Triannual Report: 2021 #2

“Unwinding the COVID Support”

Don’t it always seem to go?

That you don’t know what you’ve got ‘til it’s gone.

They paved paradise and put up a parking lot…

Lyrics from Big Yellow Taxi by Joni Mitchell

If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?

Lewis Carroll, Alice in Wonderland/Through the Looking Glass.

Executive Summary:

Generally, asset markets continued higher since the end of April when the last Triannual Review was written.

There was some rotation between sectors, but a rising tide lifted all boats (assets) for the most part.

Inflation ran hot for rents, food, vehicles, housing costs and the vast majority of everyday items, and supply bottlenecks remained a challenge for the economy too.

Client portfolio weightings tend not to shift much over the summer. Additional funds were put to work in a staggered fashion as they came free from cash positions or sales of other assets…mostly real estate sales.

In summary, the rip higher in asset valuations marches on.

Everything is expensive and getting more so. The trend forward is dependent upon interest rates staying near zero percent no matter how much inflation comes our way.

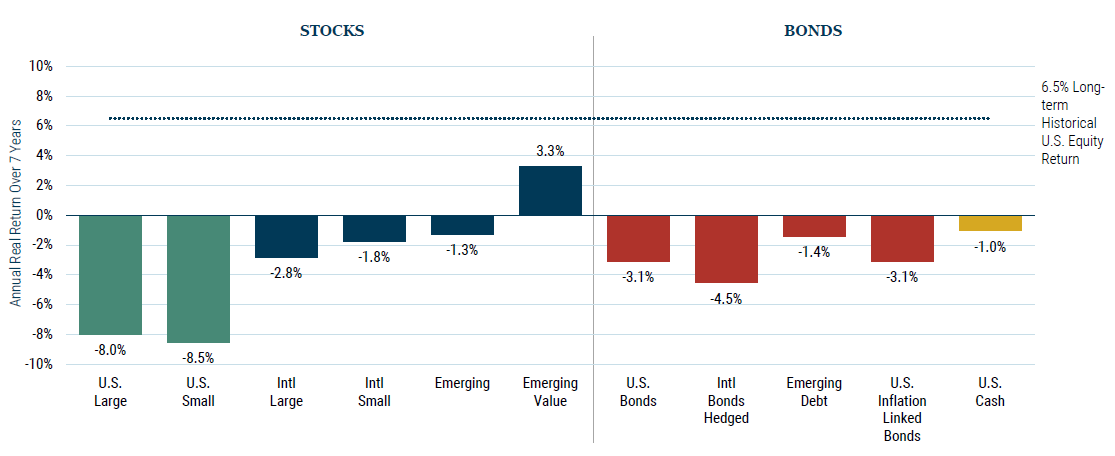

The June 30, 2021, update of GMO’s seven year forward rate of return expectations below highlights the value/price problem for a broad range of asset classes.

One would have a tough time predicting the present day interest rate policy given the asset valuations based on historical central bank activity.

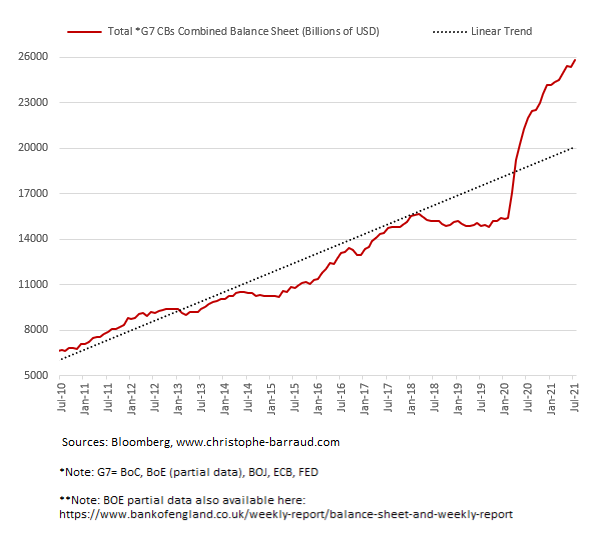

The central banks would normally have already started to raise interest rates to cool an overheating asset economy. At present, they are still pouring the same amount of stimulus into the markets that they were in April/May of 2020 when the world was all but shut down.

Perspective: The US spent about $2 trillion on the War in Afghanistan over 20 years. The Fed has minted $4 trillion to buy assets in 20 months. That is $875,000,000 every hour since March 2020. That does NOT include government deficit spending and infrastructure bills – Michael Hartnett, Bank of America.

Hence, the Mad Hatter quote from Alice in Wonderland becomes relevant.

This is the central banker’s world and they have chosen a different path from the historical norm that doesn’t make sense in light of history.

