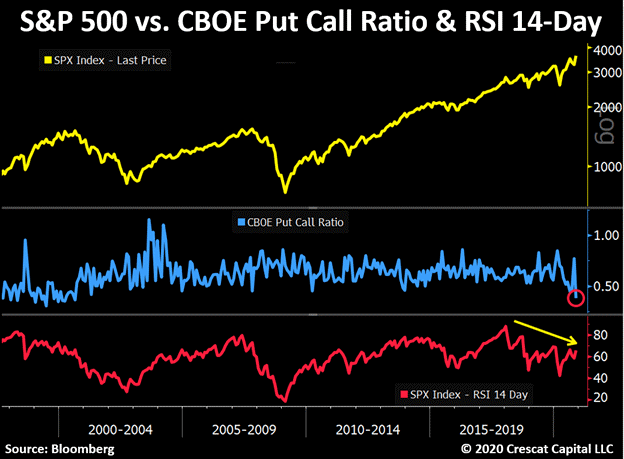

Two weeks ago, a short email note went out to clients saying the US stock market had given a “trading sell signal.” That signal came from a historic number of extreme sentiment readings across a wide spectrum of technical indicators.

In the same note, it said an “investor sell signal” had not yet been given. That is still valid today, but I have been taking some profits for those who call in.

Walter Deemer, who worked on Wall Street from 1964 – 2016, and is revered in the technical analyst community as Wayne Gretzky is on ice, Tweeted this note on December 3rd:

“I’ve never seen so many really extreme sentiment readings. I realize price/momentum/breadth are very positive, but if…if…this ever goes down we’re going to look back and the sentiment stuff and say, Of course, it was obvious. The market is a cruel mistress.”

I don’t think many would argue with his assessment.

The opposing argument comes in the forms of I will be fast enough to get out when the party ends and it is different this time.

What really caught my eye was a reply Deemer received from another old-school, long time technical analyst named Chris Carolan.

“Walter, I think we are at the inverse of 1982 in a sense. At that time there seemed to be unlimited stock for sale (on upticks) but those sellers were leaning on rich put bids.

The apparent bids for stock now will prove ephemeral when call buyers leave.

Let’s take the technical jargon out of the comment above and share why it absolutely nails the reality of the present pricing of stocks, in my opinion.

First, let’s remember 1982.

Interest rates were nearing 20% for Treasury Bills and 17% for 10 year Treasury bonds. Inflation rates had peaked in the middle teens and real estate prices had crashed. The stock market was in the process of making a BEAR market low.

What Carolan is referring to when he speaks of sellers leaning on rich put bids, is that investors were placing large bets in put options, which profit from stocks continuing lower and sell the underlying stocks rather indiscriminately, to make money on the put options.

Once the options market ACTIVITY faded, the bids to sell dried up in the stock market and the underlying value of the ravaged stocks attracted true investors.

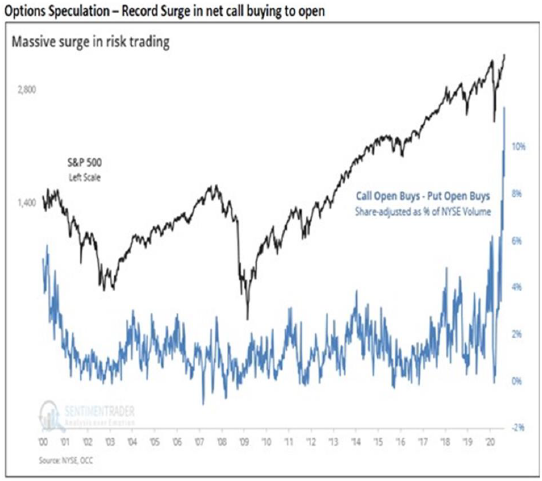

The options market of late 2020, is truly the flip-side of this situation. Instead of rich put option buyers, we see call buyers as far as the eye can see in the blue section on the graphic below.

Therefore, what we should be watching, is for the options market volumes to begin to normalize as to a clue to when markets may begin to correct down again.

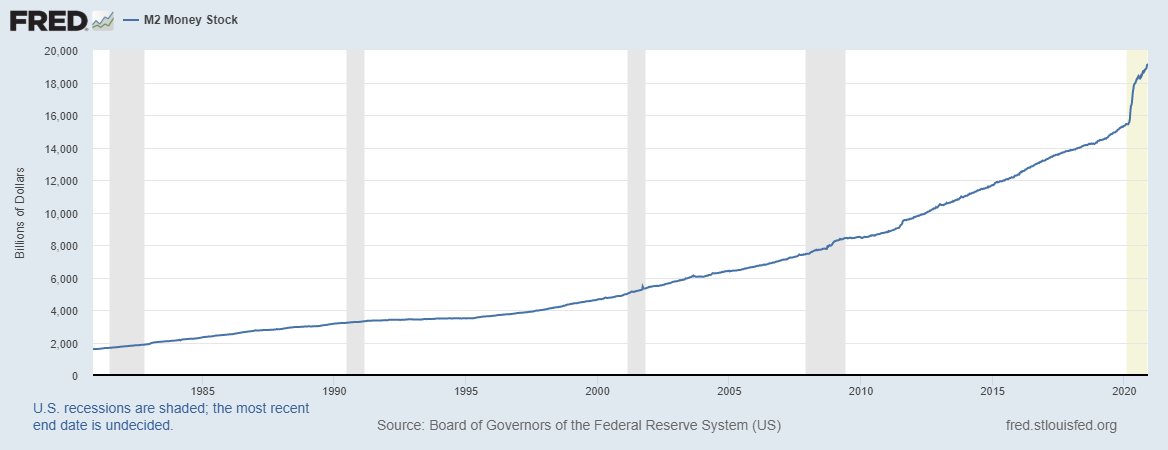

The next two graphics depict broad US money supply via M2 money stock.

