Service Announcement and Gold

If one good thing can be said to have come out of COVID, it’s our enhanced ability to serve you remotely.

In many cases, such as opening a new account, an extra RIF payment, or depositing a cheque, which would have meant a visit to the office—or waiting for documents to arrive and then make their way back to us by mail or courier—can now be done with an electronic signature (e-signature).

What used to be a waste of your time and delay processing, can be initiated in the time it takes to open an email and click a button.

This isn’t “that” message and paper continues to be an option. But, it is a message that hopes to nudge you into taking advantage of the expanded selection of electronic services we offer.

It is not what you’re used to. It’s better.

The convenience of being able to quickly do these things from the safety and comfort of your home is a game changer.

Dominion Securities (DS) Online

By signing up for DS Online you can securely:

- Access all of your RBC Dominion Securities account information at your fingertips.

- If you are an RBC banking client, we can link your investment accounts to your RBC online banking profile, so no need to remember yet another password,

- Send confidential documents and information to us using the secure two-way message feature,

- Create and track your personal watchlists in real time, and gain access regularly updated market insights and research.

Electronic statements

We often hear from clients, that once they have their online access set up and can look at their accounts whenever they wish, they hardly look at the statements coming in the mail.

It doesn’t need to be all or nothing.

Switching to e-statements and trade confirmation letters, does not mean that you must also receive your tax documents electronically. We can tailor your selection to meet your needs.

At Dominion Securities we give you the option to continue getting your tax information in physical paper form, even once you’ve switched to e-statements.

E-Signing

Many of us are not strangers to the idea of e-signing and some have even purchased a property or two without setting a pen to paper. The technology has been around and improving for years now, but it’s taken the finance and investment industry a bit longer to get onboard.

As previously mentioned, we can now use e-signatures to open new accounts, add a trading authority, initiate transfers and so much more. Given current circumstances, this is the preferred method.

In coming months as Megan and I talk to you on the phone, we will be asking you if you would like to set up more electronic services for your accounts.

You may be hesitant to adopt these services, but they save you time and allows us to better take care of your banking and investment needs as they come up.

Besides, there is nothing that stops us from switching your preferences back to paper if you give it a try and decide it’s not right for you.

For more information and to start using these services, please email Megan. She will call you to set things up exactly as you wish.

Gold

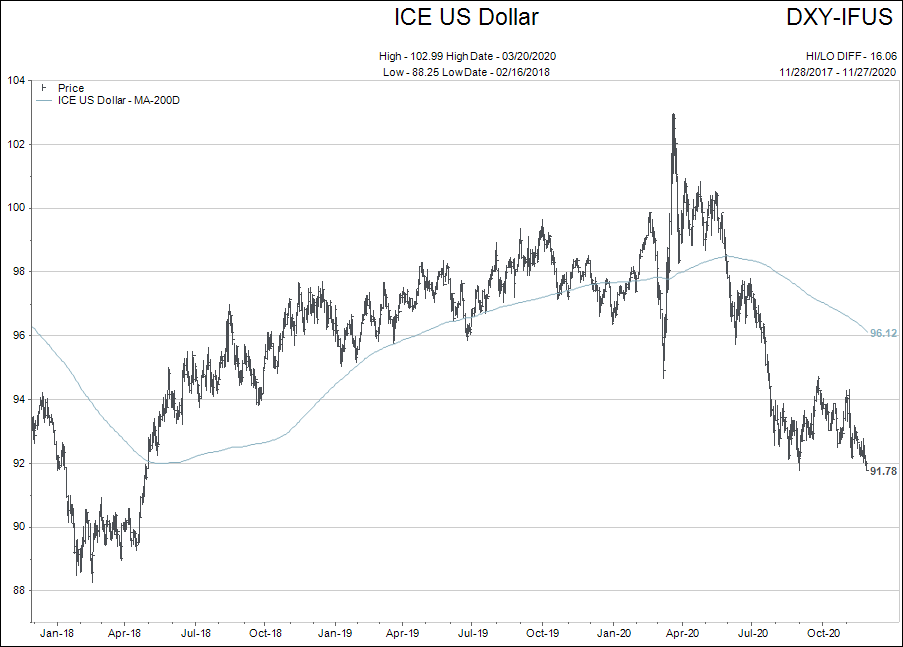

The ongoing correction in gold bullion and stocks kind of came out of nowhere. In hindsight, it makes sense how a vaccine announcement would be somewhat negative for gold as pandemic fears drift further into the rearview mirror, but I really expected a rally to start in the US dollar index before gold got hit since the two are negatively correlated most of the time.

The chart below shows how the US dollar index has been weakening, not strengthening.

