With a present value a little more than 4,000, could the S&P 500 rally to 14,000?

Sometimes you stumble into a conversation that you have no right being a part of. One of those experiences happened to me a week ago and it's had a profound impacted.

The conversation was at our golf club. It was between a group of young men in their 20s talking about their financial situations. One of them called me over and asked a question about interest rates. I hung around to hear where this fascinating line of thinking was going to take the group.

The theme of the conversation centered around borrowing as much money as possible, as often as possible, and buying as many assets as possible. The key was never to sell anything unless you were buying bigger and better.

It is not hard to understand why they feel this makes sense when you think of the financial world they have grown up in since the Great Financial Crisis (GFC) in 2009.

Remember, these young men would have been in their late teens at that time. The only financial reality they have known is that asset prices always go higher.

Central banks have ushered in this reality by printing money out of thin air to buy assets the rest of us have to work for.

If asset prices decline, the central banks flood the financial system with newly minted money to salvage asset prices.

The entire cycle reminds me of a Martingale System of betting.

In a nutshell, Martingale betting requires the player to double the size of the bet in a 50/50 odds game. This is often played as “double or nothing," so if you bet $10 the first hand and lose, you bet $20 the second. If you win the second hand you win a net of $10.00, the same you would have won if the first bet had succeeded.

If you lose the second bet the third bet would have to be $40.00. Again, if you lost the first two bets and won the third bet, your profit would still be $10.00 (and so on). To be successful at a Martingale bet you only have to have enough money to keep betting double or nothing until the 50/50 bet goes in your favour.

In many ways, the Martingale betting system psychology outlines the structure of the central banks “strategy” in dealing with each financial crisis since 1987.

Central banks must realize where they are positioned within the financial system at this moment in time. Especially since the global flood of liquidity since March 2020.

The sheer magnitude of the total debts outstanding is mind blowing; the rate of change is exponential and there is no end in sight from my perch.

Let’s take this backdrop to the financial markets.

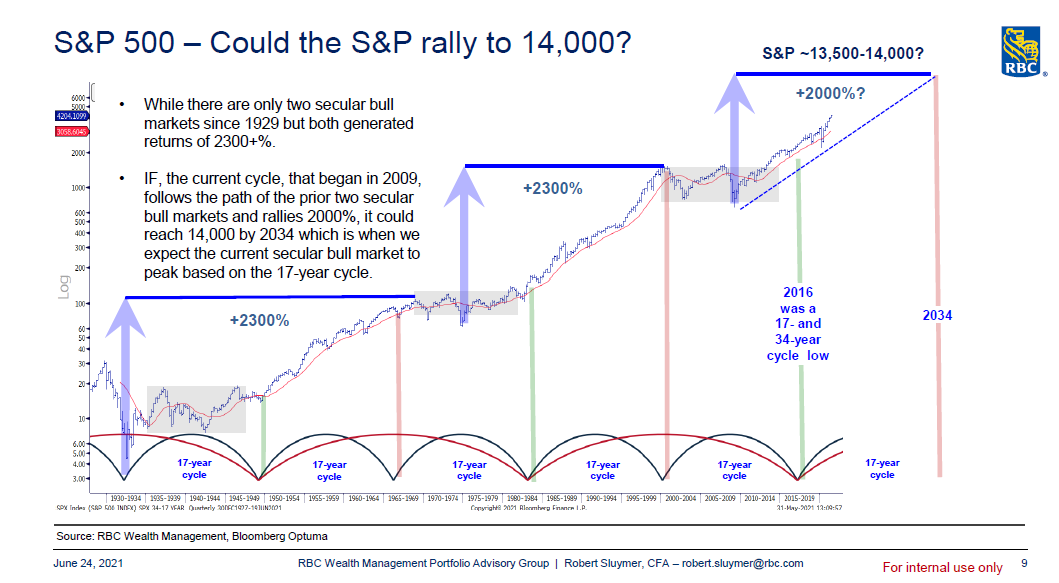

The following slide, shared here with permission from RBC Wealth Management Portfolio Advisory Group Robert Sluymer, was used in a presentation done in mid-June.

Let’s consider both the financial market and real life conditions such a result would imply.

