Managing Emotions in the Present Financial Bubble

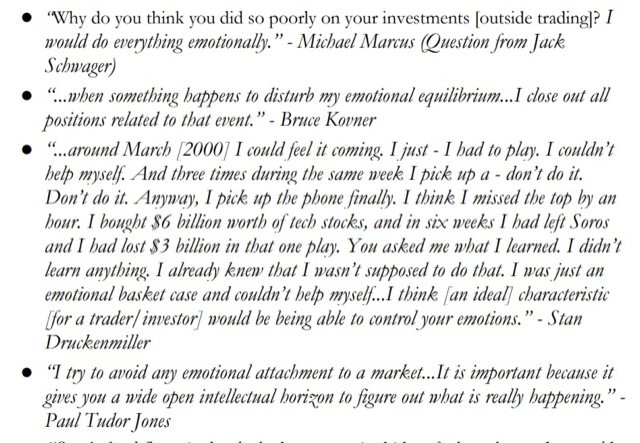

The quotes below are offered up by some of the greatest investors of our time. They show none of us are immune to making emotional money decisions.

Objective of Editorial:

Move investors towards a portfolio structure that is less North American- centric and allow for less emotional decision process during times of financial turmoil.

Reasons for Recommendation:

- The present period of extended asset valuations represented by speculative stock market and real estate behavior has reached all-time extreme levels.

- Rates of return following such periods are muted as speculative excesses revert to the mean by either sharp correction of long sideways movement in price.

- Currencies around the world are at risk of brisk corrections that can leave the citizens of the affected country with serious deterioration to purchasing power.

- Cash and fixed income (bonds and GICs) are no longer offering any real rate of return or opportunity for appreciation.

Discussion:

There are no longer any upside targets generated for stock markets I follow based on anything more than a technical projection. In general terms, all fundamental targets have been exceeded. Many by more than 30% to 50%!

The way to participate in “bubbles,” is to let it grow to its completion by methodically having less and less money exposed to the bubble sectors, while adding to both conservative investments and cash reserves when taking profits.

The biggest challenge in this bubble is to find a place to not be exposed to the bubble that pays a rate of return. In reality, none such investments exist.

Since the central banks took it upon themselves to battle the COVID recession, the relationships between asset prices, interest rates and currencies has grown significantly, in terms of dislocation risk.

At the same time, central banks appear to be committed to do “whatever it takes,” to keep asset prices at present levels or higher. The three variables in this equation are (1) asset prices, (2) interest rates, (3) currency valuation relative to other currencies and commodities.

This leads me to the following conclusion: Asset prices will peak in terms of the present financial bubble in the relatively near future (less than a year). The bubble can unwind by either sharp correction or revision to the mean over a longer period of time.

The newer risk for investors is that, in the revision to the mean outcome, their sovereign currency is debased against other global currencies and purchasing power is seriously diminished.

Going forward a portfolio will be required to guard against both of these outcomes with greater awareness than in the past.

Two ideas need to be integrated into such a solution:

- Well diversified holdings that can be size-scaled quickly.

- A more global diversification of assets for currency protection.

Recommendation:

There are three portfolios I am willing to recommend given the opening comments of this editorial. Also, each portfolio has a passive and active version available:

- “Prepare Today for the Longer Term Future” – This portfolio is for the person who believes the “bubble” is very near its peak and wishes to take evasive action now.

- “Hybrid to the Longer Term Future” – This portfolio is for the person who wants to begin making the transition with some percentage of their portfolio as if the bubble is peaking, but try and time the bubble with another percentage.

- “Dance ‘till It’s Done Portfolio” – As the name suggests, this portfolio makes no changes and the holder of the portfolio is intending to stick with their present structure throughout the entire market cycle.

As an investor living in a bubble era that now exceeds the other great bubbles of financial history, it is important for you to consider what the future might look like.

This is a daunting challenge.

We need to be open minded in terms of the possibilities for the financial future.

You see, the people who make up the financial community, have a vested interest to keep you “dancing ‘till it’s done.” That is how they get paid and, most of the time, it has been wise to just hang in there and live through any market corrections.

But, to be blunt, we are in different times now.

In the past, interest rates could be cut by central banks in the face of each asset decline, but the COVID central bank stimulus packages, which now total more than $20 trillion in liquidity, have left virtually no room for interest rates to be lowered if/when the next crisis.

What this means, is the next time the central banks ride to the rescue, they will have only one solution to the crisis: Print Money.

I sincerely believe they will print in the neighbourhood of $100 trillion and likely send out cheques to families in the $20,000 to $30,000 range (written about in greater detail in the Tri-annual Review).

It is easy to say that will drive up asset prices even higher, so why not just keep dancing? But, I have two issues with this perspective being automatically built into a portfolio.

- What impact will that have on the purchasing power of the currency of a country?

- How much would financial assets have to fall to justify the decision to try and print that much money?

Notice, I used zero charts this week.

That was completely on purpose.

My goal is not to justify one of the above portfolio solutions over another.

My goal and purpose is to be on the same page as you when we are considering the long term positioning of your financial life.

Comments and questions are welcome. Clients considering any action should send me an email to give you a call. That way I can look at your portfolio, prepare some thoughts that are personalized to your situation so when you share your thoughts I am totally up to speed with your present situation.