As we proceed to the final trimester of 2021 three questions stand out as important to consider:

- Will interest rates continue to ignore inflation and stay low?

- Is there a central bank “tapering of balance sheets” in our future?

- Could the global economy be headed back towards a stagflation-like phase?

More on these questions below.

In summary, the second trimester of 2021, was a continuation of the market trends that morphed out of the global response to the COVID crisis. There is lots of talk of a new direction for interest rates and monetary policy in response to high asset prices and renewed inflation, but there has been no action so far.

The balance of this report will explore the three questions mentioned in the Executive Summary.

If I had to choose only one data point to focus on in the final trimester of 2021, it would be the direction of interest rates.

A move higher in interest rates is inevitable. How long it takes to develop remains to be seen?

How We Got Here:

The following summary has been included in these triannual outlooks since 2016. It is added to as things develop:

- “Great Mistake” – Central banks letting Quantitative Easing (QE) run for more than a year back in 2010.

- Ten Years Later – The slow pace of raising interest rates continued. Central banks never took back the “great mistake” for fear of stalling asset price increases, but in the final quarter of 2018 stocks declined anyway: real estate stalled too.

- The Panic of 2019 – No it wasn’t investors that panicked…it was the central banks. The Bank of Japan, European Central Bank, and the US Federal Reserve all pivoted from tightening monetary conditions back to loosening them.

- “Hotel California Economy” – The pathways to interest rate normalization are nowhere to be seen. In 2019 investors around the world scrambled to try and lock in yield on investments. As the old Eagles song hauntingly informed us…You can check out anytime you like, but you can never leave. The highly indebted, low interest rate world was baptized into permanence.

- Asset inflation without growth – Resistance is futile, looking into 2020 lower asset prices are not considered an acceptable outcome. Any and all means necessary to inflate asset prices will be employed. If that means printing hundreds of billions of dollars every month to create liquidity…so be it.

- “Bonfire of the Vanities” – the hundreds of billions of dollars printed in the pre-pandemic world became trillions after March 2020. No amount of monetary stimulus is viewed as too much. There are no goal posts measuring whether more is necessary in terms of amounts or results. “More stimulus is necessary” exists as its own reality now.

- But will interest rates co-operate and stay low? Will the inflation wave that is expanding its borders to more and more asset classes keep investors in the frame of mind to hold on to their bond positions? If not, who buys all the bonds and where does the money come from to make the purchases?

Questions One & Two

Will Interest Rates Co-operate and Stay Low?

Is there a central bank “tapering of balance sheets” in our future?

The “how we got here” section above of the Triannual Report remains unchanged from four-months-ago. That is because the end question has not changed: Will interest rates co-operate and stay low?

So far, the answer is yes.

What has changed, is the tone of the central banking community in their jawboning of expectations.

The gentle nudges towards expectations of less accommodative monetary policy and higher interest rates continues to ratchet higher as central bankers give their near daily speeches.

These warnings have been largely by ignored by investors since they have been conditioned to believe central banks only threaten action and never take it.

That sentence summarized the moral hazard our global monetary leaders have painted themselves into a corner with.

By always supporting asset prices with massive injections of liquidity they have been seen to be toothless wolves.

