Semi-Annual State of the Nation Summary

Each June and December, I do a top-down overview of, well, a bunch of things.

A wise, long retired, advisor, was the person who got me on to this habit and his rationale was to distance your thoughts from the day-to-day and week-to-week and look at the year-to-year themes to stay grounded.

It is not something I typically write about directly, but this time the themes seemed so diametrically opposed to what I am watching happen on the shorter term time scales, I decided to share it.

The comment breaks into two sections: The Markets and Value(s)

The Markets

When viewed from a year-to-year perspective, nothing is cheap and speculation is running rampant.

The eight charts below summarize a number of technical correlations for the S&P 500. Many are at all-time high valuations.

Without listing again a bunch of commodity indexes, it is common knowledge that lumber, agricultural and metals are at all-time highs as well.

Global real estate prices are at all-time highs.

Year over year increases of 25%, or more, are common throughout the world. Some signs of moderation are appearing but nothing concrete enough to signal a top in the market.

To keep this brief, let me summarize the notes I wrote for myself in a series of questions for you to consider.

- What would I feel good about buying with available cash in June 2021?

- What should I think about selling?

- How much “liquidity” is in the financial markets?

- Is liquidity increasing or decreasing?

- Are investors fearful or overconfident at this moment?

After considering these questions I always go back to review my personal investment holdings and client portfolios.

Do I need to adjust the asset mix of the portfolios I manage higher or lower in risk exposure?

My answer: not quite yet.

Markets can stay overvalued for a long time. The present time is a perfect example. Yet, this semi-annual market review has me watching for a trigger.

Triggers for a market revaluations tend not to come out of the blue. Especially after a long running BULL market.

Long term BULL markets usually end when the valuation gets high enough that the present state of liquidity is not sufficient to support the market capitalization any longer.

Therefore, I am looking for a trigger that lowers liquidity.

Central bankers are the originating source of liquidity. Their actions create conditions for banks and shadow banks to further multiply the monetary base via loan creation.

The world has been awash in record amounts of liquidity for the past 13 months, but central banks are stepping back from this position.

Liquidity MIGHT have already peaked for the cycle. Higher inflation and the subsequent rise in interest rates would be the easiest way to stay on top of the state of liquidity.

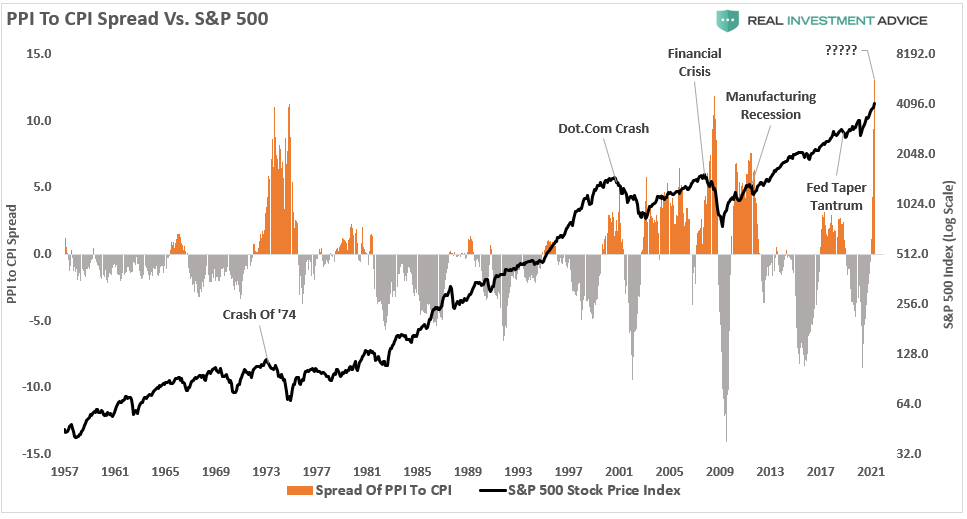

The chart below shows the rate of change for inflation in the gold bar chart lines against the S&P 500.

Hmmm? Best to keep watching closely!

