Correction from Earlier Comment

To start this week we need to set the record straight from an error I made in an earlier weekly as to rental costs in the housing market. The summary statement I made was that rental costs were falling while real estate prices boomed.

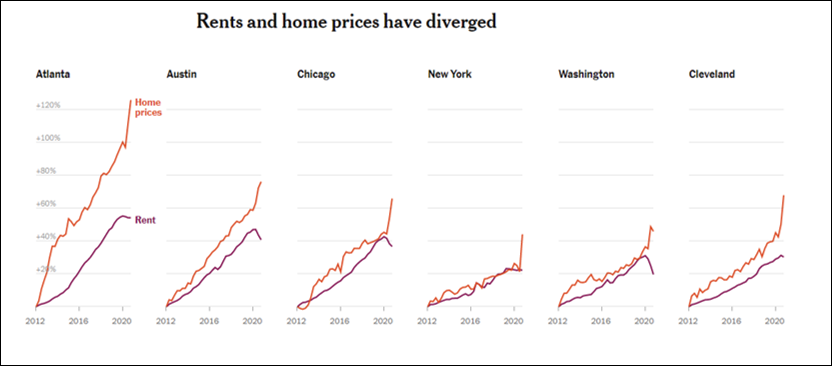

Below is the image I used to justify my point.

The data is correct in the chart above but, as usual, there is more to the story than meets the eye.

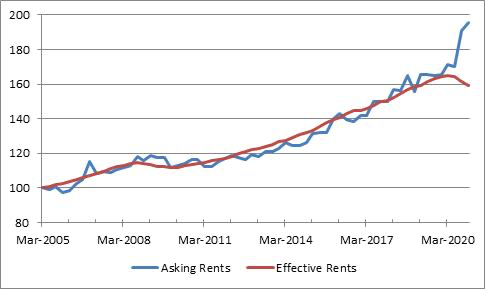

Here is another chart that explains where I went wrong.

Notice how the “asking rents” has actually followed real estate prices while effective rents has rolled over and turned down.

Why is there a difference?

If a landlord is unsure of being able to collect rent, the value used in the effective rent calculation goes in a ZERO.

Clearly, it doesn’t take too many zeros to turn the curve lower, meaning the average rent can decline when the actual amount of rent by those able to pay rent is increasing.

With government controls on eviction notices, there are more people not paying their rents to landlords and these circumstances are recorded as the tenant paying no rent for the official calculation.

Megan called me out on this data point when I first presented it in the weekly comment. She said there is no way rents are actually going down. Turns out she was correct in her boots on the ground assessment.