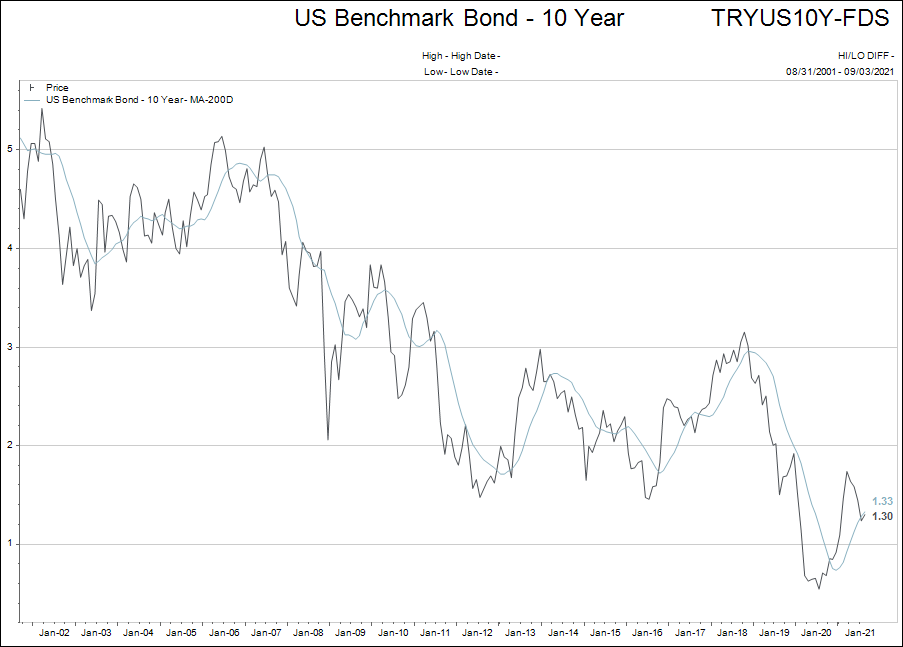

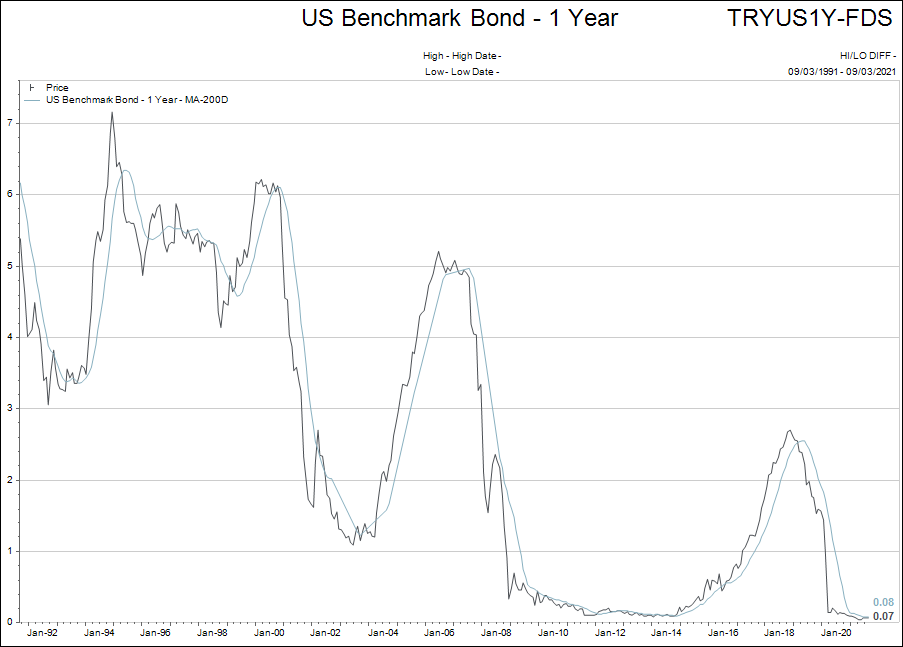

Consider the yield on the US 1-year Treasury bond.

It has barely budged from the zero-bound, even with inflation running hot for more than a year.

The 30-year chart of the 1-year US Treasury bond yield above shows how the coming “tapering of asset purchases,” by the US Federal Reserve will be the fourth attempt to normalize interest rates in that time frame.

In the previous three attempts, the Fed raised interest rates up to seven per cent by 1996, five per cent by 2007, and 2.8 per cent by 2018. How high will the Fed raise interest rates this cycle before they crush asset prices again?

Based on the balance sheets of the global central banks and the debt levels sprayed about in the corporate and private sectors, my guess is the Fed will be lucky to raise interest rates back to the 0.75% level.

Something has to happen; inflation is becoming more entrenched.

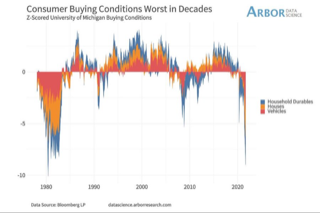

The chart below shows how the super-charged policies after March 2020, and supply chain disruptions, have resulted in the worst buying conditions for cars, food, stocks and real estate since the 1980s.

Take a moment to think about what the chart above is saying.

The blue bars are household durable items, the yellow is housing and the red bar graphs vehicle prices. Each bar is composed by computing a “relative cost” for each category inputting price and prevailing interest rates.

Go back to 1980. Interest rates for borrowing were in the 20 per cent range…and prices were relatively expensive too. The spike higher during that time period is easier to rationalize.

But 2021, has virtually no prevailing interest rate component to the calculation. The entire spike higher is due to rising prices!

That is a stunning fact.

It also makes for far more challenging conditions to manage an asset bust under since interest rates cannot be lowered to stimulate demand.

Therefore, investment common knowledge today says:

- Interest rates can never go up again.

- The central banks will never let interest rates stay up if a rise in rates were to happen.

Both of these points are mired in FOMO and TINA.

FOMO is an acronym for fear of missing out and TINA is there is no alternative (to owning stocks or real estate when interest rates are so low).

Central banks are the creators and owners of investor psychology. Their legacy requires the continuation of these narratives.

They have conditioned investors to ignore historical data and signals to de-risk by rescuing asset prices from their natural ebbs and flows.