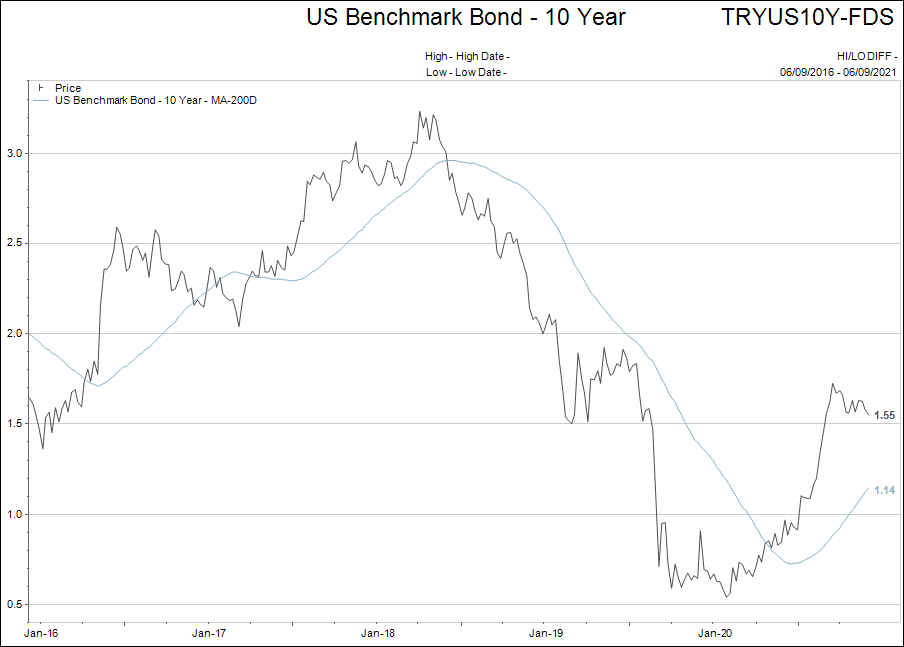

So far, the interest rate charts do not share the concern that inflation is going to stick around.

This thought concluded my analysis of the markets for June 2021. Now you know what I am watching for in coming months as well.

The next section is a personal perspective I write about each time I do a semi-annual review. Just a heads up, it is not investment related. I share it with you as it might help to make sense out of the crazy world we find ourselves in today.

Value(s)

The title of the weekly comment is borrowed from the former Canadian and Bank of England Governor, Mark Carney’s new book; Value(s). I have not read the book yet. It is next on my summer list of reading, but I did read the synopsis.

Mr. Carney is weighing in on the debate of value (price) relative to value(s) what we cherish and hold sacred. From the synopsis, he applies the debate to the environmental, generational and, of course, monetary dilemmas of the present age.

Many of you know me well enough to understand that the debate around value(s) is a cornerstone of my life and one of the most important reasons why I continue to work as an investment advisor for RBC Dominion Securities.

From the perspective of the financial markets, I continue to ask the question: “How does one calculate the value (price) of things when the units of valuation are electronically created out of thin air, which in turn, erode the value(s) of society?”

From a human life perspective my question shifts to: “How does society stay true to its core values when fiat denominated price runs amok?”

The past 20 years of debt growth has unequivocally favoured the “haves over the have nots.” But a strange thing has happened to those who fall into the medium and lower echelons of the “have” category. Even people in these categories now feel they need more to be happy.

The Psychology of Money with Morgan Housel podcast (Hat-tip to Kevin S. for the suggestion, please email me for the link if you're interested) is worth a listen.

It highlights some of the ways social media and asset price expansion have impacted the values (both price and human) of society. In a summary statement it proposes that the more we have as a society, the more we want.

There is always someone with more to compare ourselves to IF we are using the yardsticks of wealth and material possessions. The podcast submits it is incumbent upon us to guard our attitude towards wealth and make sure it lines up with our personal beliefs.

The last resource I will use for reference is an editorial I stumbled upon speaking to the question of how entrenched is Modern Monetary Theory (MMT) in the present central banking toolkit?

The die is cast and central banks are committed to a MMT trajectory for the long term future.

