Before we begin, a quick reminder that this is a good time to look at your income for the year and decide if you need to make any financial decisions for tax purposes. These may include:

- Extra payments from a RRIF or a lump sum from an RRSP because of an unusually low income year.

- Capital gain or loss selling depending upon your previous tax years.

- In-Kind Charitable donations.

If you have any questions about your personal situation, please email and I will contact you.

Preferred Shares

This reader’s request, was a timely topic for my final weekly comment before the Year End Review, so without further ado…

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders. (Hence, “preferred”)

Companies issue preferred shares and pay the dividends from after-tax profits. Therefore, the shares qualify for the dividend tax credit which is a tax advantage over interest income.

A preferred share usually has an issue price (par value) of $25.00. This par price is the amount that the dividend rate is based upon. For example, if a $25.00 preferred share pays $1.50 dividend per year the yield would be 6%. ($1.50/$25.00 = 6%)

This share trades on the stock market, so the share price fluctuates, but the dividend paid would remain the same (depending on the conditions of the offering).

If the stock price fell to $22.50 the dividend would remain $1.50, and the “at market purchaser” of the shares would receive 6.67% dividend yield. ($1.50/$22.50 = 6.67%)

There are a number of different classes of preferred shares. Each has its own set of privileges that it allows its possessor to enjoy.

We will cover off in this note:

- The different classes of preferred shares.

- The conditions favour this types of preferred shares.

- Where these types of preferred shares fit into your portfolio…maybe.

Perpetual Preferred Shares

A perpetual preferred share has:

- a fixed dividend rate

- no maturity date, it goes forward in perpetuity

- it is almost always redeemable by the issuer

Perpetual preferred shares offer a long term, predictable stream of income. The share price can be volatile so investors should only hold them if they are comfortable with long term price swings of 25% or so.

Perpetual Preferred shares like “stable” or “slowly declining” interest rate environments.

This class of preferred shares has been a good long term performer with the long term trend of interest rates being lower. They fit into portfolios requiring stable income at reasonable rates of return.

Retractable Preferred Shares

Retractable preferred shares are another type of preferred stock that lets the owner sell the share back to the issuer at a set price. Typically, the issuer can force the redemption of the retractable preferred share for cash when the shares mature. Sometimes, instead of cash, retractable preferred shares can be exchanged for common shares of the issuer. This may be referred to as a soft retraction compared with a hard retraction where cash is paid out to the shareholders.

There is a tradeoff using retractable preferred shares. For the extra advantage of being able to put the shares back to the issuer at a fixed future date, they pay a lower dividend yield than a perpetual preferred share.

An example might look like a $25.00 share that pays a $0.95 or 3.8% per year. Both the issuer and the holder would have the privilege to redeem the shares at $25.00 again in five years’ time from issue date.

The yield is much lower than the examples of perpetual preferred shares above but the purchaser has more flexibility knowing they can get their money back in five years.

These shares were very popular 30 or 40-years-ago, but have not been issued in large quantities for a long time. Corporate finance changes, along with corporate tax changes, swung the advantages to issue towards other classes of preferred shares.

These shares are a good investment at any time in the economic cycle if you can find one that suits your risk criteria. They are just hard to find.

Floating Rate Preferred Shares

Floating rate preferred shares are created almost exactly like perpetual preferred shares, in that they usually have no maturity date, but the issuer can redeem them after a specified date, if they so choose.

The big difference is that the dividend is adjusted up or down at a preset interval of time (maybe every three, six or 12 months).

The new dividend is determined by a formula or ratio based off of some benchmark (say, the 5-year Government of Canada bond rate or the 90-day Canada T-Bill rate).

An example would be a $25.00 share that paid 80% of the 5-year Government of Canada bond yield adjusted every six months. If the 5-year Canada bond paid 5%, the floating rate preferred share would pay 4% of the next two quarterly dividends or six months.

Investors would want to hold floating rate preferred shares when they anticipated interest rates about to rise. This would mean the dividend on the floating rate preferred share would rise along with the interest rates.

Clearly, these shares have not been popular with investors for a long time because interest rates have not gone higher in a long time.

Rate/Reset Preferred Shares

This class of preferred share became all the rage in the early 2000s. They were like a retractable preferred share in that they would adjust their dividend payment at a preset schedule (usually every five years), and they paid a high dividend yield like a perpetual preferred share.

Issuers like them because after 40 or 50 years, they would often become converted to commons stock and the CRA allowed them to be considered “equity” on the balance sheet rather than debt.

The prevailing thought at the time was interest rates would soon be going back to “normal” again after the technology stock driven recession righted itself and the abnormally low interest rates could be let to float freely again. (I can hardly write that paragraph without throwing up a little bit in my mouth).

An example would be a $25 share that pays $1.35 or 5.4% dividend. For the next five years the owner would receive a 5.4% annual payment. Then at the end of five years the dividend adjust like a floating rate preferred share at some preset formula. (Again, say 80% of the 5-year Government of Canada bond yield). Then it would pay that new dividend for the next five years.

This class of preferred shares made so much sense at the time, yet became one of the most painful investment choices investors in Canada ever made in terms of a good quality investment, more on this below.

Limited Recourse Capital Notes (LRCN)

A new twist on the old theme of Rate/Reset Preferred shares in 2020, are LRCN notes.

These are a type of hybrid bond/preferred share that has reignited the near comatose asset class of Rate/Reset preferred shares.

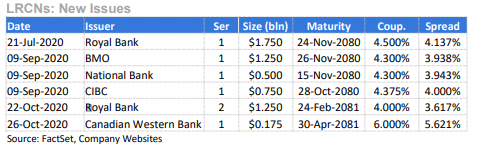

The LRCN notes are institutional only, so I will not go into a ton of detail about them, but I will show you a table of the issues up to present date.

The key takeaway here for retail investors is these issues are very large in size relative to the old rate/reset preferred issues and allow banks to refinance on favourable terms. That is why so many bank preferred rate/reset shares have been redeemed lately.

What does the future hold for this asset class?

That very much depends upon your view of what the future holds for interest rates.

I think most of us long term financial advisor types feel like the “little boy who cried wolf” too often when it comes to the imminent rise in interest rates. I know I feel very uncomfortable planning for higher interest rates because it would mean the end of the debt super cycle in…well…everything.

But, if you believe interest rates will one day meaningfully raise from the zero bound, there are lots of opportunities to buy rate/reset and floating rate preferred shares that would perform nicely.

So should investors hold preferred shares as an asset class in their portfolio?

Yes, but in small doses and chosen wisely.

If you would like to talk about these shares and how they might fit into your portfolio, please send me an email and I will call.