To begin with, the chart uses a simple 17 year cycle calculation and assumes rather symmetrical returns. The rate of return implied by the move in the S&P 500 to the 14,000 level is approximately 9% per year. With dividends added the return is nearly 11% combined. Good returns, but not an unrealistic forecast.

What is a challenge for this forecast is that it uses a world of near zero interest rates with significant valuation concerns as its starting point.

With interest rates at mathematical lows and asset valuations at all-time highs, a compounding rate of return of 9%, which is well ahead of GDP growth, requires even further valuation stretches to be realized.

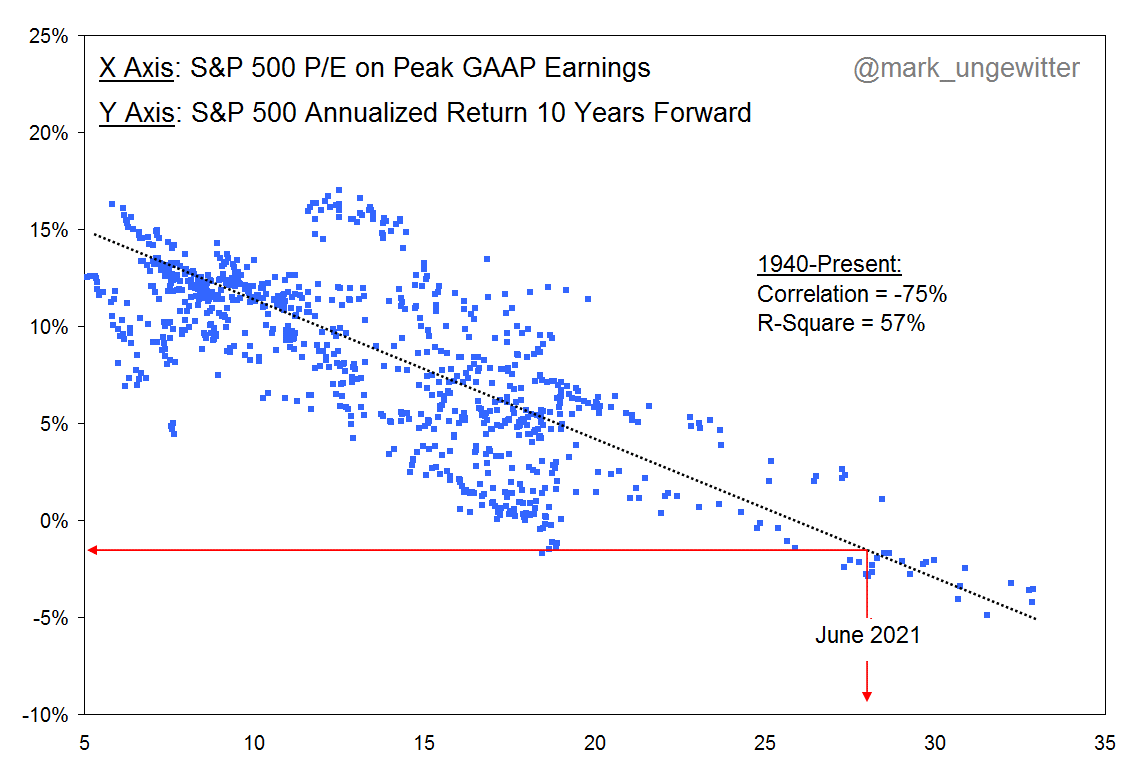

Based upon economic fundamentals, a 9%+ rate of return requires a further move of the blue dots to the lower, right hand corner on the chart above.

In reality, the forecast requires further currency erosion to take place.

That is why the beginning of the editorial spends as much time looking at HOW the financial world has gotten to the present condition as much as it considers WHERE it is.

The key to remember is that IF the chart above is to be a correct forecast for stock prices then a number of other assumptions follow:

- House prices should also quadruple from present valuations.

- Food prices should quintuple from present valuations.

- Minimum wage should be in the $60/hour in this time frame.

These things might happen. I certainly not saying they cannot, but imagine what the world will be like on the road to such results?

That is likely enough said on this topic. If you have any questions, please feel free to email me and we can connect.