My apologies for the misleading information earlier…

Interest Rate Update

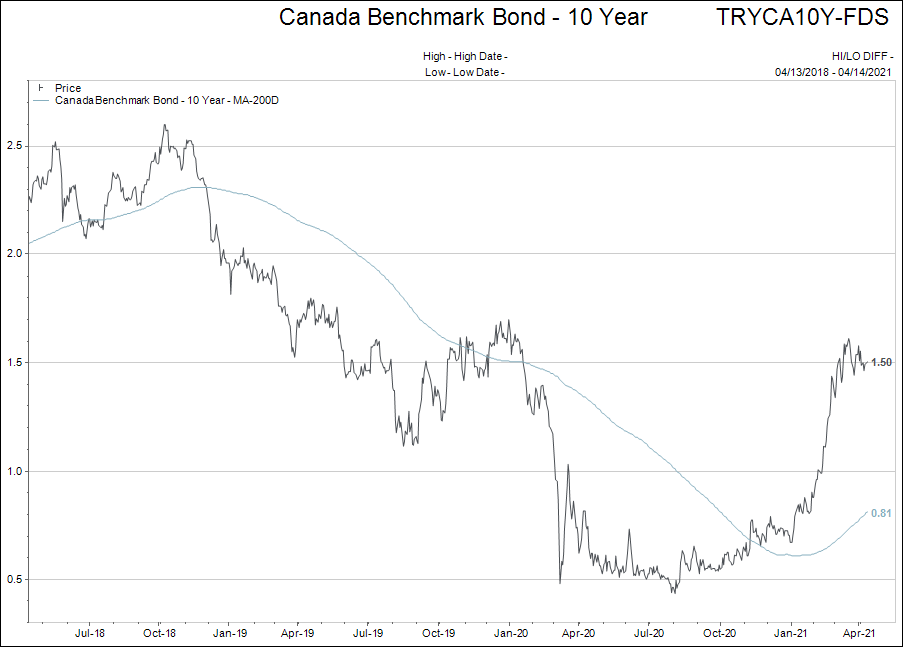

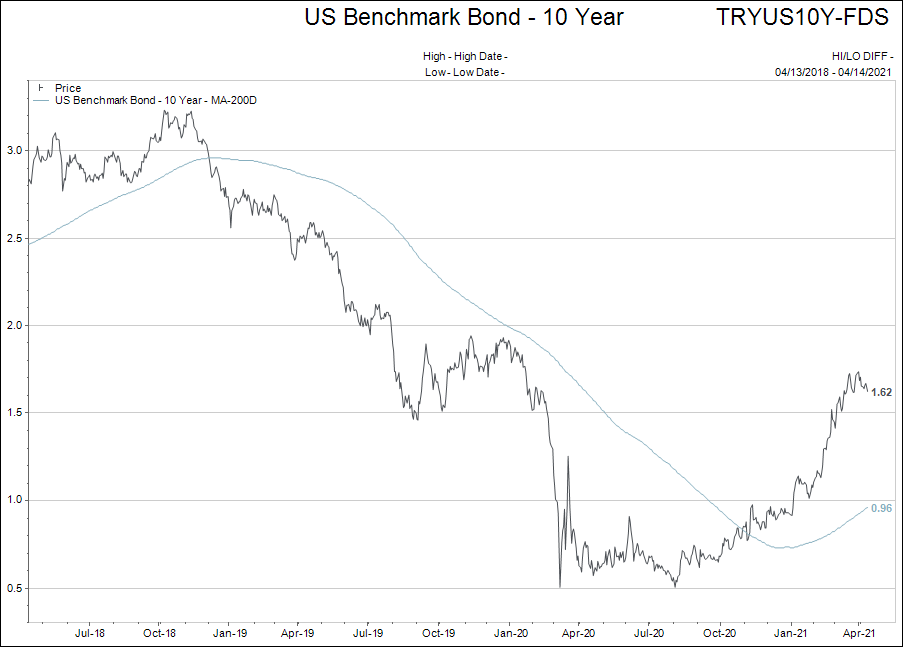

Ten year government bond yields have stopped going higher…even with face-ripping inflation data being printed. Could be connected to the growing number of COVID lockdowns globally and the concern that global demand may be peaking? Could be connected to what I am going to touch on in the next section?

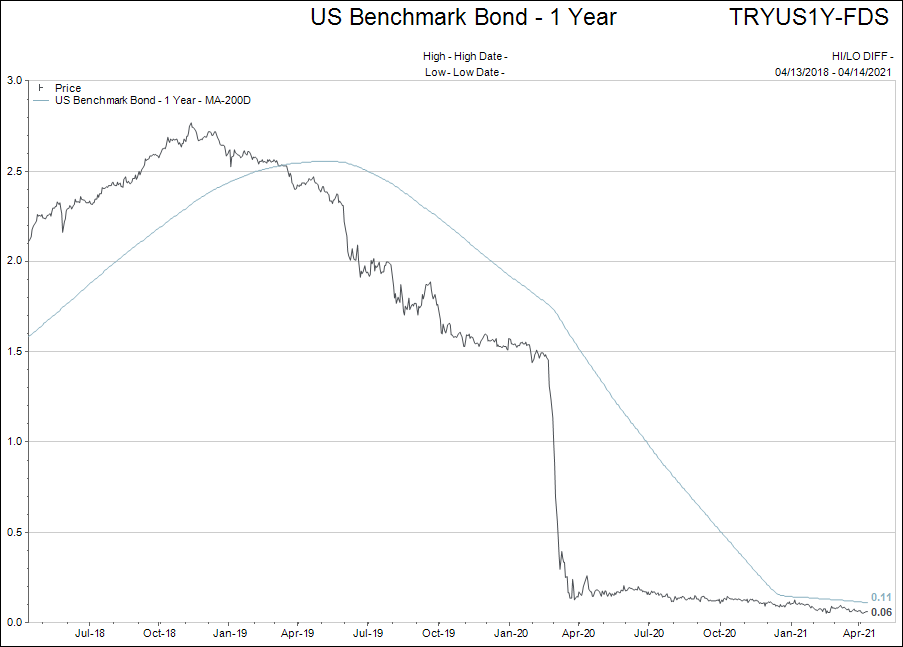

Speaking of lockdowns…the one year US Treasury bond is still glued to the zero percent line. (Below)

Not much more to say here. Warrants keeping an eye on though.

China Credit Risks

To finish off the comment this week, it is time to take you into an under-reported story that is brewing in the Chinese credit markets.

There is nothing new about credit risk in China.

Avenues of support for serial borrowers have been broad reaching and easy to access for years. This support has been done in massive credit impulses and has left large reservoirs of bad credit. These reservoirs exist manly in banks, construction and state enterprises.

There are no easy fixes to these buildups. They are just facts of life in China today.

With that said, our story begins with Huarong Asset Management. (For the background story please click on the hyperlink above. If you are not familiar with this story I recommend you read the hyperlink).

