“Blind Eye Choices”Central Bank Digital Currencies: CBDC

What is a Central Bank Digital Currency (CBDB) and what would their purpose be in the future?

By the most basic definition, CBDBs are the digital forms of fiat money. People often try to downplay the enormous impact they are going to have on our future by using that basic definition, but they are so much more that digital fiat.

CBDCs are a medium of control that past governments never dreamed of obtaining.

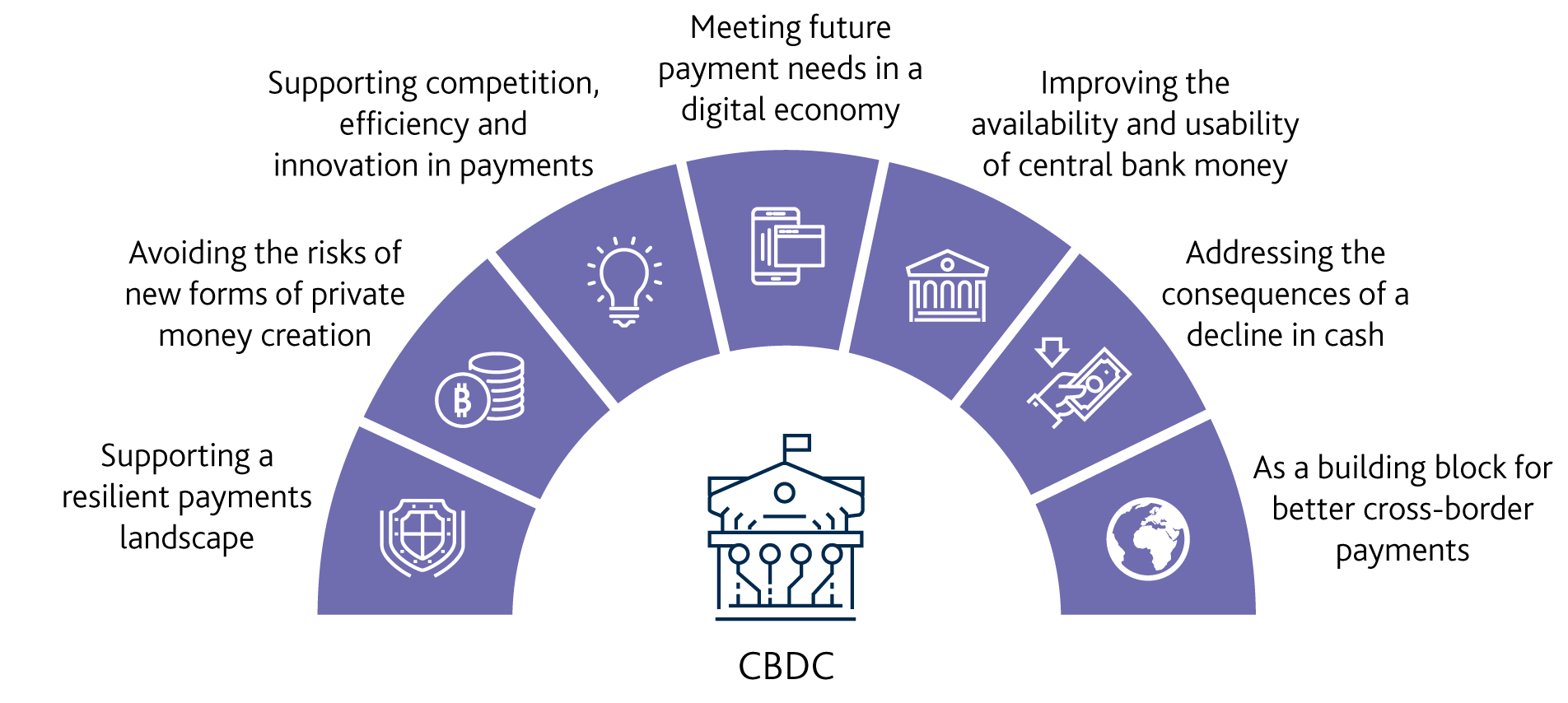

As the graphic above shows the case for central bank digital currencies is not hard to make. Crime, money laundering, record keeping, tax collection and a ton of other things are easier to monitor and control. From a personal perspective, your money is safer in a “digital wallet” than your “leather wallet.”

