Slow and Steady Wins the Race

The first week of December I watched a short video entitled “If Your Capital Market Assumptions have Changed, Why hasn’t your Portfolio?” (Robert Wilson, Picton Mahoney Asset Mgmt.).

The video was ok but it was what it got me thinking about in broad terms that I am writing about today.

The opening graphic aptly describes what we have witnessed in the capital markets in recent memory. Asset prices have reflected herd mentality and a basic set of assumptions about the future.

Those assumptions are changing but investors want to go back to the same investments/speculations that worked under the old narrative.

Let’s look at a few charts to see how far reality has moved away from the old narrative of:

- Money printing does not cause “bad” inflation.

- Growth stocks ALWAYS outperform value.

- Interest rates HAVE to stay low because there is so much debt outstanding and central bankers would not let anything go wrong.

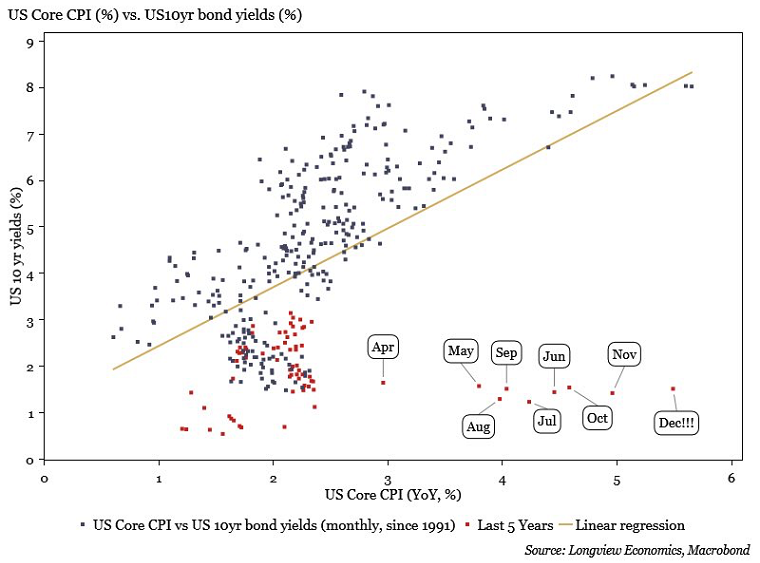

The first chart is the most important chart of the editorial.

What you are looking at is the US core consumer price inflation relative to the yield on the 10 year US Treasury bond. The red dots represent the last 5 years of data.

See how the majority of the blue dots are situated either along or slightly above the regression line. The line is drawn approximately 1.5% above the inflation rate. In other words, historically investors have demanded to receive about 1.5% above inflation on their government bond holdings in the USA.

Now let’s focus on the past 5 years shown in red dots. Notice they are all below the line. And also notice the red dots labeled with dates are FAR below the line. As inflation surges, 10 year Treasury investors normally would require a higher rate premium above inflation (dot above the line) not lower.

All of that has happened because of central bank intervention via Quantitative Easing on steroids. It was fun while it lasted for asset prices. But the reality is the only way to fight inflation is for the red dots to rise back above the regression line.

So here is the question: How can the red dots find their way back up to the regression line?

There are two ways that can happen:

- Inflation goes down

- Interest rates go up

There is one more problem I should point out. Low interest rates with too much money supply “encourage” inflation. Therefore, on its own, inflation will not go down. That only leaves us with interest rates going up to quell inflation.

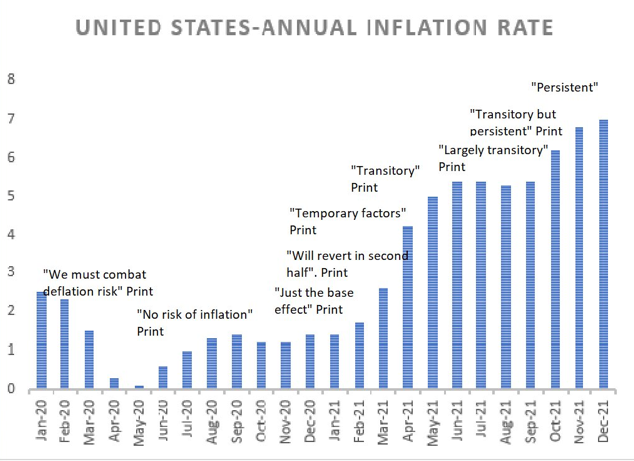

The longer central banks ignore the problem, the larger the problem becomes. Below shows the US inflation rate with the Fed’s attitude towards it added at the top of each month.

