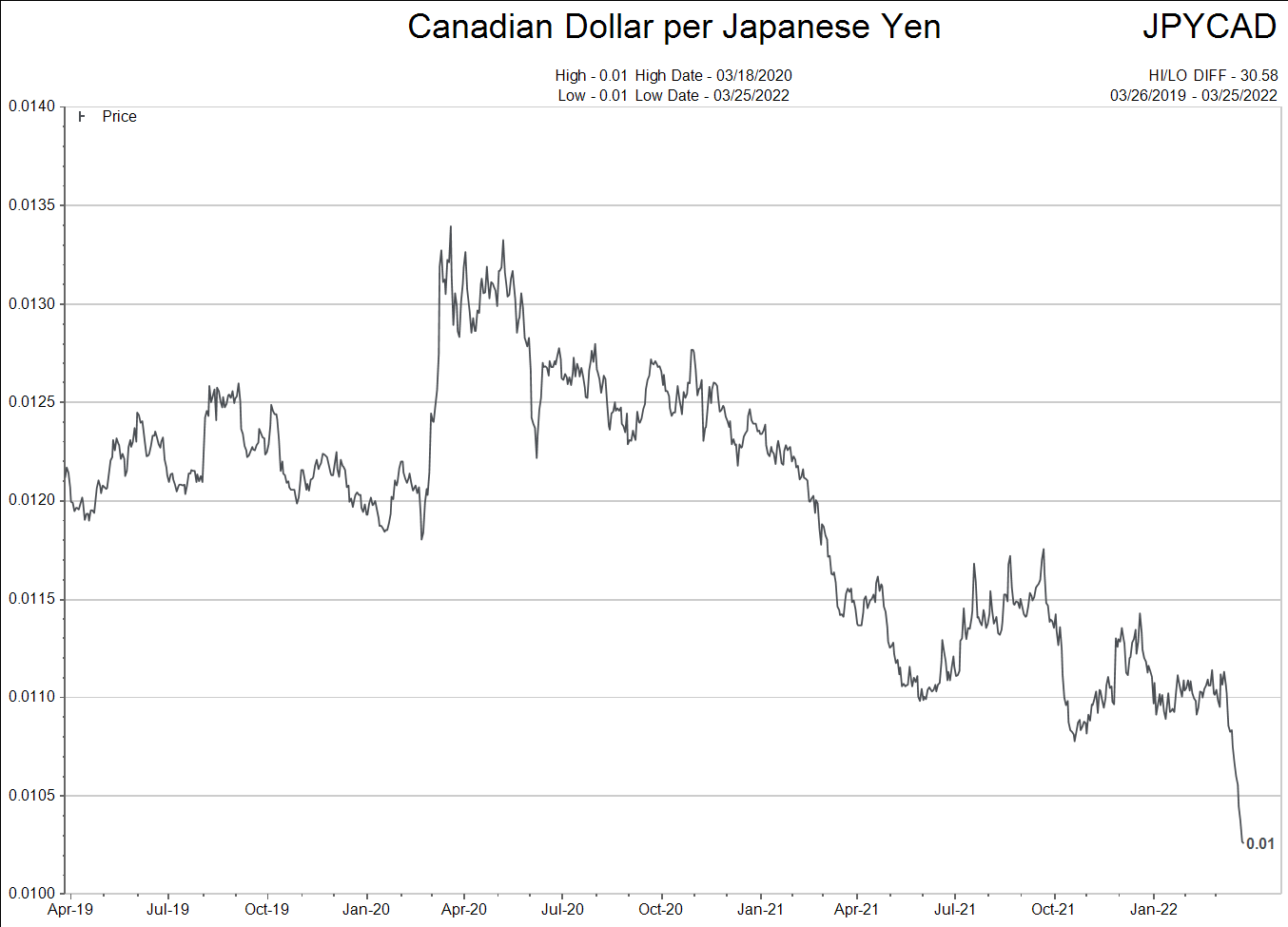

Japan has long been the canary in the coal mine in terms of extreme monetary policy. Japanese levels of debt and deficits make all the rest of the central banks look like rookies and babes in the woods.

Something different is happening with the Yen.

Japan is now attracting even greater amounts of inflation than the US or Canada with their declining currency. But interest rates are still at the zero bound. The Bank of Japan owns about 72% of all the outstanding government bonds via Quantitative Easing purchases over the years and committed to buying UNLIMITED amounts more to keep the 10 year interest rate at 0.25% over the past weekend. Interest rates cannot adjust easily if the Bank of Japan keeps buying the supply.

Therefore, it stands to reason that the Japanese Yen is getting devalued.

What is happening in Japan may be a preview to what is coming to North America? I watch the situation closely.

All I am asking is to stay open to all possible future outcomes. Don’t listen to somebody who tells you they know what is coming. Nobody knows….

It is said that “change comes slowly, then suddenly. “

Globalization seemed like the path the world would choose for decades into the future…and then it stopped and reversed in a two year period starting with the COVID recession.

Are interest rates making a similar long-term trend change? We’ll see.