The transition to digital money will, most likely, be widely heralded as a huge jump forward in monetary history.

Central Bank Digital Currencies are going to happen. What that roll out looks like remains to be seen. There are a number of excellent YouTube meetings and Podcasts on the topic for those who wish to pursue the CBDC evolution in more detail. To see more please Google Central Bank Digital Currencies and see what suits your curiosity.

For the balance of this editorial I wish to focus on two ideas. One is covered in a great many of the videos you will see and one is not.

- How do CBDCs impact Bitcoin and other cryptocurrencies?

- What are the long term implications to personal privacy with the implementation of CBDCs?

The answer to the first question is that everybody has a widely ranging different opinion. Honestly, I am not enough of an expert to offer any directional thoughts here either.

I would leave you with this thought: If you are investing in Bitcoin and you see the chart of your asset in a parabolic bubble then be aware that it is not the positive outcome from CBDCs you need to fret about. If CBDCs actually did make Bitcoin redundant, how would one price it?

Question 2 is what really captures my imagination and what, surprisingly, is not discussed all that much is the privacy issues that come with the acceptance and use of CBDCs.

The track record for governments and giant tech companies respecting our privacy is pretty bad. I cannot see how the CBDCs would not open up a whole new level of surveillance and meta-data abuse.

At the end of the day my research into this topic left me with far more questions than answers. When considering the pros of CBDCs it is easy to see why they are going to be part of our future. When considering the cons of CBDCs it seems the world has fallen into the trap that “anything that is a technological advancement must be good for our future”.

Advancement is never a one sided issue. For whatever is gained, often something is lost. Central Bank Digital Currencies will be no different and will be confined by this definition.

Generational Overreach

A client presented a well thought out discussion about “Environmental, Social and Governance” (ESG) investing to me last week and it took my thoughts for an interesting journey.

This client had done her homework and she saw the pathway to the future where, no matter how the investments might perform prices-wise, companies with an ESG focus were imperative for our planet to survive.

Examples of where the priorities of society and corporate governance had failed to make sustainable business practices the norm in the past are glaring today. Fishing, logging, mining, road construction, fresh water management, air quality, food production sustainability and hosts of other areas have brought the planet to a break point.

The investments that have made ESG a priority have had bubble-like price performance as investors put their money where their mouth is. In a nutshell, ESG investing is here to stay.

My watershed moment was seeing the present monetary policy in the same light as earlier generations saw environmental policy relative to their business goals.

Some readers of this letter are in their 80s and will likely remember these ideas. Fifty or sixty years ago people could not imagine that we would run out of forests, fish, fresh water or clean air. There was an apparent abundance of resources and there were far less people to consume them.

What, in hindsight, was clearly exploitation of these resources was seen at the time as the byproducts or collateral damage of harvesting. Maybe deep down there was a feeling that the process would be long term damaging but the old expression says “in the long term we are all dead anyway so why worry?”

It is ironic that we see the clear devastation of this type of thinking in terms of the environmental choices of past generations, yet, we don’t see the long term damage of our present unlimited amounts of debt is fine policy in terms of future generations.

The most frustrating common thread to both situations is that neither had to happen. The motivation in both examples of exploitation was the short term maximization of profits when the possible negative effects were a long ways off in the future.

Human kind is resilient and what is happening today will sort itself out somehow. But the connection between the environmental neglect of past generations and monetary neglect of our present generation became quite real to me last week during that certain conversation.

As always, please feel free to email me your comments and feedback.