Broader Markets May be Peaking, but “Helicopter Money” Coming

As many of you know, I love to write fiction stories. The one I am working on now has morphed into a 50,000 word novella. Writers are, by definition, either “architects” or “gardeners.”

An architect spends half their time planning chapter by chapter, theme by theme, charting their novel before they begin writing. Gardeners sketch their plot, settings, and characters and then write their story as it flows from their mind following the outline.

I am definitely a gardener.

Once the story/plot seed is planted, my mind begins to live within the story, and it becomes an adventure for me as I write the adventure for the characters.

It has occurred to investors that central banks have lost the plot of what they were meant to do within their original mandates.

They have become metaphorical gardener authors.

Whatever is needed, given the immediate conditions they observe, is what they convalesce to do.

I usually dump on the central bankers for their one dimensional approach to the economy, but not today.

The time has passed for pointing out central banker hubris.

It is time to look forward and see the investment landscape for what it is.

The last two comments from February 16th and February 26th, have outlined the massive shift that has taken place in financial markets in 2021.

To briefly summarize:

- Inflation is rising.

- More importantly, inflation expectations are rising. (Since expectations are what drive investment decisions).

- Interest rates are rising due to the increased inflation expectations. (Investors are selling bonds).

- Stock markets darlings in tech are flattening out.

- Commodity based names are now gathering investment momentum.

Investors have to ask themselves: “What type of investments make sense in a rising inflationary world?”

Let’s work backwards to this answer.

First off, what investments DON’T make sense in an inflationary world?

Clearly bond investments are not a good choice. Especially when they are starting out at less than 1% on the yield to maturity.

Fact: Investors holding 10 year government bonds since last summer when they yielded about 0.5% have lost about 10% in capital value since yields have risen to 1.5%. That is the equivalent of losing 20 years’ worth of income.

If 10 year bonds, from here, go from 1.5% to only 2.5%, bond investors will lose another eight years’ worth of income. It seems to me that with growing inflation the chances of seeing 2.5% on the 10 year bond again is not too aggressive of a prediction.

Maturities of one year or less makes sense for cash reserves and bond allocations in portfolios, even though they pay next to nothing for return.

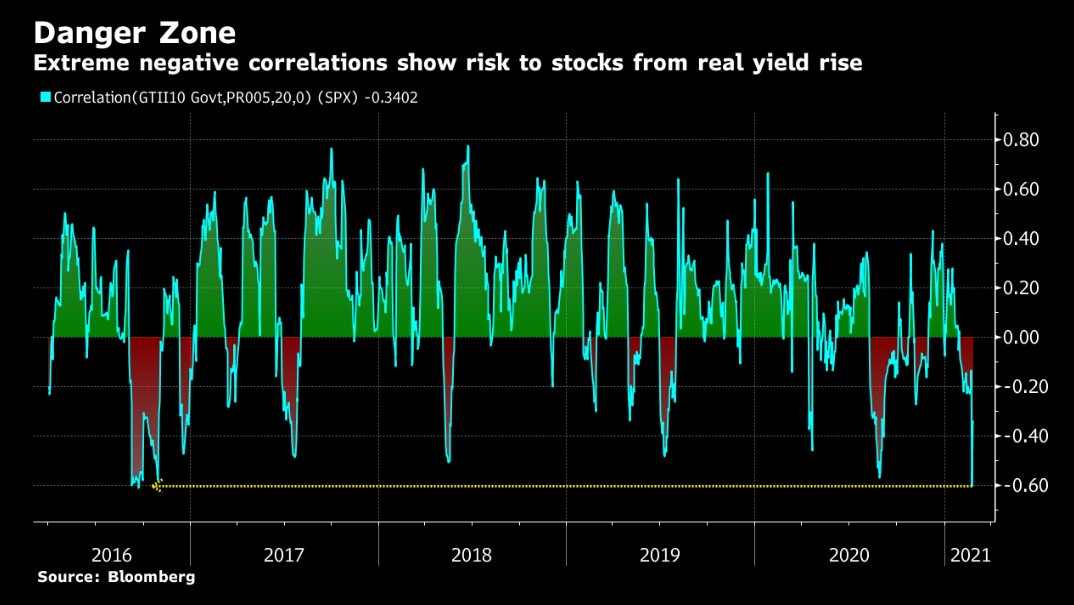

Please understand that investing in a rising inflation/rising interest rate world is HARD to do. The chart below makes the case and point.

The stock market’s sensitivity to higher interest rates is massive, especially from such a low base.

Rather than get too specific here, we’re going to look at a couple of themes that might help in deciding what to do with your investments.

- Don’t look in the rear view mirror. Look at what these changes have created for new opportunities. For me, this means balancing portfolios without using mid-term, long-term and most high yield bonds as non-correlating assets.

- Stock markets will have more volatility and larger swings as interest rates rise along with inflation. Clearly define your “buy and hold” from your “trading” positions in your portfolio.

- Follow the money. Governments are going to indiscriminately send money to citizens. The amounts they send are going to grow. This means more money is going to get poured into speculative investments. (Stay small in size but buy some risk).

- Don’t be afraid to rotate out of some long term successful holdings into others that are better value at present.

Nothing earth-shattering in this week’s comment. That is because the financial markets are still digesting the new valuations on interest bearing investments.

As always, feel free to email questions.