If these topics interest you please take the time to broaden your research exposure to the themes I will touch on below. The following is more my personal beliefs in an arena of thought that must be personalized to each individual.

After doing my research, here are a few questions I asked myself: (Least in-depth to most).

- If you had to choose either “stuff” or “experiences,” which would you choose?

This is a defining question. The answer will lie in how much you care about how others view you and your achievements. If you seek the approval of others or are conscious of “keeping up with the Jones’s” then you will tend towards stuff. If you have the “surfer/free spirit” bias, experiences will dominate your choice list.

- What are you willing to sacrifice to achieve your life goals?

Somewhere in the process of answering this question you will come to a point of balancing work with the rest of your priorities. I remember when I was in my late 30s I found myself confused and overly committed to too many responsibilities and activities. Something had to change or I was going to explode. I came up with an acronym that ordered my priorities. This is still true for me today!

FFWF – Faith, family, work, fitness.

Committing each day to accomplishing the things on that list in order of importance allows me to keep an even keel by not getting over-burdened or letting the important things slip through the cracks.

- Control of your own schedule.

The harder you drive for monetary success, it holds generally true, the less control you will have of your own schedule.

Peace of mind is often a result of having a high level of control of your daily activities. What are you willing to sacrifice in terms of productivity to have more control over your day?

- How far does your focus expand beyond your personal horizons?

This is the first of the key questions.

Is your focus all upon yourself and your well-being? Does it include your immediate family? Does it go beyond your immediate family to extended family…friends…community causes etc.?

As you consider your answer to this question, ask yourself why you feel the way you do? What are your motives? Then try to build into your daily routine the focus on what really is important to you.

- How much is enough?

The question that resembles the peeling of an onion.

You set targets and goals…once they are achieved they are not enough to satisfy you. Have you ever noticed how much more satisfying the imagination of having or accomplishing something is than the actual fulfillment? For me, it has happened many times over. Accomplished goals that I thought were going to make me happy for a long time only satisfied me for the moment.

Something inside of us is always hungry for more. The human mind is amazing.

To finish, let’s circle around to the Mark Carney title Value(s). Does the price of anything reflect its actual value?

The answer to that question, in my opinion, is yes but it comes with an explanation why it may not seem to be true anymore. Let me explain…

The price a sale is made at is defined as the highest available bid being satisfied by the lowest available offer. When those two numbers are the same for something (candy bar, golf club, car, or house) a transaction takes place between buyer and seller.

When it comes to a candy bar the established range of bids and offers are clustered around a small node. (Say $1.00). Therefore, the transaction price is a near constant, but what about a house?

Let’s imagine there are 30 people wanting to move to Vancouver Island and buy a waterfront house but only five waterfront houses for sale (a year earlier maybe the ratio was 15 people and 15 houses for sale). Look what happens:

The vendors know they own a scarce asset in high demand, so they price the asset higher than what they think the market price actually is. The buyers know they are in a bidding situation so they imagine how much over list they will have to pay to win the bidding war.

In the year-ago, balanced scenario, a well-thought-out asking price might be $1,500,000 and the range of offers clustered near the asking price.

In the present situation a well-thought-out list price might be $1,750,000, but goes on the market at $2,000,000, due to the vendor’s knowledge of scarcity.

Once on the market the buyer’s offers might range from $2,200,000 to $2,800,000, with their knowledge of competition in the bidding war.

See how much wider the bid/ask range becomes in the unbalanced scenario?

The same bid/ask dynamics are still at play, but the unbalance of supply/demand creates a skewed set of “outlier offers” to the upside (note: This works in reverse on the downside too).

The longer supply/demand skew continues, final sale prices push higher in markets (cars, lumber, houses, stocks, etc.) the further from economic reality the final prices drift.

When liquidity is drained from the system and the skew rebalances, the prices will reset closer to economic reality.

At the end of the day, all markets are captive to liquidity and all prices respond to the amount of supply/demand in the system. This is why I always review liquidity in my semi-annual reviews.

So I encourage everyone to stay true to what is important to them and don’t let the value (price) of things you own or want affect your true value(s).

If you have any questions, concerns or feedback on this post, please email me and I’m happy to discuss them with you.