These few paragraphs make up the crux of what our investment thesis will be required to assimilate in the next few years.

The application of the math above is relatively straightforward to.

For the poor, nothing changes…life stays a struggle. Unfortunately, unchecked inflation increases the burden on the poor.

For retirees and those on fixed incomes, the challenge remains about maintaining a standard of living in a rising cost environment. Interest rates will go up allowing for term deposits to pay more but until the dots on the chart above get above the regression line that income stream is losing purchasing power to inflation.

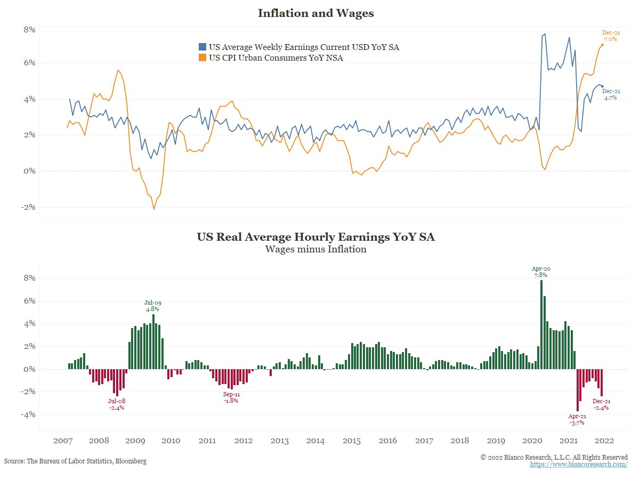

For middle class workers the future is brighter. Workers are now finding themselves with power to fight for higher wages. The chart below that, so far, workers have not been able increase wages as fast as inflation but that will likely change.

For the comfortably wealthy (which is our typical client) the objective is to invest capital in areas that provide inflation protection as far as possible.

Wealth protection during inflationary periods is easier said than done. The central bank battle to fight inflation is, by extension of policy, a battle against asset prices in general.

This brings me back full circle to the short video I watched in December, “If Your Capital Market Assumptions have Changed, Why hasn’t your Portfolio?” (Robert Wilson, Picton Mahoney Asset Mgmt.).

The first step is to acknowledge that market conditions have changed. Then we adapt to the changing conditions.

If I had to make one guess about how investing is changing before our eyes it would be that many of the leveraged, speculative ideas that have been so crazy during this Fed-debt infused cycle will not be the answer going forward.

Quality, dividend paying, value oriented ideas will outperform crazy as interest rates move higher. Slow and steady wins the race.

Two final charts to finish this weekly.

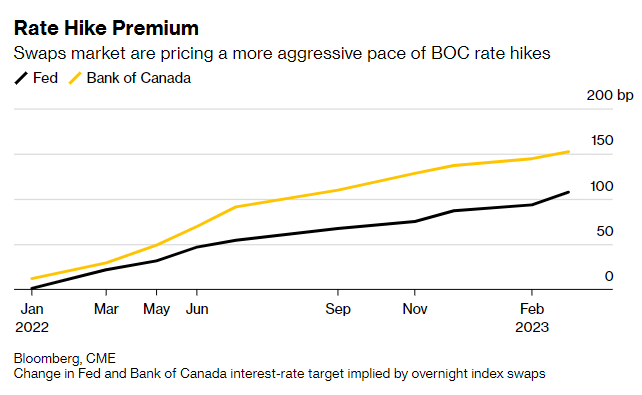

The first shows how interest rate speculators are positioning their bets on how much interest rates will rise in the US and Canada in the next 14 months.

If you are planning to borrow money to purchase investments in stocks or real estate please budget about 1.5% higher than the present interest rate you are paying on your floating debt in a year’s time.

The second is a bit of perspective to just how much the pricing for asset classes has shifted since the end of the March 2020 stock crash.

The blue line represents the flagship, meme-tech exchange traded fund ARK Innovation’s price and the red line represents the US oil index exchange traded fund.

As you can see, investors in meme-tech outperformed value investors by a large margin up until February 2021. Since then, the tables have turned and now investors in oil have outperformed.

Not what you think when you read most newsletters.

Have a good week, Nick