Graphic number one shows the outstanding amount of M2 money stock in the United States. I have used the Canadian data the past few editorials and it is even worse than the US. The US data goes back further so I chose it this week.

The shaded areas are recessions, and the blue line shows the total growth in M2 money supply. March 2020, is not a tough data point to pick out on the chart.

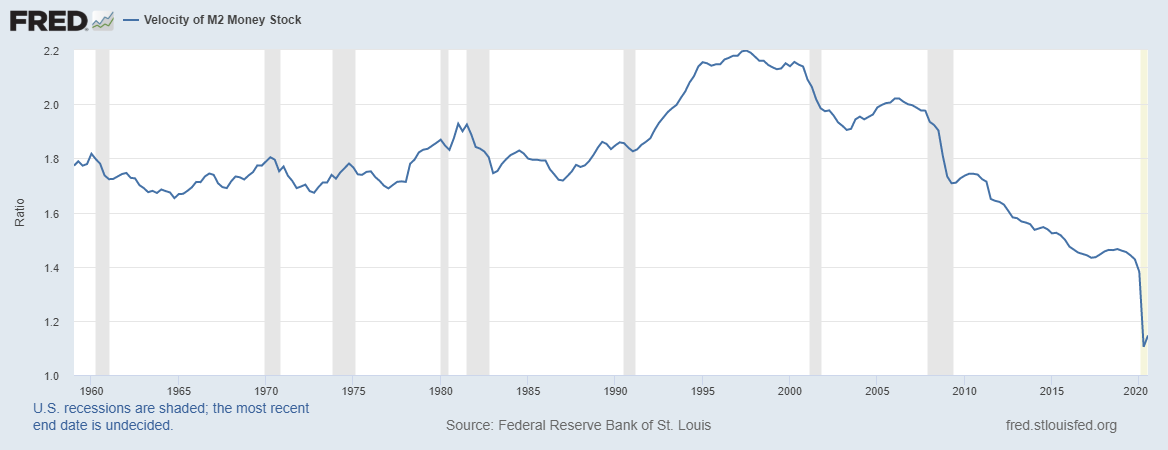

The next graphic is of the same M2 money stock, but it shows the rate at which it flows through the economy.

The bottom line, is that central banks can print as much money as they want and that money has shown that it will flow into asset markets--stocks, real estate, and bonds--but, it does not create anywhere near a historical economic activity outcome. Hence the term “pushing on a string.”

Before we wrap up this section, I want you to go back on the chart and notice the contrast of the 1990-1998, sections on the M2 charts.

During that time frame, M2 was slowly rising at the same time as M2 velocity.

What that means is that the US Fed was getting a “good bang for its M2 expanding, money printing buck.”

Here is a rough analogy of the point looking at M2 in this comment.

Think of this as someone taking two Tylenol for their sore back after work each day.

For a period of time the Tylenol fought the pain, but the person kept trying to expand their amount of work that was making their back sore; taking more and more Tylenol to feel better.

Of course, it got to the point where their body could not exist without taking the Tylenol, and the growing dosage was getting medically dangerous. The easiest course of action was to ignore the long term facts and just keep working and taking more pills.

This was not a sustainable solution, but it was the easiest choice.

Monetary policy is in much the same position as the medicated worker.

Summary:

Nobody knows how the future unfolds. This past weekend I started gathering information for my Year End Summary publication. Before I begin that process, I always go back and read my previous two Year End Summaries.

It brought a smile to my face when I read the January 2020 post, because I'm glad I didn’t venture out into trying to make a forecast of events.

Looking forward this year is even crazier.

It is time to ask ourselves some honest questions.

- Could the stock markets continue to rise in 2021…even gaining another 25%? Answer – yes.

- Could the stock markets fall 40% in 2021? Answer – yes.

- Could rising inflation bring on much higher interest rates? Answer – low probability, but yes.

- Could interest rates fall to negative numbers in Canada and the US in a recession and sharp stock market decline? Answer – yes.

- Could the COVID vaccine be the facilitator that allows an economic recovery that surprises many by its strength and creates an environment where interest rates are not easily controlled by central banks? Maybe?

- Is this the year that China and India see their economies transition to more internal demand driven models that export driven? In doing so, is there a global scramble for natural resources and materials? Maybe again.

I could keep going.

My year end blog will take deeper dives into the types of questions I think will matter most in 2021.

If you have a question you are asking and you think is important to the next 12 months, please send it to me. The help would be great and now is the time when I try to get this piece roughed out.

Thanks for reading.