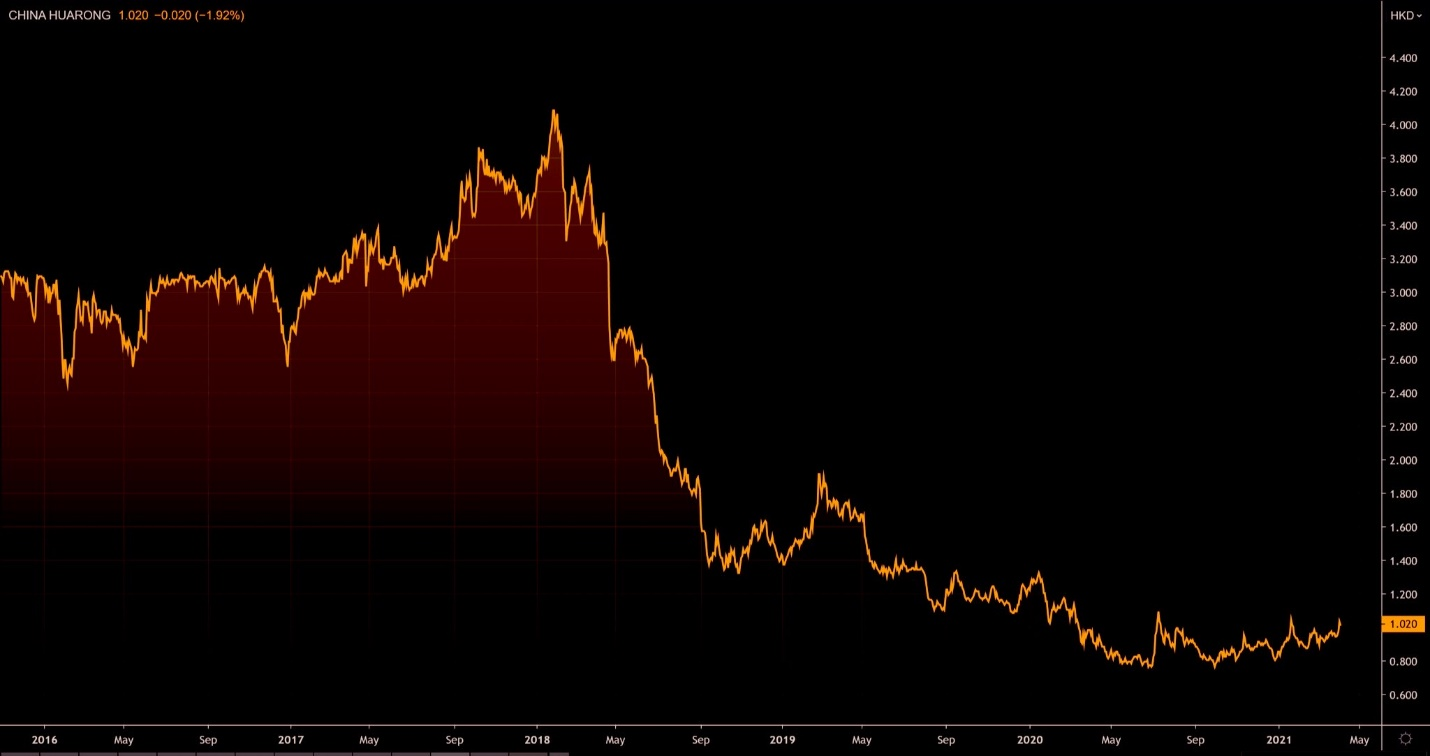

Huarong is an Asset Management Company or an AMC. Their job was to mop up distressed debt that the over-indebted Chinese financial system routinely created and make it look neat and tidy again. But now all of the AMCs in China are in some amounts of difficulty. (Stock price of Huarong).

To be clear, AMCs are in the business of distressed credit management. The problem now is that distressed credit managers are distressed.

Where this problem begins to impact the markets is when the AMCs have to roll over their credit instruments to keep the party going. Bonds issued by AMCs have dropped in value significantly in past weeks and there are large tranches of bonds coming due in the near future. Who is going to buy them and at what price?

There are piles of rumours floating around out there about who owns these bonds presently and what they are actually doing with them. I won’t spread those names around in this publication.

Why I added this to the weekly comment is to help you to see that the present era of ultra-low interest rates sustained for far too long has allowed ridiculous amounts of leverage to creep into the financial system at so many levels. These are multi-trillion dollar amounts of borrowing being described.

I have no idea if any of this matters. What I do know it that each week that goes by seems to feel like another brick in the wall in terms of debt choking out something.

If you have any questions or concerns about your portfolio, please don't hesitate to shoot me an email and we can tee up a time for a call.

With the nicer weather finally here, we hope you have a chance to safely get outside and enjoy it this weekend.