As an analogy, they have become the parent of the child who never experienced any pain or suffering during their formative years and, now that the child has grown to become a young adult, they have few skills to navigate the coming rising interest rate cycle.

Central banks will be walking a fine line in coming quarters to try and encourage their child—with minimal coping skills—to not be over-burdened with a new challenging reality.

Shifting gears, let’s explore an important question: What might markets look like on the way to a meaningful rise in interest rates?

From the perspective of the central banks, the blueprint for a transition to higher interests is a two-step process.

- It begins with a tapering of balance sheets.

- Once tapering completes, the actual raising of interest rates can begin.

Before we move forward, let’s define what tapering means.

Tapering is a term used to describe the process of gradually stopping asset purchases when there is no predefined end date or amount.

Tapering does not involve the outright sale of Treasuries or agency MBS by the Fed, it only means reducing purchases to zero.

It is important to see that tapering is the process of ceasing support, not actually taking away the stimulus pool.

Even though the talk of tapering has ratcheted up, the action of tapering is still not in play. My expectation is for a tapering announcement, followed by central bank action to actually REDUCE the amount of stimulus, to come in September/October 2021.

From the perspective of financial markets and consumers, a transition to higher interest rates might feel more like a pause in rising asset prices. Investors will see more price volatility on a daily basis which will likely lead to even less trading volume for both stocks and real estate.

A more balanced, wait and see-type attitude will begin to take hold during the last four months of 2021.

This brings me to the third question left to be discussed from the Executive Summary section.

Question Three:

Could the global economy be headed back towards a stagflation-like phase?

During the inflationary markup phase of the market cycle the world has been experiencing since the Great Financial Crisis in 2008, there has been a panic to own assets.

The natural end of that cycle was ready to evolve as the COVID lockdowns took hold in March 2020, but central banks decided to re-ignite the inflationary cycle with their massive monetary injections.

Asset prices re-accelerated further away from economic fundamentals and wage growth.

Once the asset acceleration train left the station, it was a 12 month long dogpile in the asset markets.

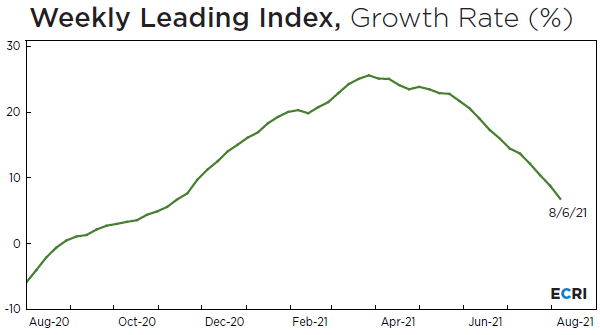

Growth peaked in May 2021. Asset prices have continued higher but in a less broadly based fashion. (Chart h/t ECRI Institute)

The concept of trying to reign in stimulus is once again on the table.

The potential for a stagflationary future is plausible and growing. Here are the ingredients that would fuel such a future:

- The start of central bank tapering and reduction in liquidity

- A continued bottleneck in supply chains

- Government infrastructure spending that cares not for costs to complete continuing to suck up limited supply chains

- Higher interest costs due to higher interest rates

As I read over the list above, all of those things could easily happen in the next trimester.

We will keep an eye on this list in coming months.

Summary

“An investor’s four biggest enemies are hope, greed, fear and vanity” – Reminiscences of a Stock Operator (Edwin Lefevre)

If you have never read the above noted book, you are missing out on a great opportunity to learn from another’s mistakes; email me for a link if you’re interested.

Jesse Livermore (Edwin Lefevre) shares in detail what is was like to make and lose multiple fortunes almost 100-years-ago in its pages.

These enemies are alive and well in our world today.

There is never going to be a perfect time for the central banks to begin taking away the punch bowl of stimulus. Never.

The time to begin is coming up in the next four months…and I believe likely in the next two months.

How financial markets decide to react to this uncaring mood from the central bank sugar daddy, that has been so quick to supply all of our liquidity needs and wants, remains to be seen.

If this publication gives you a feeling that you would like to speak with me, please touch base and we can chat.

To end this report, there is another essay I’d like to share. It has no bearing to the financial markets directly, yet, I found it profoundly important to anchoring my mindset to write this report.

Here is a quote from the essay:

“Turning everything into a soulless data point masks the immense losses our country has been dealing with, from things that we can’t, or don’t measure. Like community, family, and faith. Being physically and intellectually cloistered has allowed us to ignore the ugly secondary and tertiary consequences of the policies we advocate for.”

I read those words a few times and considered how many facets of life have shifted in this way…especially since March 2020. Let me know if you’d like me to forward that link as well.

Thanks again for your trust and readership.