The “Opportunity” to Come

There are a lot of difficult investment correlations that stare back at investors trying to make long term capital commitments at this time.

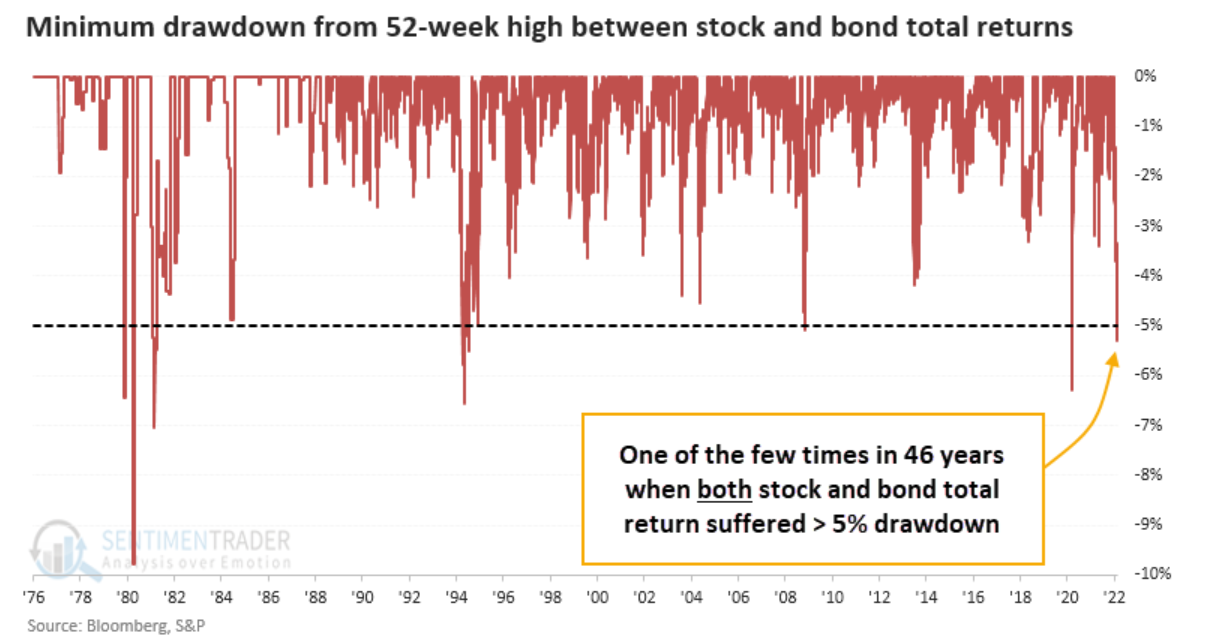

The chart below makes the case that portfolios have had few places to take refuge in the last 3-6 months.

The challenges markets face at the moment are a byproduct of ridiculous monetary policies and political leaders that never had the courage to rein in liquidity infused “prosperity.”

I can’t sugarcoat that reality in any way for you….I just can’t.

Many have financially benefited from these policy choices. A far larger number of people have not! So now comes the time when we basically reap what we have sown collectively.

But this is where my writings begin to align themselves with my BULLISH colleagues in the investment-sphere.

Let me start with the punchline and I will add a little colour below:

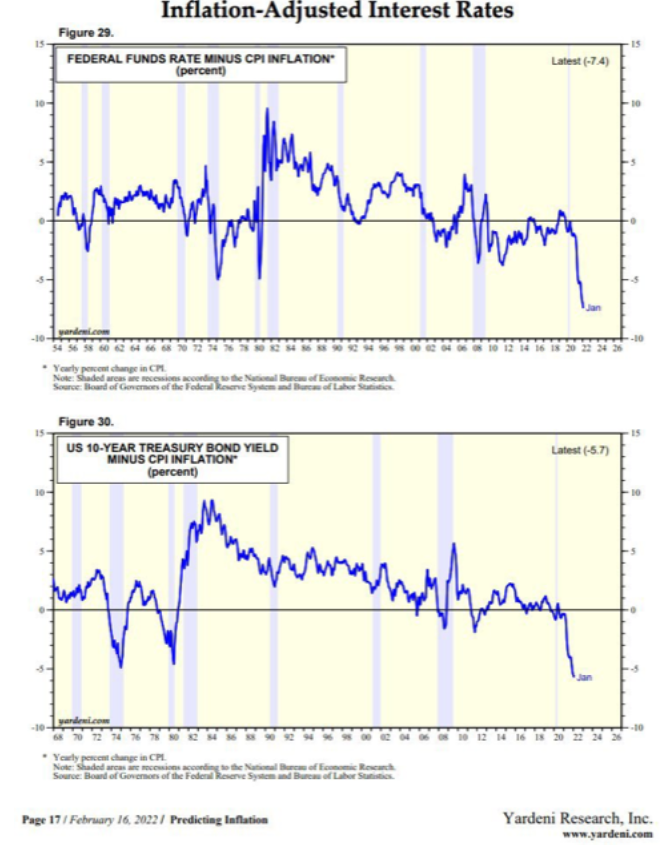

The central bankers around the world are going to panic again LONG BEFORE they raise interest rates remotely close to the inflation rates. This implies that they will not get more than a couple of interest rate increases on the books before asset prices wobble enough to send them back to their old bag of tricks to print more money and lower interest rates again.

Can you imagine a way the blue line on the chart above rises back to the zero line without a painful recession? Neither can I.

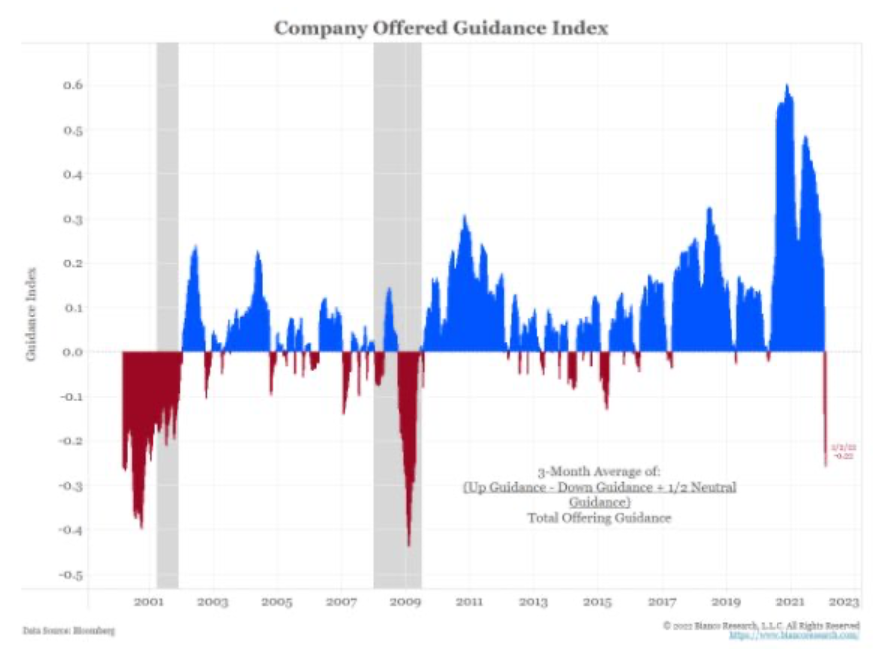

This chart depicts earnings guidance going forward. The minimally tighter monetary conditions, coupled with raw material costs and wage increases, are already creating recession like forecasts.

I could roll out another 5-8 charts making this point. It is more important to consider the investment related tactical implications of what this implies.

What I have been projecting to be a longer term deeper BEAR market now appears to be morphing into another of the typical sharp decline that has another near vertical run to new highs AFTER the central banks capitulate.

None of this shift implies you should not heed the advice of the past few months that focuses on “know what you own.”

It does imply that portfolios that have shifted tactically to a higher cash position should be ready to deploy cash once the central banks capitulate. (Print money and lower interest rates).

The market challenges are likely to continue into the early summer and maybe the fall. It would not surprise me if “the dip” takes the indexes down 30% peak to trough.

But the opportunity resides in having some cash set aside to take advantage of the central bank pivot on the other side of the BEAR market.

One final thought:

It saddens me that the central banks are most likely going to do the same thing they always do. As said at the beginning of the editorial, some have benefited from financially repressive policies. But the majority have not….

It is definitely time to ask yourself: Do I ride through the dip or do I take some money out of the markets and build my cash reserves?

Feel free to call if you want to chat about this.