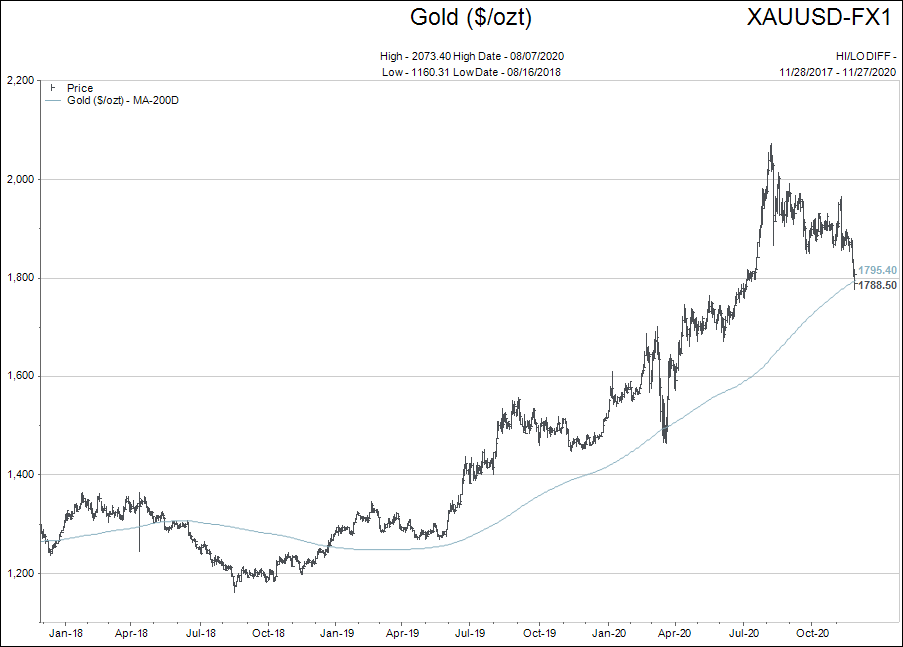

Gold bullion in US dollars has now corrected back to its 200 day moving average (light blue line at $1,795 US).

Gold bullion in US dollars has now corrected back to its 200 day moving average (light blue line at $1,795 US).

Long term clients know I get nervous when anything corrects back to its 200 day moving average after a long run holding above such a level.

Gold needs to rally back, and soon, to above $1,800 US.

Keep a close eye on gold:

- If you own it and are watching the 200 day moving average as a “stop-loss” on your positions, OR

- If you don’t own gold and want to initiate a position in the precious metal as it hold onto the $1,800 US level.

The “fundamental story” for gold based in currency debasement and central bank loss of control is still on track. But technically, investors should take precautions at and around the 200 day moving average of any position they own.

Tesla

Every cycle it seems there is one stock that stands out to define the era. For me, Tesla is the poster child of this present cycle.

In my last weekly comment, I used it as an example of how the present financial conditions make it hard to correctly value of a company.

I got three emails back telling me that Tesla is grossly over-valued and it is not at all hard to tell this to be true. I got two more emails back telling me Tesla is still in its early stages and there is plenty of room to run.

Full disclosure: I have never been long or short Tesla. It is too emotional for me and my style. Therefore, I have no dog in this hunt, so to speak.

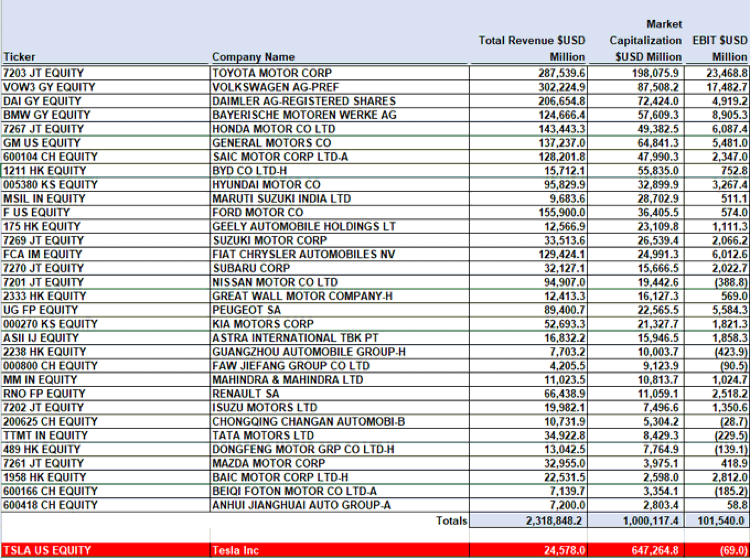

But I came across one chart that really made me think. It shows the total revenue, market capitalization and earnings of the world’s car producers in descending order from most to least.

It shows the same data for Tesla at the bottom of the graphic in red.

The graphic shows that Tesla shares are worth 65% of the value of all the car companies in the world…COMBINED! Yet Tesla loses money only has 1% of the global sales volume.

What a world we live in...

As always, please share your questions, comments and thoughts.